2024年ゴールデンウィーク(4月25日~5月5日)の旅行動向

株式会社JTB

JTBは、「ゴールデンウィーク(以下、GW)<2024年4月25日~5月5日>の1泊以上の旅行に出かける人」の旅行動向見通しをまとめました。本レポートは、1泊以上の日本人の旅行について、各種経済動向や消費者行動調査、運輸・観光関連データ、JTBグループが実施したアンケート調査などから推計したもので、1969年より継続的に調査を実施しています。

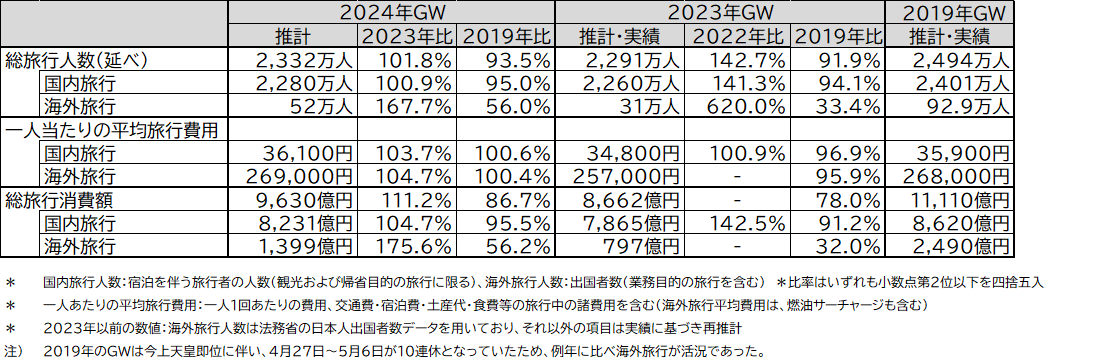

総旅行消費額が9,630億円(対前年111.2%)

●国内旅行は、旅行者数が2,280万人(対前年100.9%)、平均費用は36,100円

(対前年103.7%)、旅行消費額が8,231億円(対前年104.7%)

●海外旅行は、旅行者数が52万人(対前年167.7%)、平均費用は269,000円

(対前年104.7%)、旅行消費額が1,399億円(対前年175.6%)

【国内旅行】

➣ 旅行者数は、株価高騰の好条件がある一方で、物価高騰の影響もあり前年並み

➣ 平均旅行費用(単価)は物価高で上昇

➣ 行先はやや近場が多いものの前年に比べ分散傾向、交通機関は鉄道や航空機を利用した旅行が増加

【海外旅行】

➣ 旅行者数は、新型コロナウイルス感染症流行前の8~9割程度まで回復(10連休だった2019年を除く)。前年の水際対策終了がGW間際の発表で海外旅行を断念した人が一定数いたと想定、その反動が見込まれる

➣ 平均旅行費用(単価)は、円安や物価高の影響により上昇

➣ 旅行意欲は高めだが、旅行費用の高騰を受け、行先は近場が多く、特にアジアの人気が高い

(図表1)2024年GW旅行動向推計数値

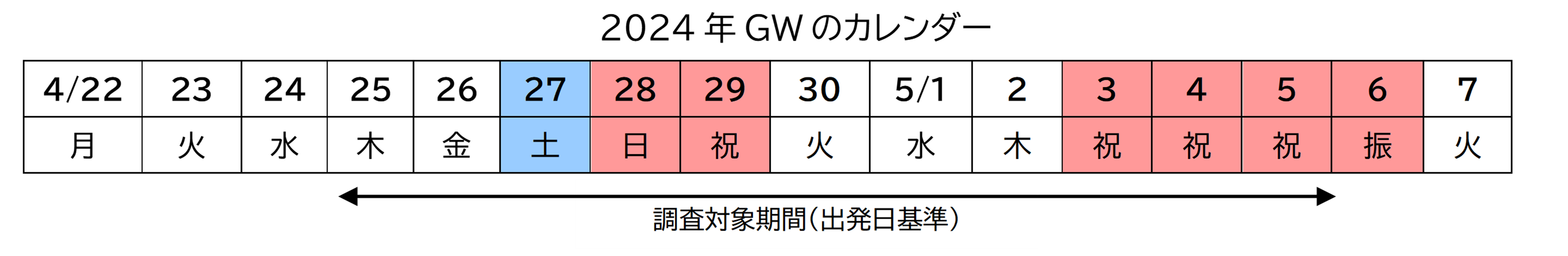

1.今年のGWのカレンダーと旅行傾向

2024年のGWは、新型コロナウイルス感染症(以下、新型コロナ)が2023年5月8日に5類感染症に移行されてから初めてのGWとなります。 カレンダーは、4月27日(土)~29日(月・祝)が3連休、5月3日(金・祝)~6日(月・振)が4連休となっています。4月30日(火)、5月1日(水)、5月2日(木)を休みにすると、4月27日(土)から10連休となります。2024年GW(4月25日~5月5日)の帰省を含めた旅行意向の詳細について、前述のアンケートで聞きました。

