JTBグループ 2025年3月期 連結決算概要

株式会社JTB

株式会社 JTB(代表取締役 社長執行役員 山北栄二郎)は、2025年3月期の連結決算を取りまとめました。

1. JTB グループ 2025年3月期 連結決算について

(1)全体概況

2024年度、JTBグループは中期経営計画『「新」交流創造ビジョン』におけるフェーズ2の最終年度として、「未来から現在(いま)を創る〜未来のためのビジネスモデル変革〜」をテーマに掲げ事業活動を展開しました。世界の観光セクターはパンデミック前の水準の98%まで回復し、訪日外客数も3,600万人を突破して過去最高を更新しました。このような市況下、JTB グループでは、グローバル領域でDMC(※1)、MICE、ビジネストラベルの各事業が多角的に成長するとともに、海外旅行、訪日旅行、国内外のMeetings&Events、商事領域における売上高が大きく成長しました。当初の計画通り、ITシステムの刷新、DX推進、イノベーション創出プロジェクトの運営、高度専門人財(※2)およびグローバル人財の採用など、幅広い分野への戦略的な投資を実施し、基盤整備を推進しました。その結果、営業利益において計画比128%(計画116億)を達成しました。

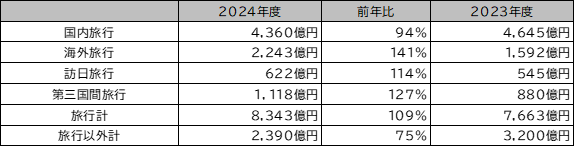

① 訪日旅行はオンライン個人販売とツアー受注で、第三国間旅行は欧米・アジアの市場拡大を捉え、両領域とも回復する人流を背景に前年比を大きく上回り伸長しました。

② 国内外の国際イベント(パリ2024オリンピック・パラリンピックや大阪・関西万博など)において、関連事業や第三国間の取り扱いを拡大しました。

③ グローバルDMCでの「世界発・世界着」の取り組み拡大、SIC(※3)の中南米市場の獲得、グローバルビジネスソリューションでのMICE需要と訪日インセンティブ需要の拡大など、世界的な人流回復を背景にグローバルでの事業が多角的に成長しました。

④ 商事領域では宿泊施設の好調な稼働を背景に消耗品・装備品販売が好調に推移し、決済領域では旺盛なインバウンド需要により、宿泊施設向けのクレジットカード一括加盟店決済サービスや宿泊オンライン決済サービスの決済額が過去最高を記録しました。

⑤ 国内旅行は物価高の影響による購買行動の慎重化傾向により前年比減となりましたが、海外旅行は前年比増となりました。

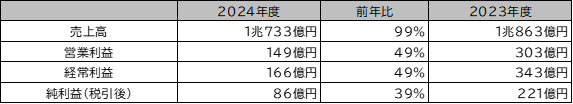

これらの取り組みを推進した結果、当社のグループ概況は以下の通りとなりました。

■ 当社グループの概況

■ 部門別概況 (金額はすべて売上高)※第三国間旅行:日本発着以外の旅行 ※旅行以外:MICE・BPO、商事、出版等

■ 連結対象会社数 :国内22社、海外72社、持分法適用会社17社 計111社 (2025年3月末現在)

従業員数 :19,376名 (2024年3月末より383名増)

2.事業別ハイライト

ツーリズム事業

* 法人:「企業」「教育」マーケットでの取り扱いを拡大し、スポーツでは「MLB™ WORLD TOUR TOKYO SERIES公式観戦券付きホスピタリティ・パッケージ」を通して、お客様の体験価値を高めました。

* 個人:マルチチャネルでお客様に正対するOMO(※4)モデルが進化しました。国内旅行は「日本の旬(※5)」(上期:北陸、下期:京都・奈良・滋賀)による活性化や、「株式会社ジャパンエンターテイメント(JUNGLIA OKINAWA)」との「オフィシャル・マーケティング・パートナーシップ契約」を締結し、体験価値の高い商品を発表しました。海外旅行は年間を通じ円安・物価高等の外部環境でしたが、MLB™効果での北米、パリ2024オリンピック・パラリンピック効果でのヨーロッパ、アジアが顕著で前年を上回る結果となりました。

* JTB協定旅館ホテル連盟とのサステナブルツーリズム推進のための協働宣言など、新規事業展開とサステナビリティへの取り組みを積極的に推進しました。

エリアソリューション事業

* 観光DX領域:活況なインバウンド市場に連動し、株式会社グッドフェローズJTBが提供する入場施設向けチケット流通プラットフォーム、およびアクティビティ商品の在庫・予約の一元管理が可能な「JTB BÓKUN」での販売流通額が、過去最高を更新しました。

