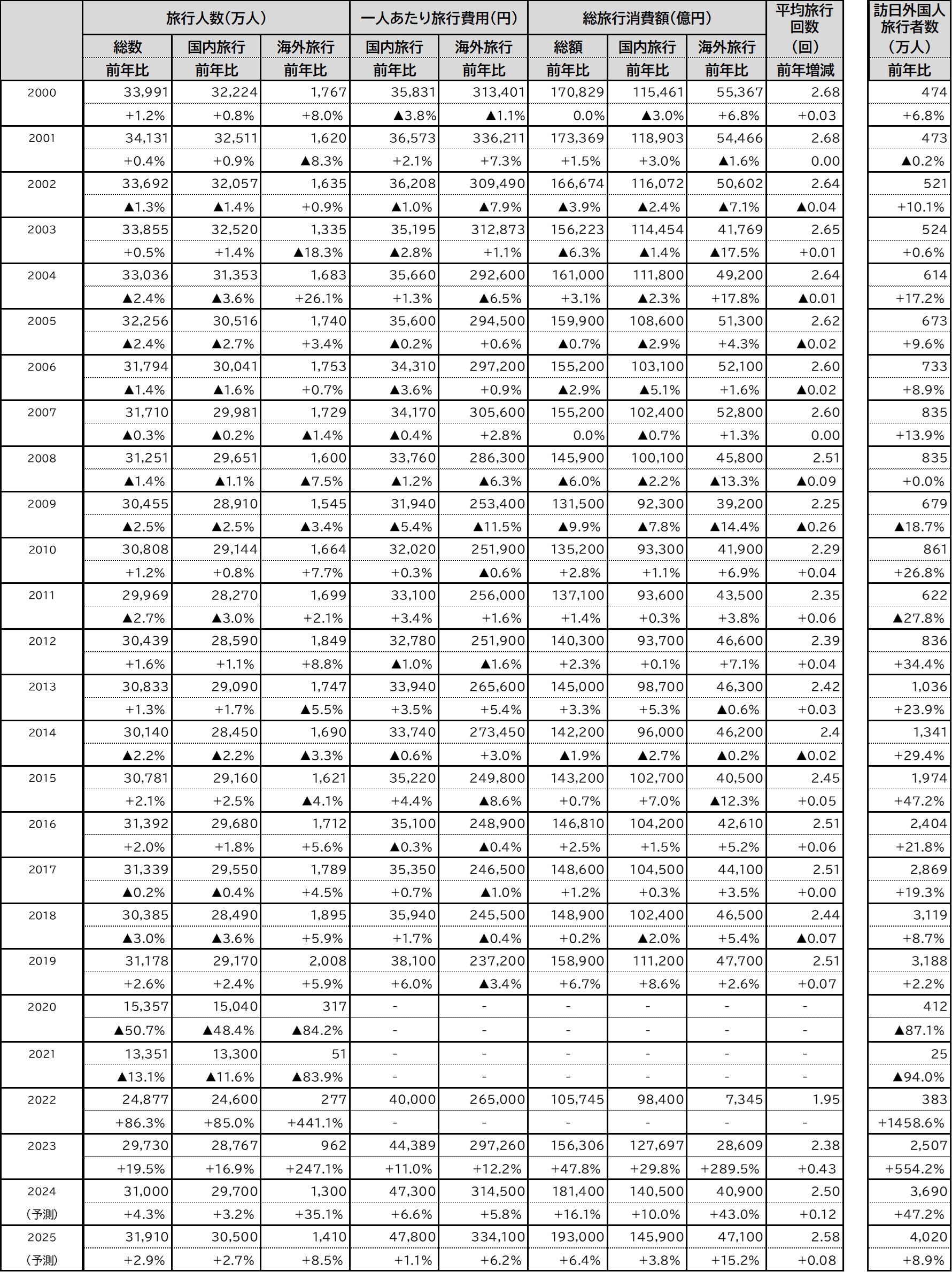

2025年(1月~12月)の旅行動向見通し

株式会社JTB

JTBは、2025年の旅行動向見通しをまとめました。当調査は、1泊以上の日本人の旅行(ビジネス・帰省を含む)と訪日外国人旅行について、各種経済指標や消費者行動調査、運輸・観光関連データ、JTBグループが実施したアンケート調査などから推計したもので、1981年から継続的に調査を実施しています。2025年の調査結果は、次のとおりです。

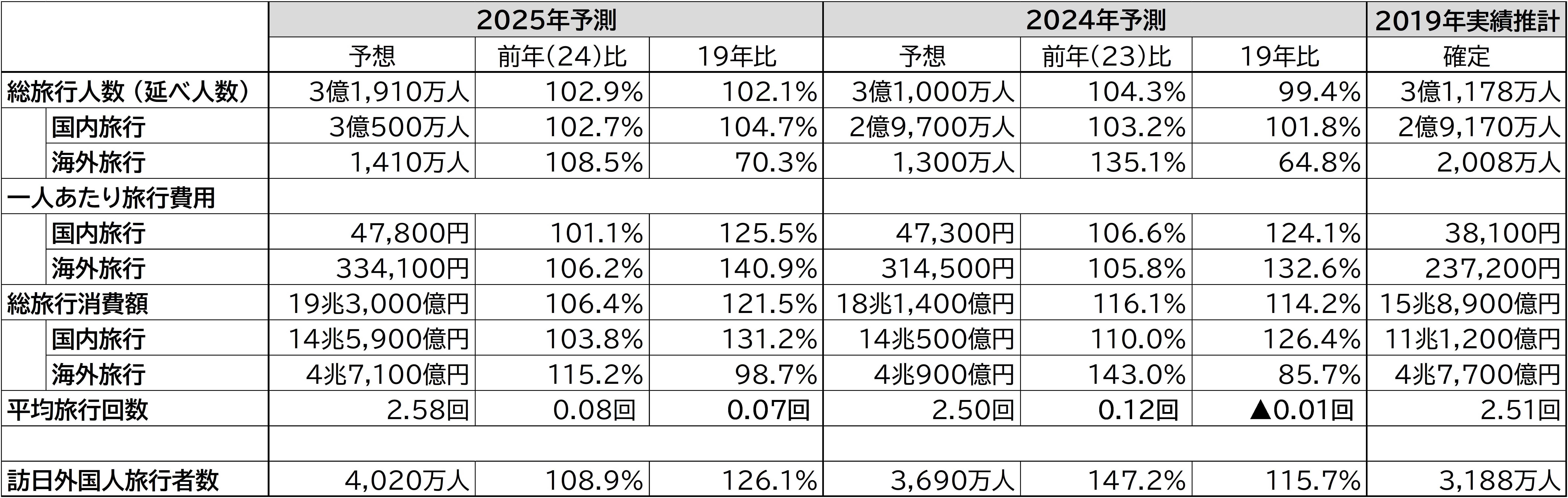

●国内旅行は、旅行人数が3億500万人(対前年102.7%)、一人あたり旅行費用は47,800円(同101.1%)、総旅行消費額が14兆5,900億円(同103.8%)

●海外旅行は、旅行人数が1,410万人(対前年108.5%)、一人あたり旅行費用は334,100円(同106.2%)、総旅行消費額が4兆7,100億円(同115.2%)