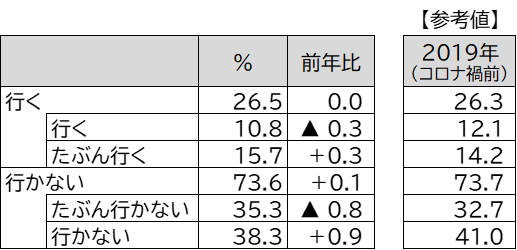

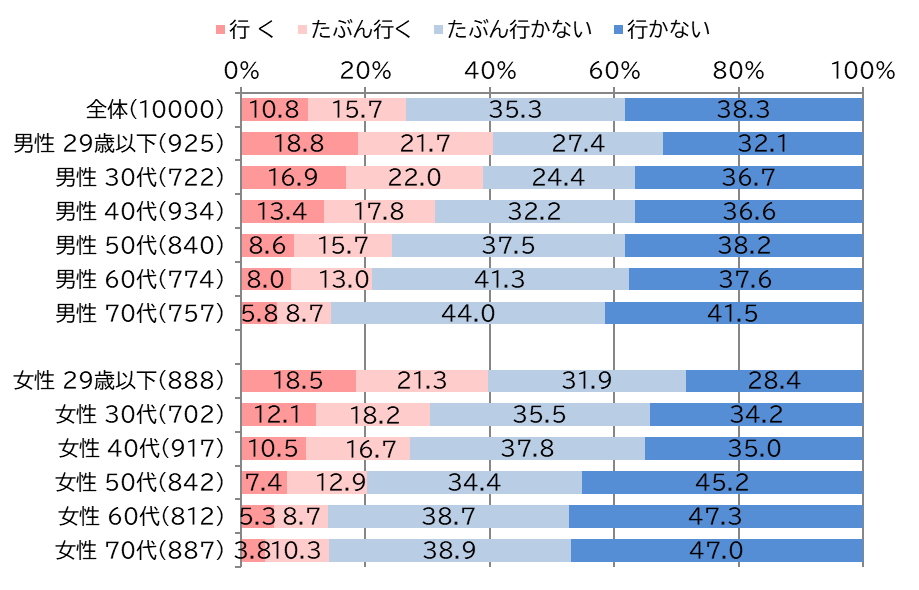

GW期間中に旅行に行くかどうかについては、「行く("行く"と"たぶん行く"の合計)」と回答した人は調査時点で26.5%と前年同様の結果となりました。コロナ禍前の2019年は26.3%だったので、旅行意欲は今年もコロナ禍前と同等まで回復しているといえます(図表2)。性年代別でみると、男性29歳以下は40.5%となり前年から0.3ポイント増加、女性29歳以下は39.8%となり2.5ポイント増加しました。一方で、男性70代は14.5%となり5.0ポイントの減少、女性70代は14.1%となり0.5ポイント減少しています。すべての世代で旅行意欲が大きく回復していた前年に比べ、今年は男女とも若い年代ほど旅行意向が高くなる傾向がみられます(図表3)。