* 観光地整備・運営支援領域:ふるさと納税の寄付額が過去最高を達成。商事領域、決済領域ではインバウンド需要を捉え、好調に推移。出版領域では1925年創刊の「JTB時刻表」が100周年を迎えました。

* エリア開発領域:新規投資と小豆島でのコンテンツ開発を進める一方、大阪・関西万博に向けては「大阪・関西万博公式観光サイト」の運営などを通して、グループ全体で需要獲得と準備を推進しました。

ビジネスソリューション事業

* 顧客課題の解決に資するソリューションとして、Meetings&Events、旅行、ビジネストラベル領域において、前期を大きく上回る実績となりました。

* ABM(※6)戦略を基軸に成長拡大する企業需要を的確に捉え、既存需要に留まることなく未捕捉領域への積極的なアプローチにより、取り扱いを拡大しました。

* Meetings&Events領域:リアルとオンラインのハイブリッド需要に対応し、ROI(投資対効果)測定スキームの充実やデジタルソリューションの提案、活用促進を強化しました。

グローバル領域

* グローバルDMC事業:大型国際イベントであるパリ2024オリンピック・パラリンピック等での世界発フランス着の取り扱いや、アジア、米国から欧州への旅行が伸長するなど、欧州のインバウンド事業が活況となりました。また、アジアパシフィック地域では多様化する教育旅行の需要を捉えました。またSIC事業では、中南米発欧州方面行需要を獲得するとともに、日本市場向けのヨーロッパ周遊バス商品「ランドクルーズ」の販売が、メディア露出と商品拡充によって拡大しました。

* MICE事業:グローバル市場全体でのMICE需要取り込みと訪日インセンティブ需要の拡大。海外・国内の営業体制強化とデジタル活用による情報連携を強化し、グローバルABM戦略を加速させました。

* ビジネストラベル事業:需要回復の確実な捕捉とともに、CO2排出量削減に取り組む外部パートナーとの連携により環境配慮を強化しました。

* 訪日旅行:底堅いインバウンド需要に対して、オンラインでの個人向け提携販売や旅行会社からのツアー受注で需要を捕捉し伸長しました。

(※1)Destination Management Companyの略称。地方や地域の観光資源を活かした旅行プランの企画・運営を行う会社。

(※2)JTBグループでは、"人材"は「企業や組織の成長を支える財産となる大切なリソース」であるという意思を込め"人財"と表記。

(※3)Seat In Coach の略称、コース組み合わせ自由のバスツアー。

(※4)Online Merges with Offlineの略。 顧客体験の最大化を目指しオンライン(Web)とオフライン(店舗やコールセンターなど)の垣根を超えて購買意欲を創り出そうとするマーケティングの考え方。

(※5)「日本の魅力の再発見」をテーマに、1998年よりJTBグループで実施している国内観光地活性化を目的としたキャンペーンで、半期ごとに対象方面を選定している、当社の登録商標。

(※6)Account Based Marketing(アカウントベースドマーケティング)」の略で、企業を対象とし戦略的にアプローチをしていく、BtoBマーケティングの手法

3.2026年3月期(2025年度)の通期見通し

2025年度は中期経営計画フェーズ3「成長・飛躍」の初年度であり、各事業の更なる成長に向けた重要な年度と位置づけています。急速に変化する市場環境に適応し、新たな成長機会を捉えるため、「未来から現在(いま)を創る~ビジネスモデル変革の加速~」をテーマとしてビジネスモデルの抜本的な変革に取り組むと同時に、経営基盤の強化と事業の持続的拡大を推進します。

また、2025年度も将来に向けた先行投資を継続し、売上高1兆2,980億円、営業利益120億円を目指します。

■2025年3月期の決算概要の詳細については、以下URLよりご参照ください。

URL:決算情報|企業情報|JTBグループサイト (jtbcorp.jp)

JTBグループは「交流創造事業」を事業ドメインとし、デジタル基盤の上に人の力を活かし、 地域や組織の価値を共創し、人流や情報流、物流を生み出すことで、 人と人、人と地域、人と組織の出会いと共感をサステナブルにつくり続けることを目指します。

※「交流創造事業」は(株)JTBの登録商標です。

JTB広報室 TEL:03-5796-5833(東京)