●訪日外国人旅行者数は4,020万人(同108.9%)

【日本人の国内旅行】

➢雇用や給与は次第に良化し、暮らし向きもゆるやかな改善が期待され、旅行の追い風に

➢物価は引き続き上昇し、一人あたり旅行費用は高値傾向が継続する見込み

【日本人の海外旅行】

➢近年は急激な円安により海外旅行控えの傾向が見られたが、今後為替相場が落ち着けば、海外旅行の盛り上がりが期待される

➢東アジアなどの近距離方面だけでなく、ヨーロッパやオセアニアなどの中長距離方面の旅行者数も伸びる見込みで、一人あたり旅行費用は昨年からさらに増加

【訪日外国人旅行者】

➢2025年は過去最高となった2024年をさらに上回る見込み

➢新型コロナウイルス感染症後の急激な需要回復が一巡するとみられ、前年と比べ伸び率がゆるやかに

(図表1)2025年 年間旅行動向推計数値

*国内旅行費用は、自宅を出発してから帰宅するまでの総費用。現地での買物代、食事代など現地消費分を含む。旅行前後の消費(衣類など携行品の購入費用など)は含まない。*海外旅行費用は、旅行費用(燃油サーチャージ含む)のほか、現地での買物代、食事代など現地消費分を含む。旅行前後の消費(衣類など携行品の購入費用など)は含まない。*国内旅行人数および海外旅行人数は、ビジネス・帰省を含む。*訪日旅行は、人数予測のみで消費額は算出していない。 *前年比および19年比は、小数点第二位以下を四捨五入している。

※調査結果の数字は四捨五入しているため、小計や前年公表の調査結果との差分が合わない箇所があります。

1.旅行者の現状

国内旅行について、2024年は前年に実施された観光支援策の終了や国内の物価高などの影響により、宿泊者数は伸び悩みとなっています。2024年の延べ宿泊者数をみると、1~11月の累計は4億4,858万人泊で、2023年同期(4億5,975万人泊)と比べると97.6%、2019年同期(4億4,232万人泊)と比べると101.4%となっています(図表2)。

海外旅行について、2024年は国内外の物価高、円安、世界的な政情不安などの影響により、海外旅行者数の回復は遅れています。2024年1~11月の日本人出国者数の累計は1,182万人で、2023年同期(867万6千人)と比べると136.2%、2019年同期(1,836万8千人)と比べると64.3%となっています(図表2)。

訪日旅行について、2024年は円安および物価安などの影響により、回復の勢いが一層増しています。2024年1~11月の訪日外客数の累計は3,338万人で、2023年同期(2,233万2千人)と比べると149.5%、2019年同期(2,935万6千人)と比べると113.7%となっています(図表2)。国・地域別にみると、2024年1~11月の累計は多い順に韓国(795万人、2023年同期比128.7%、2019年同期比149.0%)、中国(637万7千人、2023年同期比301.8%、2019年同期比71.8%)、台湾(555万3千人、2023年同期比146.0%、2019年同期比122.3%)となっています(図表3)。

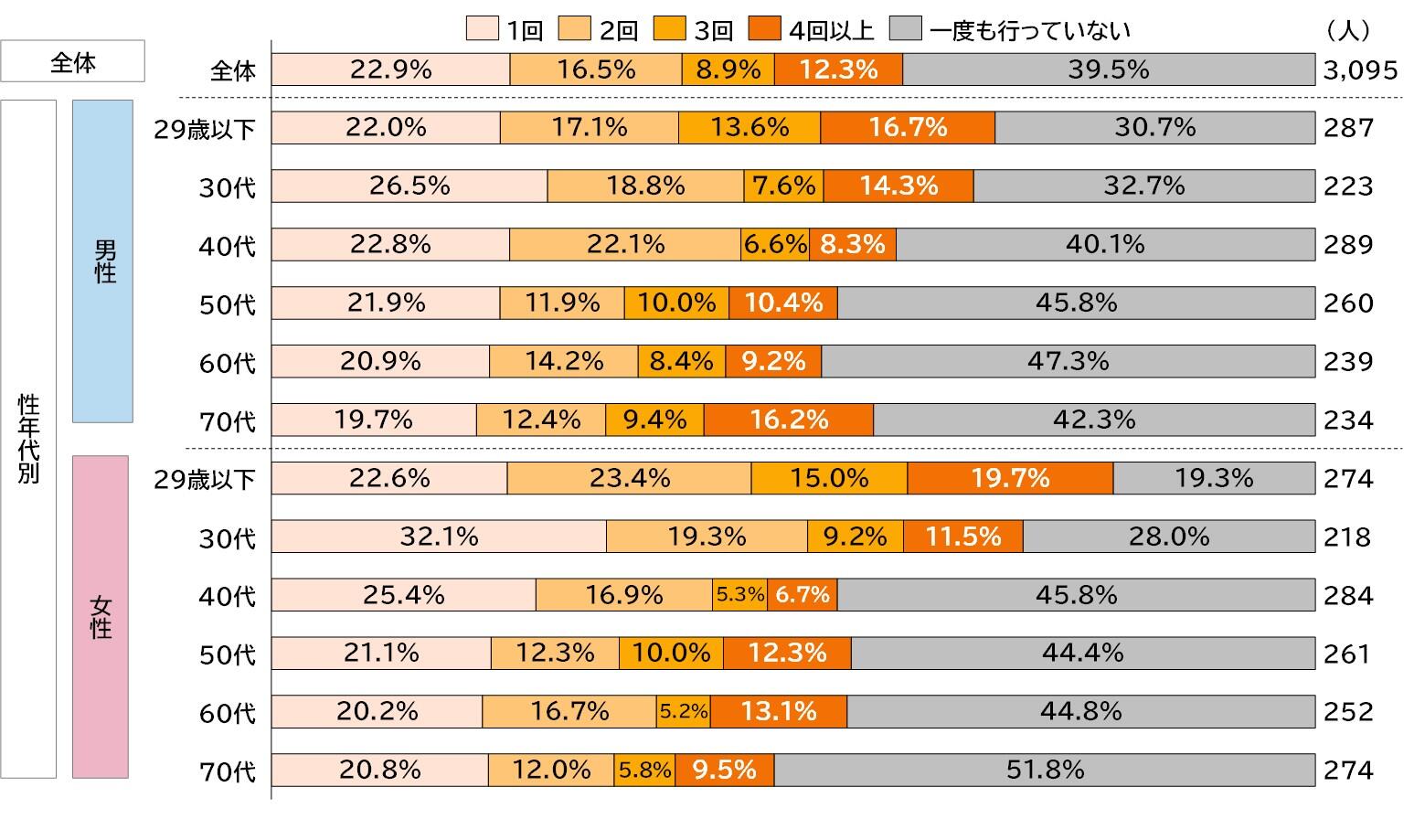

今回実施した旅行に関するアンケート調査によると、2024年1月~12月の1年間で1泊以上の旅行を実施した人の割合は、国内旅行については「1回」が22.9%、「2回」が16.5%、「3回」が8.9%、「4回以上」は12.3%で、6割以上の人が国内旅行を実施しました。性年代別に見ると、国内旅行を実施した人の割合は「女性29歳以下(80.7%)」が最も高く、次いで「女性30代(72.1%)」、「男性29歳以下(69.4%)」、「男性30代(67.2%)」となり、若い世代、特に女性の実施率が高い結果となりました(図表4)。居住地域別にみると、国内旅行を実施した人の割合は「中国・四国地方(63.9%)」が最も高く、次いで「近畿地方(62.2%)」、「東北地方(61.8%)」となりました(図表6)。