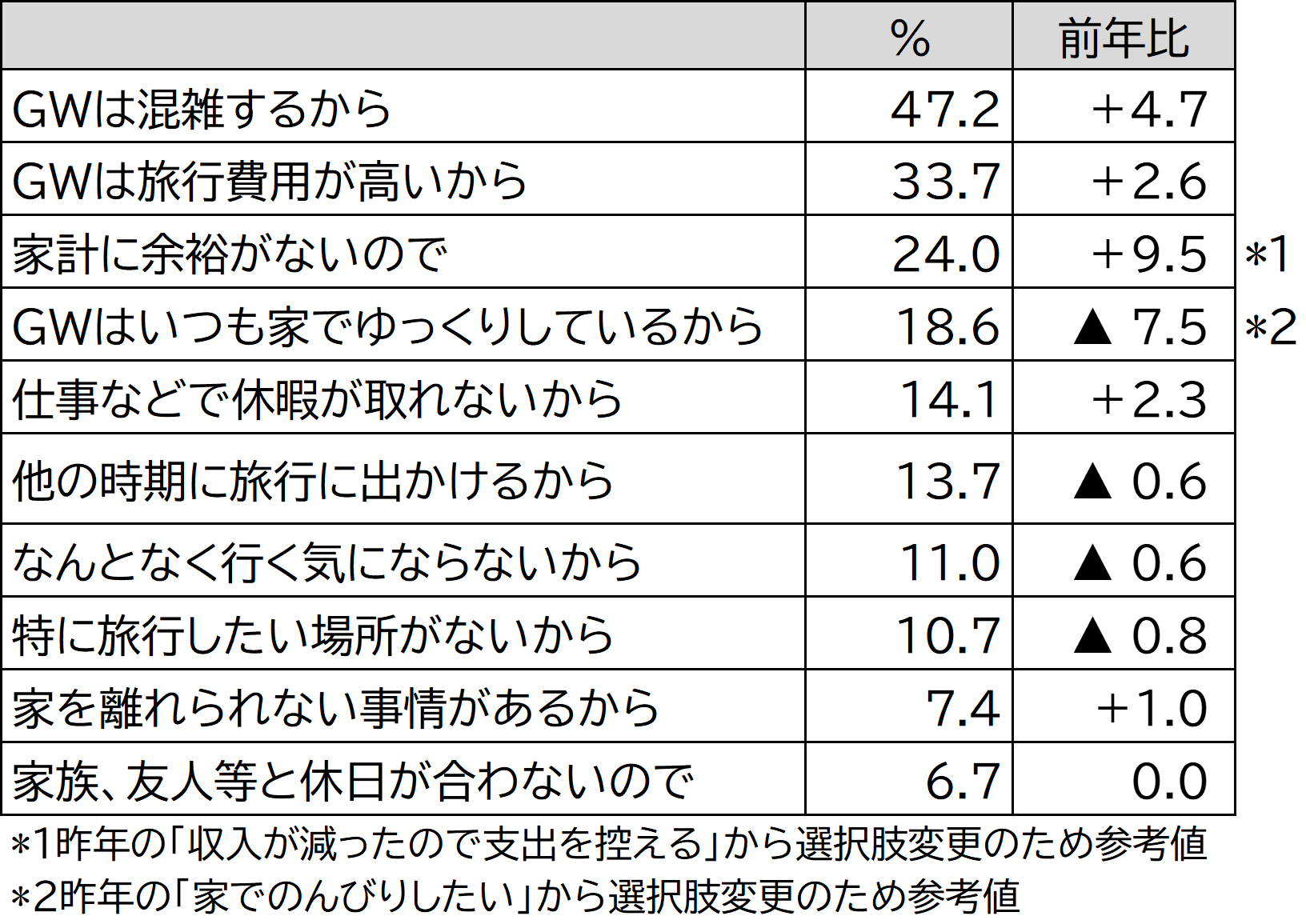

旅行に行かない理由としては、「GWは混雑するから(47.2%)」が最も多く、前年から4.7ポイント増加しました。次いで、「GWは旅行費用が高いから(33.7%)」、「家計に余裕がないので(24.0%)」と経済的な理由が続きました。一方、「GWはいつも家でゆっくりしているから(18.6%)」は、選択肢を変更しているため参考値となりますが、前年の類似項目「家でのんびりしたいので(26.1%)」と比較すると7.5ポイント減少しました(図表4)。

(図表2)GWの旅行意向(単一回答、回答者数=10,000)

(図表3)GWの旅行意向(性年代別、単一回答、回答者数=10,000)

(図表4)今回のGW旅行に行かない理由(複数回答、回答者数=7,351)

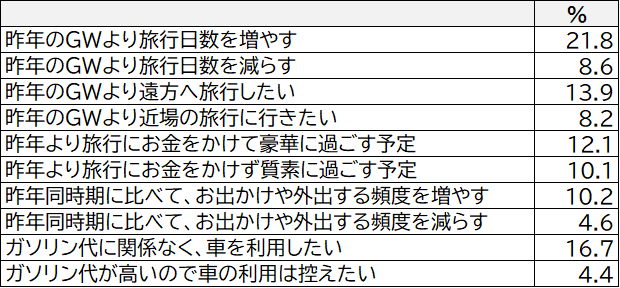

また、GWに旅行へ行くと答えた本調査対象者2,060人に対して、今年のGWの旅行に対する考え方を聞きました。前年は、GW直前になって水際対策の大幅な緩和措置が発表されるなど、新型コロナの影響が残っていた可能性もあり、今年は「昨年のGWより旅行日数を増やす」が21.8%で最も多く、「昨年のGWより旅行日数を減らす(8.6%)」を大きく上回りました。加えて、「昨年のGWより遠方へ旅行したい(13.9%)」が「昨年のGWより近場の旅行に行きたい(8.2%)」を5.7ポイント上回り、前年と比較すると「長く」「遠くに」旅行したいという意欲がうかがえます(図表5)。

(図表5)今年のGWの旅行に対する考え方について(複数回答、回答者数=2,060)

2.国内旅行の動向

国内旅行者数は2,280万人(対前年100.9%)、国内旅行平均費用は36,100円(同103.7%)、総国内旅行消費額は8,231億円(同104.7%)です(図表1)。

今年のGWの旅行に関するアンケート調査において、本調査回答者(2,060人)のうち旅行先を「日本国内」と答えた1,964人の旅行の傾向を分析しました。

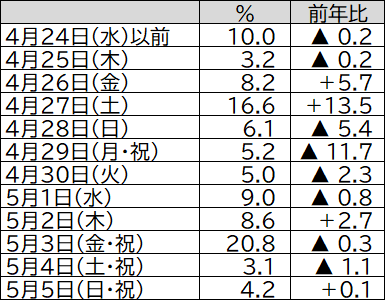

旅行出発日:出発日のピークは「5月3日(金・祝)(20.8%)」、次いで「4月27日(土)(16.6%)」となっており、前半の3連休と後半の4連休の2つのピークがみられます(図表6)。

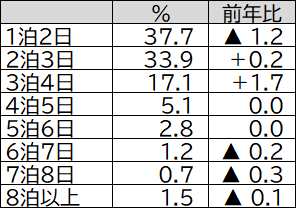

旅行日数:全体では、「1泊2日(37.7%)」が最も多いものの、前年から1.2ポイント減少しています。一方、「2泊3日(33.9%)」は0.2ポイントの増加、「3泊4日(17.1%)」は1.7ポイントの増加となりました。なお、前年は日並びの関係で今年に比べて長期休暇が取りやすい環境にあったためか、6泊以上は微減となっています(図表7)。

