JTBグループ 2025年3月期 第2四半期(中間期)連結決算概要

株式会社JTB

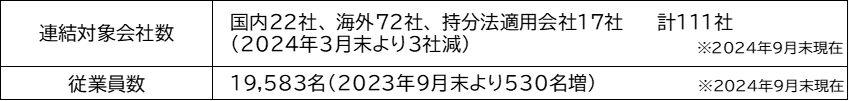

株式会社JTB(代表取締役 社長執行役員 山北栄二郎)は、2025年3月期第2四半期の連結決算を取りまとめました。

1.JTBグループ2025年3月期 第2四半期連結決算について

(1)全体概要

第2四半期(中間期)におけるツーリズム産業を取り巻く市況は、国連世界観光機関(UNWTO)のデータでは「国際観光客到着数」が7月累計で推定7億9,000万人(2019年同期比96%)に達し、2019年と同水準まで回復を遂げています。日本国内では1月に発生した能登半島地震など災害の影響を被ったものの、底堅いインバウンド需要が国内旅行市場を支えており、日本政府観光局(JNTO)のデータでは「訪日外国人客数」が7月累計で3,292 万人に達し2019年を上回る状況で推移しています。海外旅行については、円安や物価高、不安定な国際情勢などの影響により回復が遅れています。観光庁が公表する「主要旅行業者の旅行取扱状況」では、4月から8月までの総取扱額は2019年度比で61%に留まっています。

当社において国内旅行は前年の「全国旅行支援」の反動減や自然災害の影響を一部受けたものの、段階的に回復しています。「日本の旬」※1キャンペーンを北陸で実施、復興に向けて交流を復活させる息の長い支援を続けています。海外旅行は燃油高騰や円安、現地の物価高なども影響し、依然として緩やかな回復にとどまっていますが、第3国間のグローバル旅行では、東アジアから欧州への旅行が好調で、欧州・米国・アジアにおけるグローバル領域は顕著に伸長しました。訪日旅行も円安の追い風を受け欧米市場を中心に増加しました。

旅行以外の領域では市況の回復を捉えたM&E、旅行回復に伴う商事が好調に推移しました。また成長戦略の一つである観光DX領域においては、デジタルメディア事業を中心に前年比を超え着実に伸長しています。コーポレート部門においては、人材面ではリファラル採用の導入、IT・DX面ではデジタル・IT資源の見える化や生成AIを活用した基盤開発やユースケース実装および「スマートワーク」実現のための基盤整備など、将来に向けた投資を積極的に行いました。

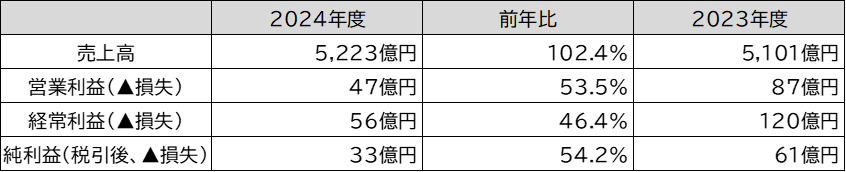

これらの取り組みや改革を推進した結果、当連結会計年度の売上高5,223 億円(前期比122億円の増収)、営業利益は47 億円(前期比41億円の減益)、経常利益は56億円(前期比64億円の減益)、当期純利益は33 億円(前期比28億円の減益)となりました。

■当社グループの概況

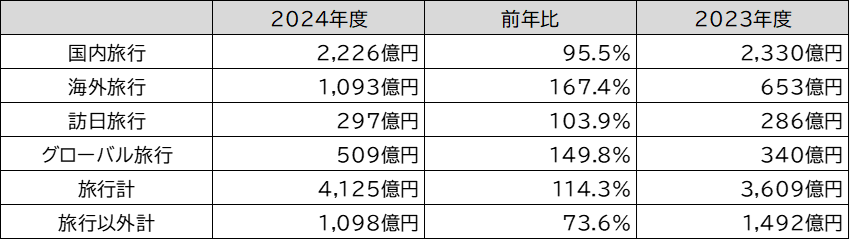

■部門別概況(金額はすべて売上高)