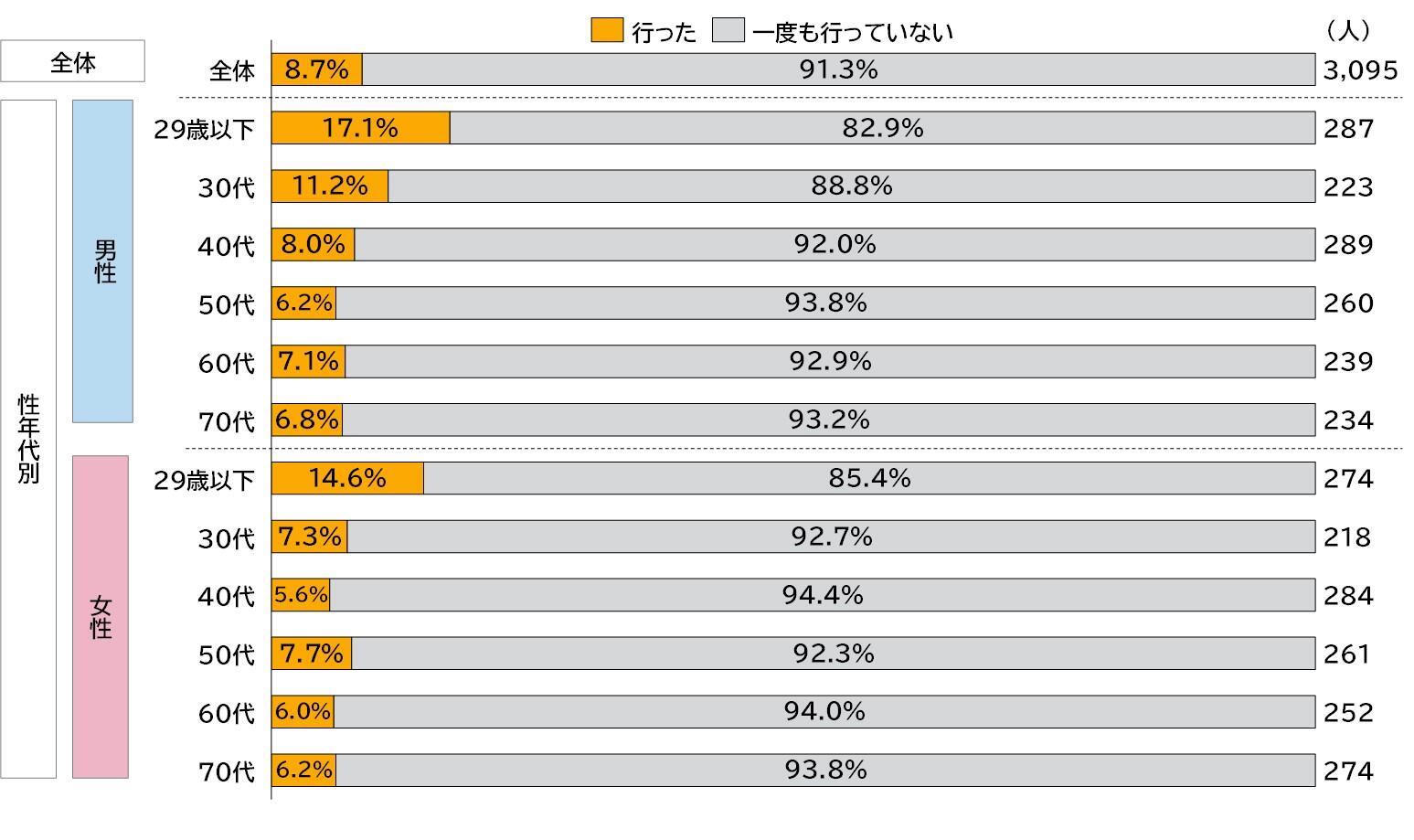

海外旅行については、実施した人の割合の合計が8.7%となりました。性年代別に見ると、「男性29歳以下(17.1%)」が最も高く、次いで「女性29歳以下(14.6%)」、「男性30代(11.2%)」、「男性40代(8.0%)」となりました(図表5)。国内旅行同様若い世代の実施率が高くなった一方で、海外旅行では女性より男性の割合がやや高い結果となりました。居住地域別にみると、実施した割合は「関東地方(11.9%)」が最も高く、次いで「九州地方(沖縄含む)(9.1%)」、「近畿地方(8.6%)」となりました(図表6)。

(図表2)2024年の訪日外客数(1月~11月累計) (2023年2019年との比較)

出所:観光庁「宿泊旅行統計調査」(2024年11月は第1次速報値、2024年1~10月は第2次速報値、2023年および2019年は確定値)/JNTO「訪日外客数・出国日本人数」(日本人出国者数:2024年11月は推計値、2024年1~10月は暫定値、2023年および2019年は確定値、訪日外客数:2024年10月・11月は推計値、1~9月は暫定値、2023年および2019年は確定値)

(図表3)国別 2024年の訪日外客数上位7か国(1月~11月累計)と2023年・2019年との比較

出所:JNTO「訪日外客数・出国日本人数」(2024年10月・11月は推計値、2024年1~9月は暫定値、2019年及び2023年は確定値)

(図表4)2024年の国内旅行実施率(性年代別、単一回答)

(図表5)2024年の海外旅行実施率(性年代別、単一回答)

(図表6)2024年旅行実施率(居住地域別、単一回答)