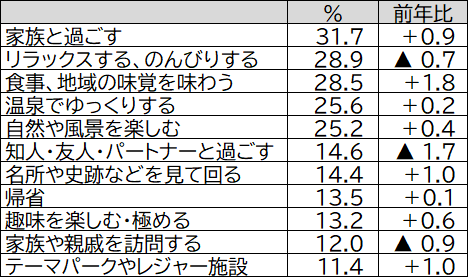

旅行目的:「家族と過ごす(31.7%)」が最も多くなりました。次いで「リラックスする、のんびりする(28.9%)」「食事、地域の味覚を味わう(28.5%)」となりました(図表8)。

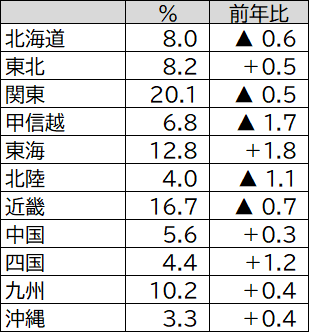

旅行先:「関東(20.1%)」が最も多く、次いで「近畿(16.7%)」、「東海(12.8%)」となりました(図表9)。

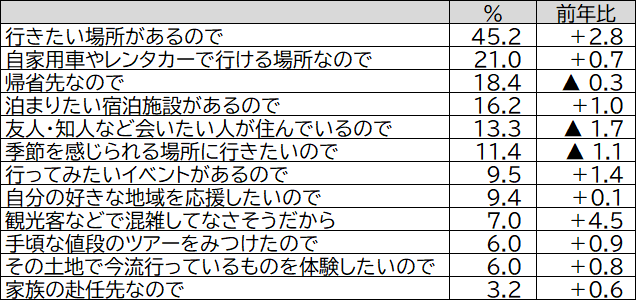

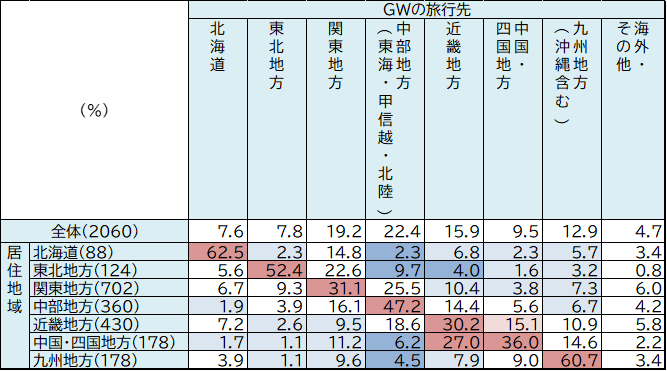

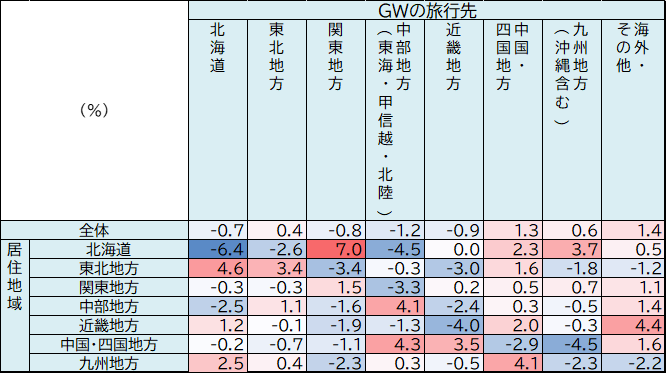

その旅先を選んだ理由として、「行きたい場所があるので(45.2%)」が最も多く、前年から2.8ポイント増加しました。次いで「自家用車やレンタカーで行ける場所なので(21.0%)」、「帰省先なので(18.4%)」となりました。また割合は小さいものの「観光客などで混雑してなさそうだから(7.0%)」は前年から4.5ポイント増加し、最も大きい伸び率となりました(図表10)。居住地別に旅行先を見ると、旅行先と居住地が同じ地方である域内旅行の割合は、「北海道(62.5%)」、「九州地方(60.7%)」の2地域では60%を超えている一方で、「近畿地方」は30.2%、「関東地方」は31.1%となり、隣接する地方に分散している様子がうかがえます (図表11)。また前年と比較すると、北海道、近畿地方、中国・四国地方、九州地方では域内旅行の割合は減少していますが、東北地方、関東地方、中部地方では増加しており、地域によって特徴がみられます(図表12)。

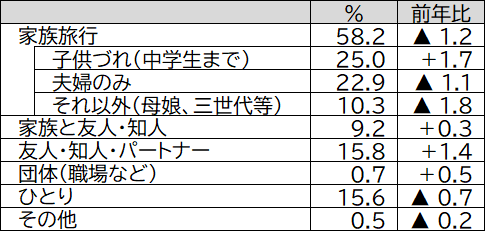

同行者:「子供づれ(中学生まで)の家族旅行(25.0%)」が最も多く、前年から1.7ポイント増加しました。次いで「夫婦のみ(22.9%)」、「友人・知人・パートナー(15.8%)」となりました(図表13)。