※グローバル旅行:日本発着以外の旅行 ※旅行以外:MICE、地域交流・BPO、商事、出版事業など

(2)事業別概況

①ツーリズム事業

回復する旅行需要の取扱い拡大と生産性の向上による高収益化に取り組みました。「企業」「教育」マーケットでは、ソリューションビジネスの展開や、学校運営・サポートなどの教育事業を中心に成果を上げました。「地域交流」マーケットではコロナ関連業務減少等の影響を受けましたが、香川県の「SICSサステナブルラウンジ」の開業やさいたま市地域商社「つなぐ」への出資など、自主事業を起点とした観光地経営・まちづくりの具現化により、地域パートナーシップ強化に努めました。スポーツビジネスではパリオリンピック・パラリンピック、MLBなどでのホスピタリティプログラムを拡充し、当社ならではの特別な体験をお客様に提供しました。個人領域では、パーソナルエージェントの稼働やデータマーケティング強化とOMO※2推進によって顧客体験の向上が図られました。各種施策が奏功し国内旅行におけるWeb販売が伸びました。海外市場では、円安・物価高の影響を受けながらも、ワクワクを発信する場所として海外旅行専門デスクのオープンや海外旅行キャンペーンによる需要喚起と取扱い拡大に努めました。さらに、海外旅行バリューチェーン改革プロジェクトにおいて、海外におけるコンテンツ造成とマーケティング、販売チャネルの再構築を行い、グローバルな人流拡大に対応する体制を目指します。これらの取り組みを通じ、お客様の実感価値向上に注力しています。

②エリアソリューション事業

「進化と拡大」を重点テーマに、各領域での基盤整備と事業開発の拡充に取り組みました。株式会社グッドフェローズJTBが提供する入場施設向けチケット流通プラットフォーム、およびアクティビティ商品の在庫・予約の一元管理が可能な「JTB BÓKUN」での新規契約事業者数・販売流通額が計画を上回りました。地域の観光人材育成支援に向け、自治体・DMO向けに「観光DX人材育成プログラム」を開発し、宿泊事業者向け「Kotozna In-room」の導入客室数は前期末比150%超に増加しました。観光地整備・運営支援領域では、自治体への新規獲得営業により、ふるさと納税の寄付額が計画を上回りました。出版では、新たな顧客基盤の獲得と事業拡大に向け、生成AIを活用した「るるぶ+AIチャット」サービスを開始しました。商事では宿泊施設の好調な稼働を背景に、消耗品・装備品販売が好調に推移しています。エリア開発領域では、沖縄北部エリアに続く5つの新戦略エリアを策定し、各エリアでのバリューアップに向けた投資開発を推進しています。香川・小豆島では「20年先の小豆島をつくるプロジェクト」を開始し、シェアサイクル事業など環境に配慮した取り組みを通じて、持続可能な観光地づくりに貢献しています。

③ビジネスソリューション事業

市況回復を背景に、ABM※3戦略を軸とした企業需要と顧客ニーズを捉え取り扱いを拡大しました。Meetings&Events領域では、Cvent※4などのデジタルソリューションを活用したコンサルティング営業スタイルの定着と専門人材の育成に注力しました。顧客ニーズの多様化に対応しつつ、「マーケティング」「周年」「訪日インバウンド」「IR・株主総会」の4テーマに加え、「サステナビリティ」を考慮したソリューション提案で競争力を高めています。地域交流領域では、コロナ対策関連業務の縮小をその他行政案件事務局サポート業務などで補いました。EVP/HRC領域※5では、人的資本情報開示義務化などに対応すべく、HR-Tech※6を活用したサーベイ分析に基づくコンテンツ開発によるサービス提供も継続しています。ビジネストラベル領域は、市場回復傾向にあるものの、競合環境の変化に注視しつつ、ストック型ビジネスモデルへのシフトとオペレーション効率化を進め、成果が表れ始めています。