2.2025年のカレンダーと主なイベント

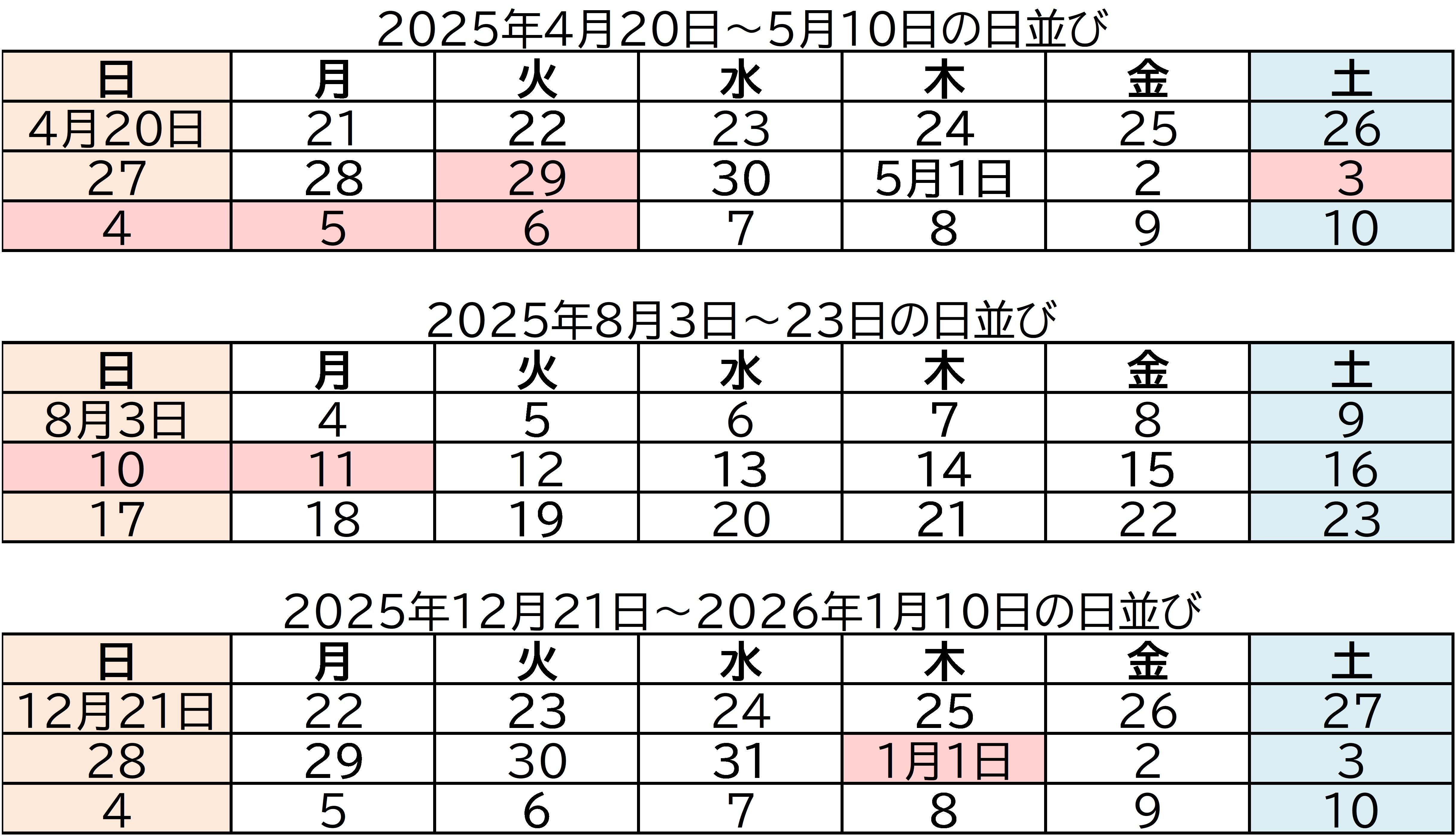

2025年のカレンダーは、3連休以上が9回あります。2024年は11回だったので、2回の減少となります。GWは後半(5月3日(土)~6日(火))が4連休となり、前半(4月26日(土)~29日(火))は4月28日(月)を休めば4連休となります。夏休みは、お盆期間の平日(8月12日(火)~15日(金))を休むと8月9日(土)~17日(日)の9連休になります。2025年~2026年の年末年始は、12月29日(月)~31日(水)を休めば12月27日(土)~1月4日(日)の9連休になります。

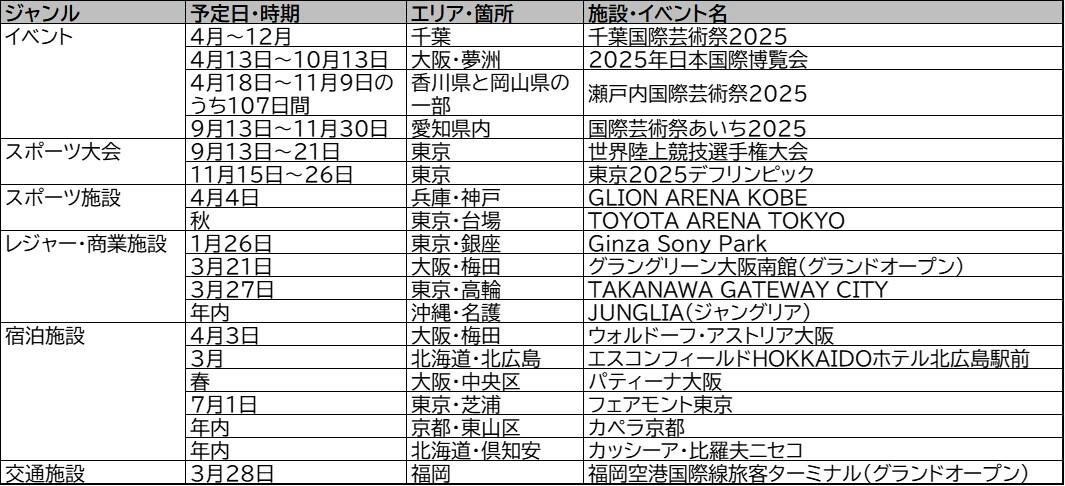

2025年に開業(開催)される主な施設・イベントは、図表7のとおりです。

<参考>2025年の連休

・1月11日(土)~13日(月):3連休

・2月22日(土)~24日(月):3連休

・5月3日(土)~6日(火):4連休

・7月19日(土)~21日(月):3連休

・8月9日(土)~11日(月):3連休

・9月13日(土)~15日(月):3連休

・10月11日(土)~13日(月):3連休

・11月1日(土)~3日(月):3連休

・11月22日(土)~24日(月):3連休

※赤色は国民の祝日

(1)イベント:2025年日本国際博覧会 ©Expo 2025

「いのち輝く未来のデザイン」をテーマに行われる万博で、国連が掲げる持続可能な開発目標(SDGs)の達成への貢献、日本の国家戦略「Society5.0」の実現を目的とする。160以上の国・地域や国際機関、民間企業が参加。最先端技術や国際交流の活性化によるイノベーション創出、地域経済の活性化などの実現を目指す。また、会場周辺の市町村や観光地、「瀬戸内国際芸術祭2025」との連携などによる交流促進・経済波及効果も期待される。

(2)イベント:瀬戸内国際芸術祭2025

2010年から3年ごとに開催されている芸術祭。高齢化・過疎化により活力が失われつつある瀬戸内海の島々において、現代美術と島の自然・文化を融合させた芸術祭を開催し世界に発信することで、かつて交通路としてにぎわった時代のような活気を取り戻すことを目指している。6回目となる今回は、「2025年日本国際博覧会」との相乗効果にも期待がかかる。

(3)レジャー・商業施設:JUNGLIA(ジャングリア)

沖縄県名護市と今帰仁村にまたがるエリアに誕生するテーマパーク。「Power Vacance!!(パワーバカンス)」をコンセプトに、都会では味わえない沖縄県ならではの体験を提供。「恐竜サファリランド」「気球体験」をはじめ、大自然を生かしたアトラクションが充実。レストランや温浴施設も併設。

(図表7)2025年に開業(開催)予定の主な施設・イベント

出所:記事・ホームページ等をもとに、JTB総合研究所作成

3.国内旅行の動向 ※訪日外国人旅行者は除く、日本居住者の国内旅行

2025年の国内旅行人数は3億500万人(対前年102.7%、対2019年104.7%)

一人あたり旅行費用は47,800円(対前年101.1%、対2019年125.5%)

国内総旅行消費額は14兆5,900億円(対前年103.8%、対2019年131.2%)