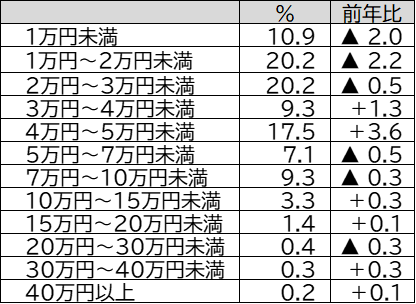

一人当たりの旅行費用:全体では、「1万円~2万円未満(20.2%)」、「2万円~3万円未満(20.2%)」が同率で最も多くなっていますが、いずれも前年から減少しています。次いで「4万円~5万円未満(17.5%)」となり、前年より3.6ポイント増加しています。3万円以上の合計は前年に比べて4.7ポイントの増加となり、全体的に費用は増加傾向といえます(図表14)。

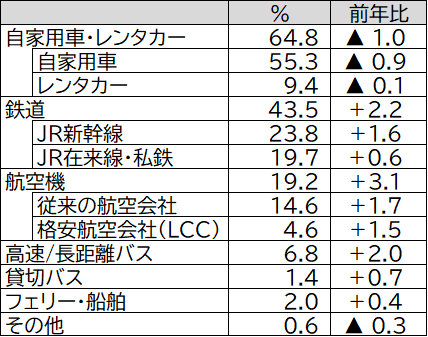

利用交通機関:「自家用車(55.3%)」が最も多く、次いで「JR新幹線(23.8%)」、「JR在来線・私鉄(19.7%)」となりました。カテゴリーごとに見ると、「自家用車・レンタカー」が1.0ポイントの減少となった一方で、「鉄道」は2.2ポイントの増加、「航空機」は3.1ポイントの増加となりました(図表15)。

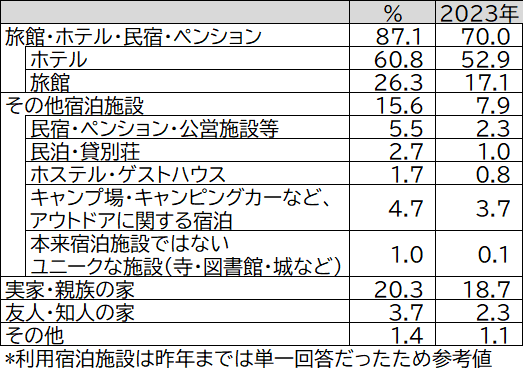

利用宿泊施設(*前年までは単一回答、今年から複数回答に変更しています):「ホテル(60.8%)」が最も多く、次いで「旅館(26.3%)」、「実家・親族の家(20.3%)」となりました(図表16)。

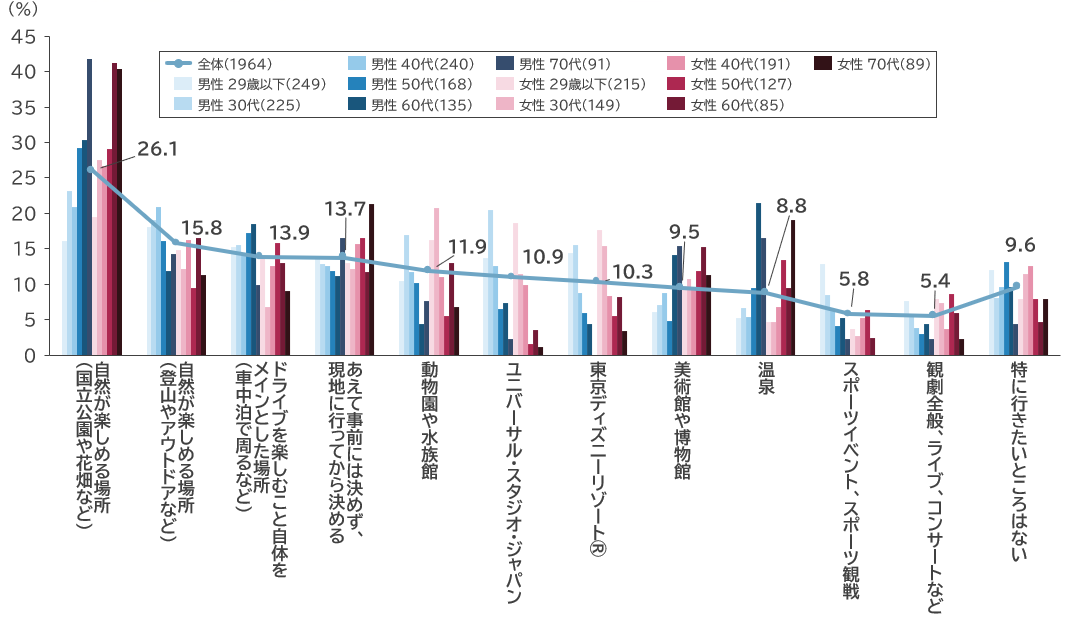

出かける場所として気になっているところは、「自然が楽しめる場所(国立公園や花畑など)(26.1%)」、次いで「自然が楽しめる場所(登山やアウトドアなど)(15.8%)」となりました。(図表17)。

JTBの宿泊・国内企画商品の予約状況をみると、前年比100%(延べ人数、4月3日付)となりました。特に好調な方面は、東京ディズニーリゾート®を含む東京、ユニバーサル・スタジオ・ジャパンを含む関西となり、季節限定のイベント開催により人気となっています。また、沖縄、九州と航空機利用の長距離方面も好調です。

(図表6)旅行出発日(単一回答)