④グローバル領域

2024年の国際観光市場が力強く回復する中、当社はグローバル成長戦略において、5つの重点領域を「ビジネスの柱」として定め推進しています。グローバルDMC事業では、インハウス需要が一定程度回復し、「安・近・短」商品や教育旅行が好調、グローバルインバウンドでは台湾を中心とした東アジアから欧州方面への取り扱いが牽引しました。SIC(シートインコーチ)※7ではEuropamundo社が昨年を上回る実績を達成。ランドクルーズ※7も学生向けの販売促進が奏功しました。グローバルビジネスソリューション事業では、堅調な訪日需要を背景にMICE案件を着実に獲得。インド市場でのSMM※8にも注力し、グローバル製薬企業案件を受注しました。ビジネストラベルでは、北米・アジア太平洋地域の需要回復を捕捉し、企業の出張管理効率を改善する次世代予約プラットフォームとの提携も実現しました。訪日インバウンド事業では、欧米市場のツアーが好調で、「ツアーグランプリ2024」において「観光庁長官賞」を受賞したサンライズツアーも好調な販売となりました。

※1 「日本の魅力の再発見」をテーマに、1998年よりJTBグループで実施している国内観光地活性化を目的としたキャンペーンで、半期ごとに対象方面を選定している、当社の登録商標。

※2 Online Merges with Offlineの略。 顧客体験の最大化を目指しオンライン(Web)とオフライン(店舗やコールセンターなど)の垣根を超えて購買意欲を創り出そうとするマーケティングの考え方。

※3 Account Based Marketingの略称。自社にとって価値の高い顧客を選定し、顧客の課題やニーズに合わせた最適なアプローチをとるBtoBマーケティング戦略のこと

※4 ミーティング・イベントの計画、プロモーション実施に至るまでの各種機能を同一プラットフォーム上で実行管理できるイベントマネジメントシステム

※5 EVP:Employee Value Propositionの略称。社員が共感できるその企業で働く価値の提案(人的資本経営の中から生まれた実践のためのキーワード)HRC:Human Resource Consultingの略称

※6組織や社員のアンケートデータ取得・分析に基づく課題の可視化やレコメンド機能等をそなえたシステム

※7 Seat In Coachの略称。JTBにおける、コース組み合わせ自由型のバスツアーの商品名。「ランドクルーズ」は当社の登録商標です。

※8 Strategic Meetings Managementの略称。ビジネスイベントが目標達成に最大限効果を発揮するために、実施におけるプロセスやデータの可視化、収集、分析をもとにお客様にあわせた最適なイベント管理プログラムを構築する考え方

2.2025年3月期(2024年度)の通期見通し

年度当初に計画した営業利益116億円達成に向け、グループ全社をあげて邁進してまいります。

当社グループは、未来を見据えた持続可能な成長を実現するため、長期的な展望を描く新たなビジョンの策定に取り組んでおります。同時に、「新」交流創造ビジョンの具現化に向けて、各事業分野における成長戦略を加速させています。さらに、DX、DEIB、そしてサステナビリティといった各戦略を通じて、将来の事業基盤を強固なものにしてまいります。これらの取り組みにより、時代の変化に柔軟に対応し、社会に価値を提供し続ける企業グループへと進化してまいります。

2025年3月期第2四半期(中間)の決算の詳細については、以下ご参照ください。

JTBグループは「交流創造事業」を事業ドメインとし、デジタル基盤の上に人の力を活かし、 地域や組織の価値を共創し、人流や情報流、物流を生み出すことで、 人と人、人と地域、人と組織の出会いと共感をサステナブルにつくり続けることをめざします。※「交流創造事業」は(株)JTBの登録商標です。

JTB広報室 TEL:03-5796-5833