2025年の国内旅行者数は3億500万人(対前年102.7%、対2019年104.7%)、一人あたり旅行費用は物価の高値傾向が継続すると予想されるため47,800円(対前年101.1%、対2019年125.5%)、国内総旅行消費額は14兆5,900億円(対前年103.8%、対2019年131.2%)と推計します。

物価は引き続き上昇する一方で、雇用や給与に関しては次第に良化されていく見通しです。暮らし向きもゆるやかな改善が期待され、旅行に対して追い風になることが考えられます。

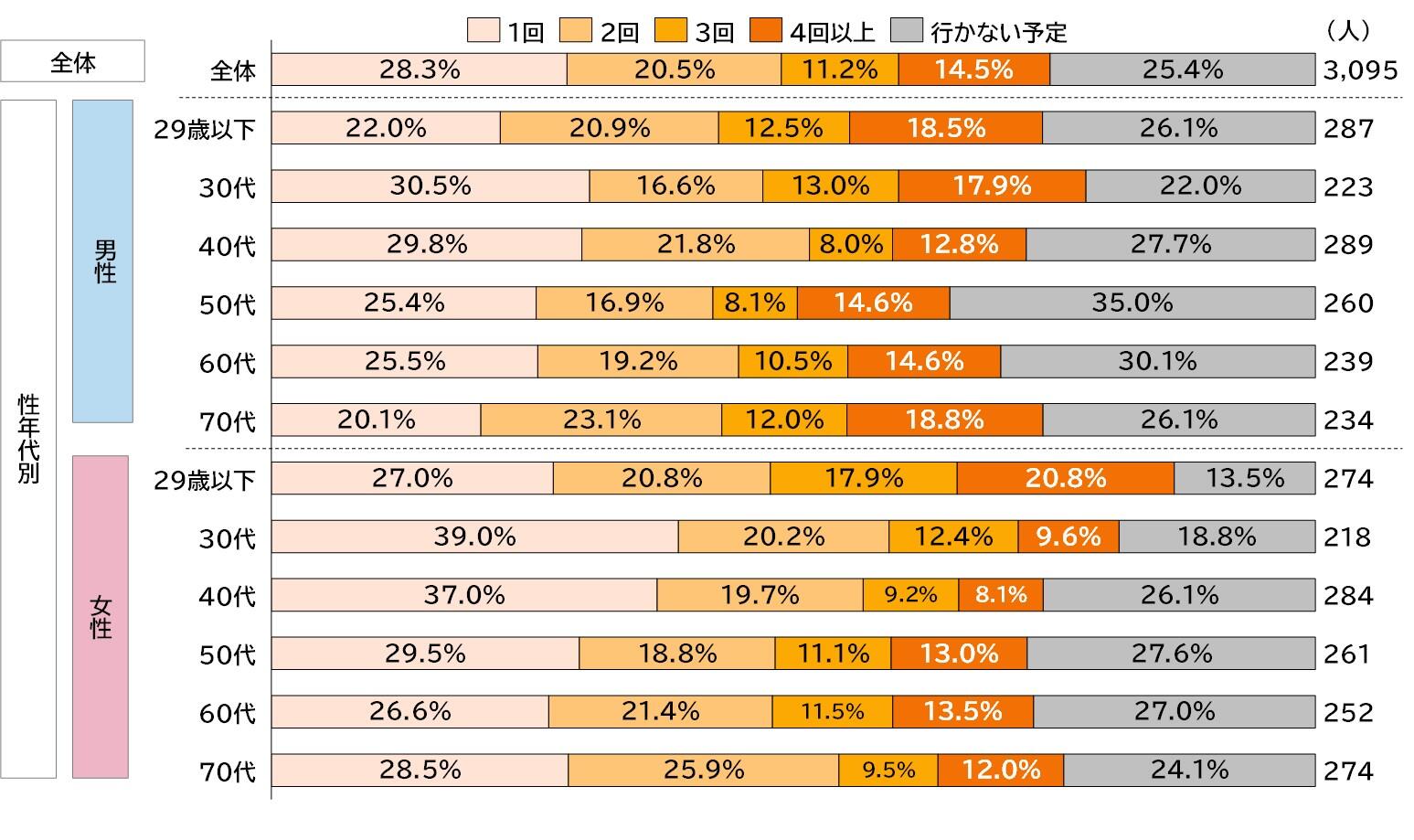

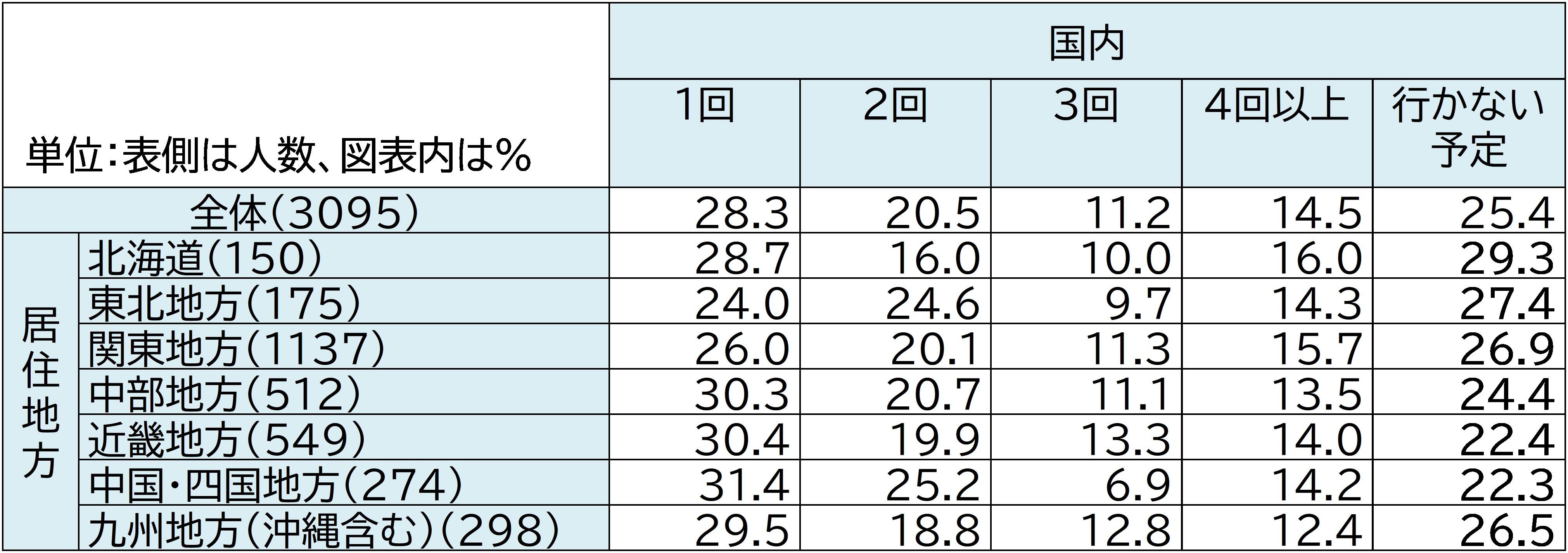

前述のアンケート調査によると、2025年1月~12月の1年間で1泊以上の国内旅行を実施する意向を聞いたところ、「1回」が28.3%、「2回」が20.5%、「3回」が11.2%、「4回以上」は14.5%となりました(図表8)。性年代別に見ると、国内旅行を実施する人の割合は「女性29歳以下(86.5%)」が最も高く、次いで「女性30代(81.2%)」、「男性30代(78.0%)」、「女性70代(75.9%)」となりました。居住地域別にみると、国内旅行を実施する人の割合は「中国・四国地方(77.7%)」が最も高く、次いで「近畿地方(77.6%)」、「中部地方(75.6%)」となりました(図表9)。