(図表7)旅行日数(単一回答)

(図表8)旅行目的(複数回答)

(図表9)旅行先(単一回答)

(図表10)旅行先を選んだ理由(複数回答)

(図表11)回答者の居住地別 GWの旅行先(地域別、単一回答、回答者数=2,060)

(図表12)回答者の居住地別 GWの旅行先前年増減比(地域別、単一回答、回答者数=2,060)

*図表11、12のみ全体傾向把握のため、行先を「海外」としている旅行者を含む

(図表13)旅行の同行者(単一回答)

(図表14)一人当たりの旅行費用(単一回答)

(図表15)利用交通機関(複数回答)

(図表16)利用宿泊施設(複数回答)

(図表17)今年のGWに出かける場所として気になっているところ(性年代別、複数回答)

*図表6~10,13~17の回答者数はすべて1,964

3.海外旅行の動向

海外旅行者数は52万人(対前年167.7%、対19年56.0%)と推計しました。前年は新型コロナに関する、水際措置変更についての発表が4月28日とGW直前でした。そのため海外旅行を断念した人が一定数いたと想定され、今年はその反動が見込まれます。なお、2019年のGWは今上天皇即位に伴い、4月27日~5月6日が10連休となっていたため、例年に比べ海外旅行が活況を呈していました。2014年から2018年の5年間の海外旅行者数は約55万人前後で推移しており、その平均と比較すると9割ほど回復しているといえます。海外旅行平均費用は269,000円(同104.7%)、総海外旅行消費額は1,399億円(同175.6%)です。具体的な傾向については、次に述べる通りです。

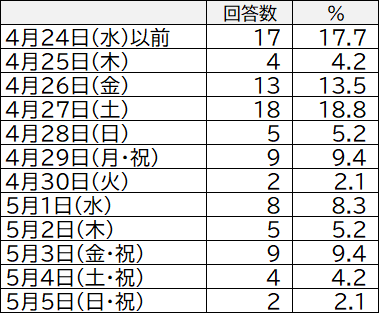

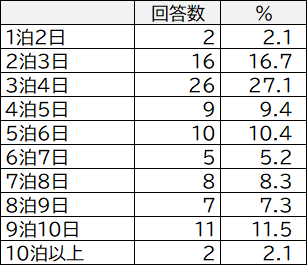

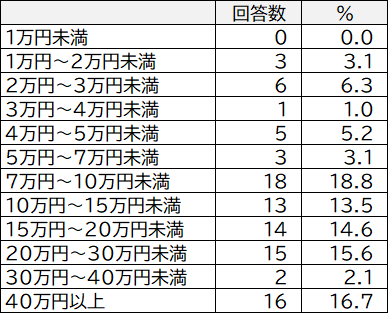

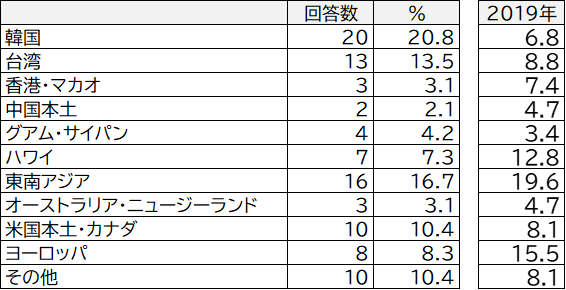

本調査対象者2,060人のうち、今年のGWの旅行先を「海外」と答えた人は96人(4.7%)となりました。出発日のピークは、「4月27日(土)(18.8%)」、次いで「4月24日(水)以前(17.7%)」、「4月26日(金)(13.5%)」となっています(図表18)。旅行日数は「3泊4日(27.1%)」が最も多く、次いで「2泊3日(16.7%)」となりました(図表19)。また旅行費用は「7万円~10万円未満(18.8%)」が最も多く、次いで「40万円以上(16.7%)」、「20万円~30万円未満(15.6%)」となりました(図表20)。行先は上位から、「韓国(20.8%)」、「東南アジア(16.7%)」、「台湾(13.5%)」となりました。参考までに、10連休だった2019年は「東南アジア(19.6%)」、「ヨーロッパ(15.5%)」、「ハワイ(12.8%)」の順でした(図表21)。

JTBの海外旅行の予約状況は前年比225%(人数、4月3日付)となりました。好調な方面は、アジア、ハワイとなっており、短い日数で旅行ができる方面が人気となっています。出発日は遠方の旅行の場合は4月27日、28日が中心となり、近場の旅行の場合は5月2日、3日に集中しています。