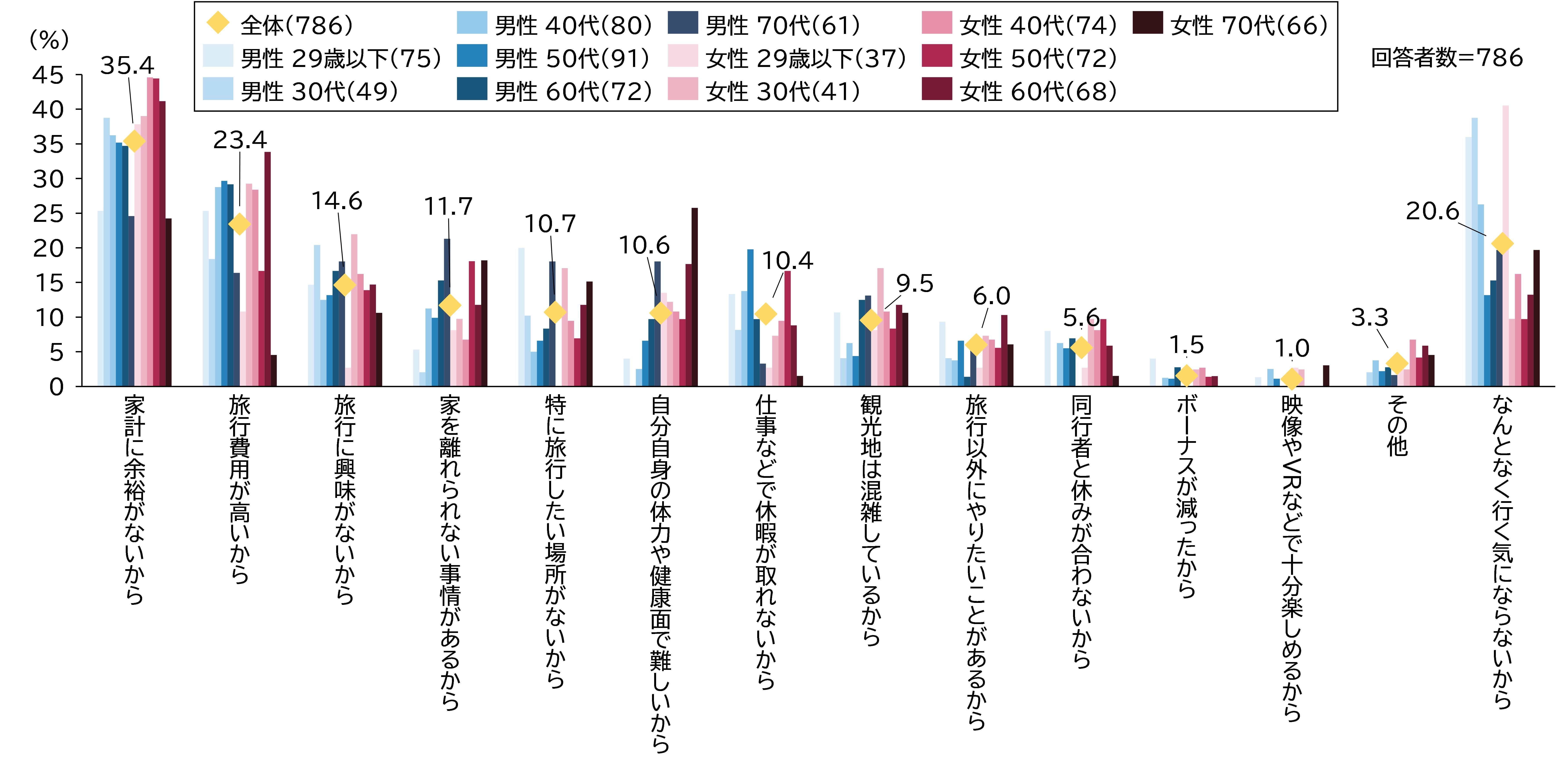

一方で、国内旅行に「一度も行かない」と答えた人は25.4%でした。その理由を聞いたところ、最も割合が高いのが「家計に余裕がないから(35.4%)」、次いで「旅行費用が高いから(23.4%)」、「旅行に興味がないから(14.6%)」となりました。予算面の厳しさが引き続きみられます(図表10)。

国内旅行を実施すると答えた人に対し、旅行先を決めるきっかけになりそうなものを聞いたところ、「自然が楽しめる場所(国立公園や花畑など)」が31.4%と最も高く、またカテゴリー別ではテーマパークなどを含む「観光施設」が軒並み高い傾向となりました(図表11)。また現時点で考えている旅行の行き先について聞いたところ、「中部(東海・甲信越・北陸)(33.8%)」が最も高く、次いで「九州(沖縄含む)(31.7%)」、「関東(31.3%)」となりました。北海道と九州は居住地域と旅行先が同じ域内旅行が多い傾向が見られる一方で、関東地方や近畿地方などから北海道・九州・沖縄などの遠方を訪れる人も相応にみられます(図表12)。

(図表8)2025年の国内旅行意向(性年代別、単一回答)

(図表9)2025年の国内旅行意向(居住地域別、単一回答)

(図表10)国内旅行に行かない理由(性年代別、複数回答)

(図表11)国内旅行先選定のきっかけになりそうなもの(複数回答)

(図表12) 国内旅行先(居住地別、複数回答)

4.海外旅行の動向

2025年の海外旅行人数は1,410万人(対前年108.5%、対2019年70.3%)

一人あたり旅行費用は334,100円(対前年106.2%、対2019年140.9%)

海外総旅行消費額は4兆7,100億円(対前年115.2%、対2019年98.7%)

2025年の海外旅行者数は1,410万人(対前年108.5%、対2019年70.3%)、一人あたり旅行費用は引き続き円安や海外物価高などの影響を受け334,100円(対前年106.2%、対2019年140.9%)、海外総旅行消費額は4兆7,100億円(対前年115.2%、対2019年98.7%)と推計します。

近年は急激な円安により海外旅行控えの傾向も見られましたが、今後為替相場が落ち着けば、海外旅行の盛り上がりが期待されます。また、東アジアなどの近距離方面だけでなくオセアニアやヨーロッパなどの中長距離方面の旅行者数も伸びているため、一人あたり旅行費用は前年をさらに上回る見込みです。

前述のアンケート調査によると、2025年1月~12月の1年間で1泊以上の海外旅行を実施する意向について聞いたところ、「行く予定」と答えた人は21.1%となりました。2024年の旅行実施率が8.7%であったことを考えると、大幅に増加しているといえます。性年代別にみると、「女性29歳以下」が34.3%と最も高く、次いで「男性29歳以下 (27.5%)」、「男性30代(26.0%)」となりました(図表13)。

居住地域別にみると、「行く予定」の割合は「関東地方(24.5%)」が最も高く、次いで「近畿地方(22.6%)」、「中部地方(18.6%)」となりました(図表14)。

また現時点で考えている旅行の行き先について聞いたところ、「韓国(30.4%)」が最も高く、次いで「台湾(26.4%)」と近隣の国・地域が高い一方で、「ハワイ(24.2%)」、「ヨーロッパ(18.4%)」など中長距離も人気があります。また性年代別にみると、韓国は女性29歳以下、台湾は男性40代と女性50代、ヨーロッパは女性70代に人気があるなど、世代による違いがみられます(図表15)。

一方で、海外旅行に「一度も行かない」と答えた人は78.9%でした。その理由を聞いたところ、最も割合が高いのが「旅行費用が高いから(33.6%)」、次いで「家計に余裕がないから (26.4%)」、「円安だから(24.4%)」とこちらも経済的な理由が上位となりました。性年代別では、女性70代では「パスポートの有効期限切れ」、「治安の面での不安」、「自身の体力面の不安」、男性50代では「仕事などで休暇が取れないから」が上位になるなど、ライフステージによる違いもみられます(図表16)。

(図表13)2025年の海外旅行意向(性年代別、単一回答)

(図表14)2025年の海外旅行意向(居住地別、単一回答)

(図表15)海外旅行先(性年代別、複数回答)

(図表16)海外旅行に行かない理由(性年代別、複数回答)

5.訪日外国人旅行者

2025年の訪日外国人旅行者数は4,020万人(対前年108.9%、対2019年126.1%)

2025年の訪日外国人旅行者数は4,020万人(対前年108.9%、対2019年126.1%)と推計します。

2024年は新型コロナウイルス感染症(以下、新型コロナ)の収束に加え、急激に進んだ円安の追い風もあり、訪日外国人旅行者数が急増しました。2024年1~10月の累計数は過去最速で3,000万人に到達しており、年間では3,500万人を超える見込みです。2025年はそれをさらに上回り、過去最高となります。ただし、新型コロナ後の急激な需要回復が一巡すると考えられ、4,000万人は突破するものの、前年比108.9%と伸び率がゆるやかになると予想しています。

国・地域別でみると、「1.旅行者の現状」でも触れたように、上位7か国のうち韓国、台湾、アメリカ、香港、オーストラリアの2024年1月~11月の累計数はすでに新型コロナ前の2019年を上回っています。2025年においても、近隣市場を中心に増加が見込まれます。また回復が遅れている中国については、ビザ緩和措置などの条件が整えば2019年並みに回復する可能性があります。

このような状況を踏まえ、今回のアンケート調査対象者に、訪日外国人観光客増加に対する気持ちについて聞いたところ、歓迎する声としては「日本経済全体の活性化につながるので歓迎だ(34.2%)」の割合が最も高く、特に29歳以下・30代・40代の男性、女性は50代で高い結果となりました。次いで「地方経済の活性化につながるので歓迎だ(23.2%)」、「観光地に賑わいが出てくるので歓迎だ(17.8%)」となりました。一方、懸念する声としては「観光地でのマナーが悪くならないか不安だ(43.4%)」の割合が最も高く、次いで「観光資源・施設、自然などがダメージを受けないか不安だ(31.9%)」、「住んでいる人の生活に影響が出ないか不安だ(31.3%)」となり、いずれも男女ともに50代以上で高い傾向がみられます。若い世代ほど、経済活性化や地域の賑わいにプラスになるなど前向きな捉え方をしている様子がうかがえます(図表17)。

現在、持続可能な観光の一環として、国を挙げてのオーバーツーリズム対応策が進められています。訪日外国人客だけでなく、日本人(旅行者および住民)の満足度も高まるような観光施策に注目が集まっています。

(図表17)訪日外国人観光客増加に対する気持ち(性年代別、複数回答)

6.旅行を取り巻く経済環境と暮らし向き

日本経済は、日経平均株価(終値)が2024年内に一時的に4万円台に乗せたものの、9月以降は総じて3万円台後半で推移しており、一進一退を繰り返しています。また、国内外における物価上昇や欧米での高い金利水準の継続、不安定な世界情勢などの影響を受け、景気の先行きは不透明な状態が続いています。IMF(国際通貨基金)が2024年10月に公表した「世界経済見通し」では、2024年の日本の成長率(予測値)は0.3%で、2025年の成長率(予測値)は1.1%と回復が見込まれています。