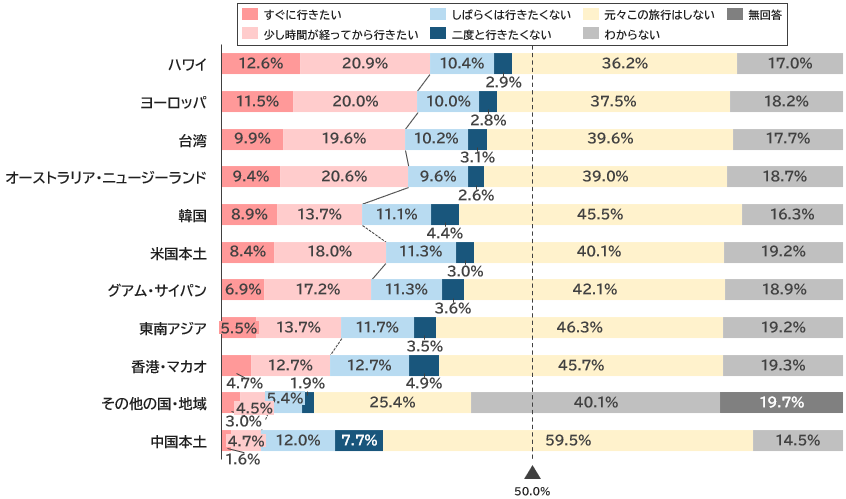

また、このGWに旅行に行かない人も含めた事前調査対象者に、今後の海外旅行に対しての意向を聞きました。海外旅行の行先別の実施時期をみると、「すぐに行きたい」という回答は「ハワイ(12.6%)」が最も多く、次いで「ヨーロッパ(11.5%)」、「台湾(9.9%)」となりました。(図表22)。

(図表18)旅行出発日(単一回答)

(図表19)旅行日数(単一回答)

(図表20)一人当たりの旅行費用(単一回答)

(図表21)旅行先(単一回答)

(図表22)行先別、今後の海外旅行の実施意向(単一回答、回答者数=10,000*スクリーニング調査対象者)

*図表18~21の回答者数はすべて96

4.旅行やレジャー消費をとりまく経済環境と生活者意識

日本経済は、新型コロナの影響がほぼなくなっているものの、国際情勢は不安定な状態が続き、国内外の物価は上昇傾向に落ち着きがみられるものの引き続き高い水準にあります。日経平均株価は2024年2月に市場最高値を更新し、3月には一時4万円台に乗せるなど株式市場は活況を呈していますが、その一方で為替相場については円安傾向が続いており、わが国の物価高の一因となっています。2024年2月の月例経済報告では、基調判断が「このところ足踏みもみられるが、緩やかに回復している」に引き下げられ、個人消費についても2年ぶりの引き下げとなりました。先行きについては、同じく2024年2月の月例経済報告によると、雇用・所得環境の改善などによる緩やかな回復が期待される一方で、海外景気の下振れが我が国の景気を下押しするリスクとなっていることに加え、物価上昇、中東情勢、金融資本市場の変動などの影響、さらには「令和6年能登半島地震」の影響が懸念されています。