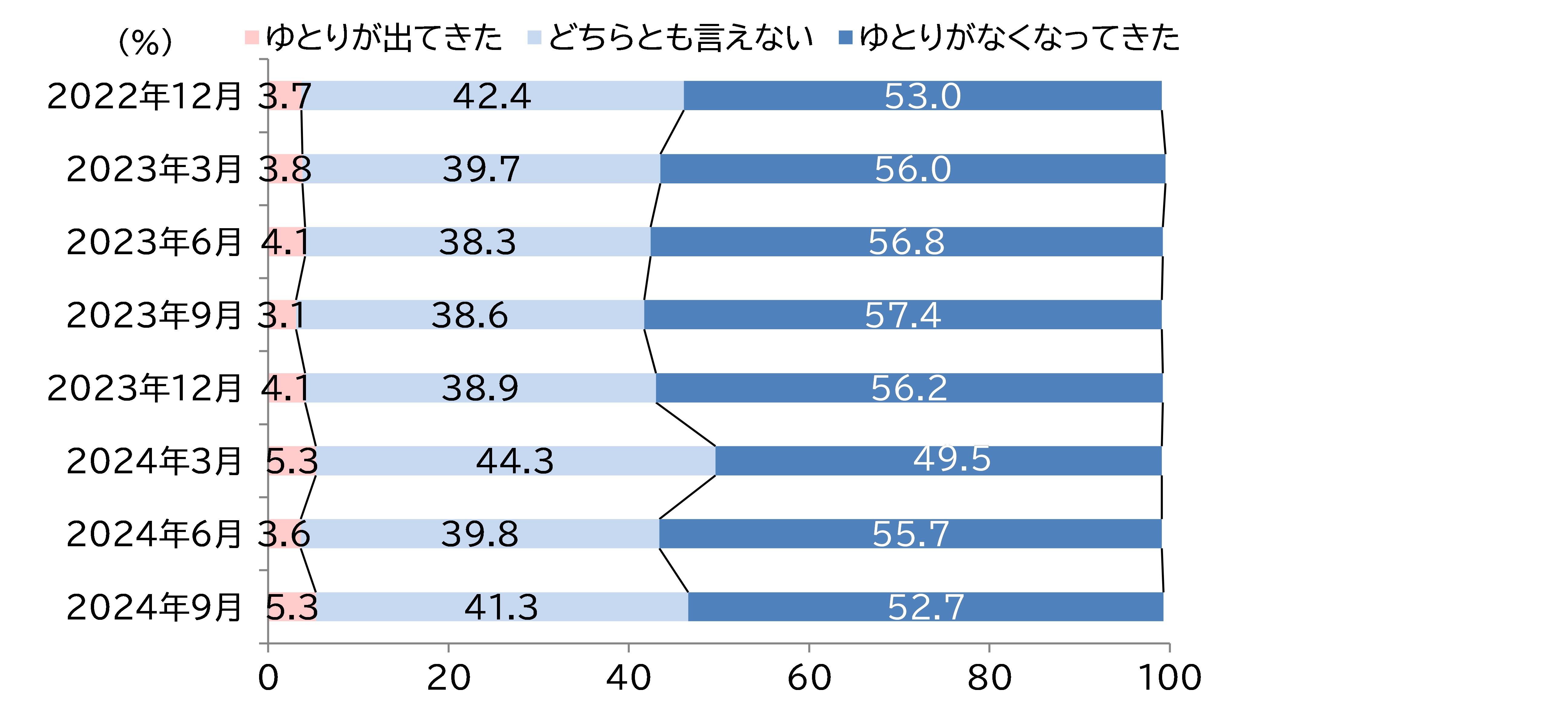

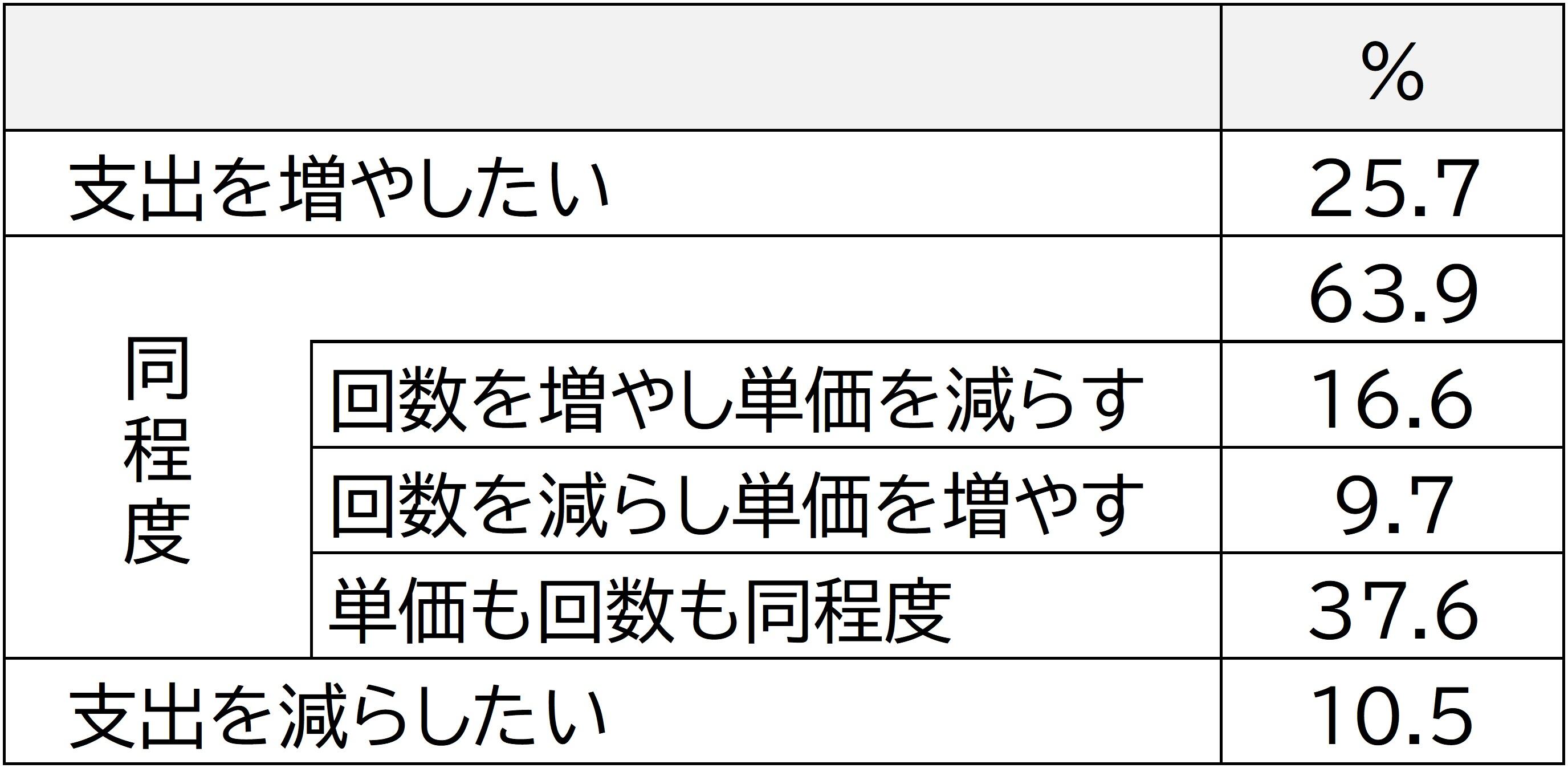

足元の経済状況をみると、円安・ドル高傾向は2024年も継続しており、7月上旬には外国為替市場の終値が1ドル161円台となりました。その後は円安の修正がみられたものの、2024年12月30日時点で1ドル158円台と引き続き円安水準にあり、物価などに大きな影響を与えています(図表18)。主な品目の消費者物価指数を見ると、2024年11月まで補助金が投入された「電気代」(反映は12月分まで)は比較的落ち着きがみられるものの、「交通・通信」を除く品目は引き続き高水準にあり、特に「生鮮食品」の伸びが顕著です(図表19)。日本銀行が実施している「生活意識に関するアンケート調査」の「現在の暮らし向き」をみると、2024年9月は「ゆとりが出てきた」の割合が2022年12月以降最も高く、一方で「ゆとりがなくなってきた」が最も低くなっており、暮らし向きはゆるやかながら改善される傾向がみられます(図表20)。また、前述のアンケート調査において「旅行に行く」と答えた人に、「今後1年間の旅行の支出に対する意向」を聞いたところ、「支出を増やしたい(25.7%)」が「支出を減らしたい(10.5%)」を上回っており、旅行への支出拡大が見込まれます(図表21)。

(図表18)2024年の円に対する主な外国為替レート

出所:東京外国為替相場/TTM(Telegraphic Transfer Middle Rate)(三菱UFJリサーチ&コンサルティング「外国為替相場情報」より)

(図表19)主な消費者物価指数の推移

出所:総務省「2020年基準消費者物価指数」データをもとにJTB総合研究所作成

(図表20)現在の暮らし向き

出所:日本銀行「生活意識に関するアンケート調査」データをもとにJTB総合研究所作成

(図表21)今後1年間の旅行の支出に対する意向(単一回答、回答者数=2,326)

―――――――――――――――――――――――――――――――――――――――――――

【2025年の旅行に関するアンケート 調査方法】

調査実施期間: 2024年11月29日~30日 / 調査方法: インターネットアンケート調査 (調査委託先:株式会社マクロミル)

調査対象: 全国15歳以上79歳までの男女個人 / サンプル数: 本調査3,095人

調査内容: 2025年1月1日~12月31日に実施する旅行について

※調査結果の数字は四捨五入のため、小計や前年公表の調査結果との差分が合わない箇所があります。

(図表22)2000年~2023年の推計、2024年~2025年の見通し数値

*国内旅行者数は2000年~2023年までは実績推計値、2024年・2025年は推計値 *海外旅行者数と訪日外国人旅行者数は2000年~2023年までは実績値、2024年・2025年は推計値

JTB広報室 03-5796-5833(東京) 06-6260-5108(大阪)