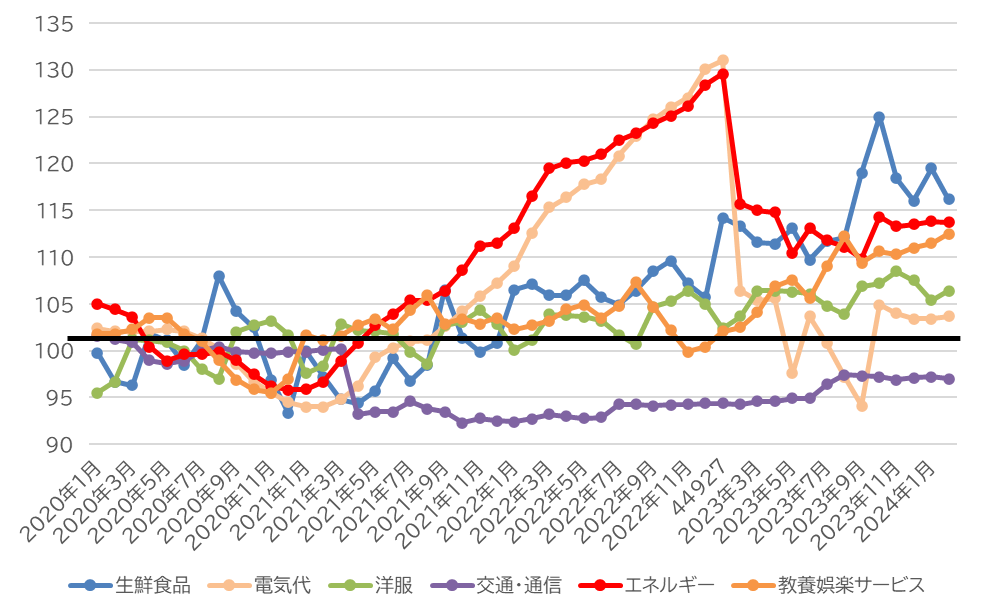

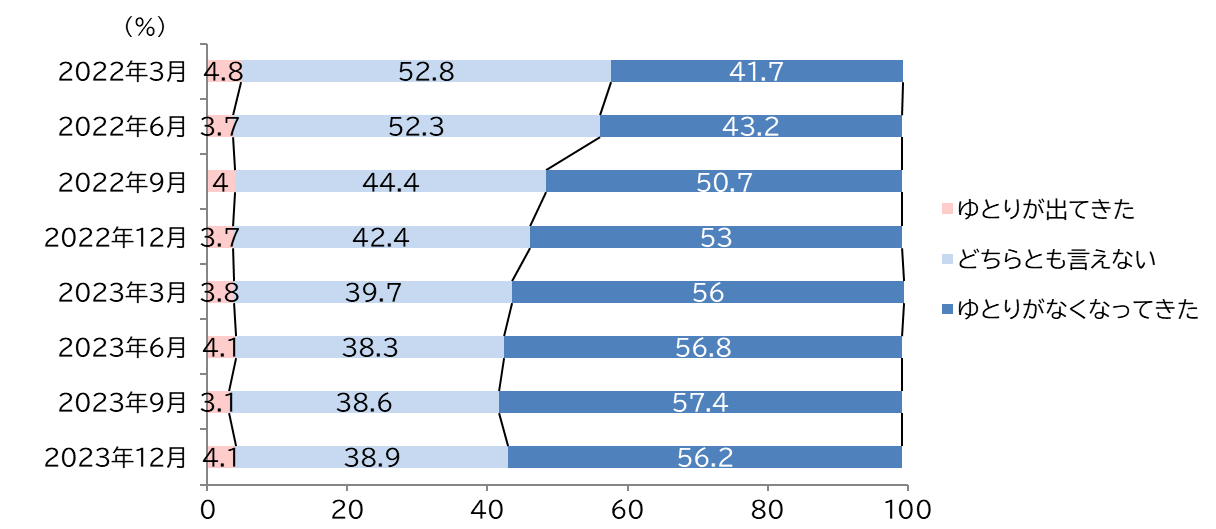

主な項目の消費者物価指数を見ると、「交通・通信」以外の品目は軒並み高く、「交通・通信」においても緩やかに高まる傾向がみられるなど、日常生活への影響がうかがえます(図表23)。一方で、日本銀行の「生活意識に関するアンケート調査」の「現在の暮らし向き」をみると、直近の2023年12月は「ゆとりがでてきた」が増え、「ゆとりがなくなってきた」が減少に転じています。物価高のなか、若干ではあるものの改善傾向がうかがえます(図表24)。

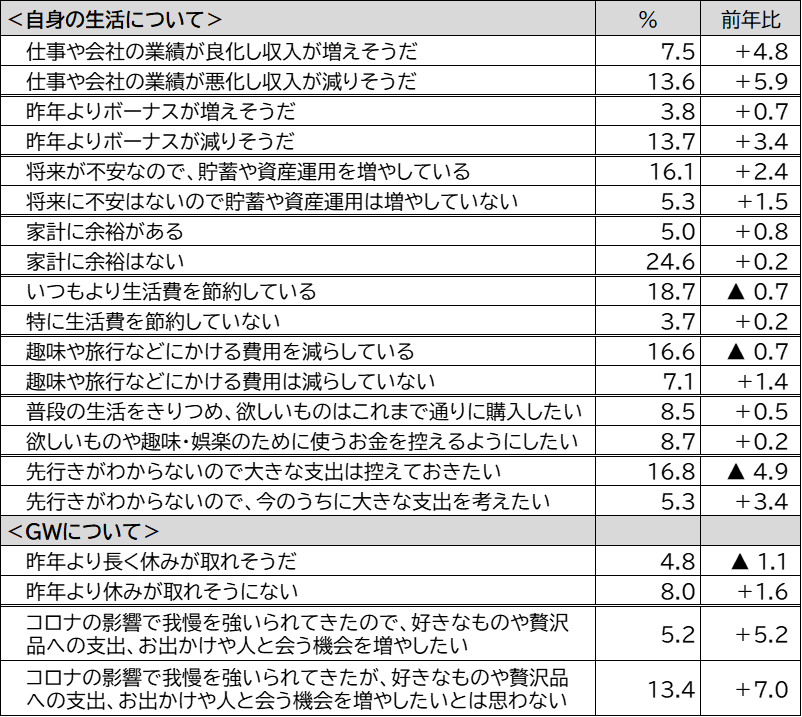

JTBが実施したアンケートで、生活とGWの旅行について当てはまる状況を聞いたところ、「仕事や会社の業績が悪化し収入が減りそうだ(13.6%)」の前年比伸び率は「仕事や会社の業績が良化し収入が増えそうだ(7.5%)」の同伸び率より高く、所得の厳しい状況がうかがえます。その一方で、「家計に余裕がある(5.0%)」の同伸び率は「家計に余裕はない(24.6%)」の同伸び率よりも高く、若干ながら余裕が出てきているようです。そのようななか、「趣味や旅行などにかける費用を減らしている(16.6%)」は前年から減少、「趣味や旅行などにかける費用は減らしていない(7.1%)」は増加となっており、また「先行きがわからないので大きな支出は控えておきたい(16.8%)」が前年から減少、「先行きがわからないので、今のうちに大きな支出を考えたい(5.3%)」が増加となるなど、趣味や旅行への出費を惜しまない様子がうかがえます(図表25)。

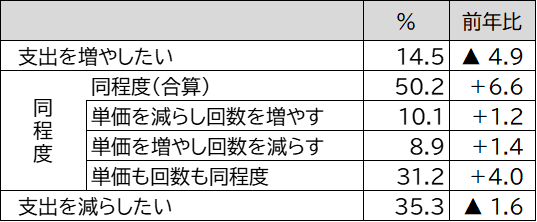

「今後1年間の旅行の支出に対する意向」については、「総旅行支出は同程度」が前年より増加し、「これまでより旅行支出を増やしたい(14.5%)」「これまでより旅行支出を減らしたい(35.3%)」はともに減少となっており、旅行支出額の変動は小さくなりそうです(図表26)。

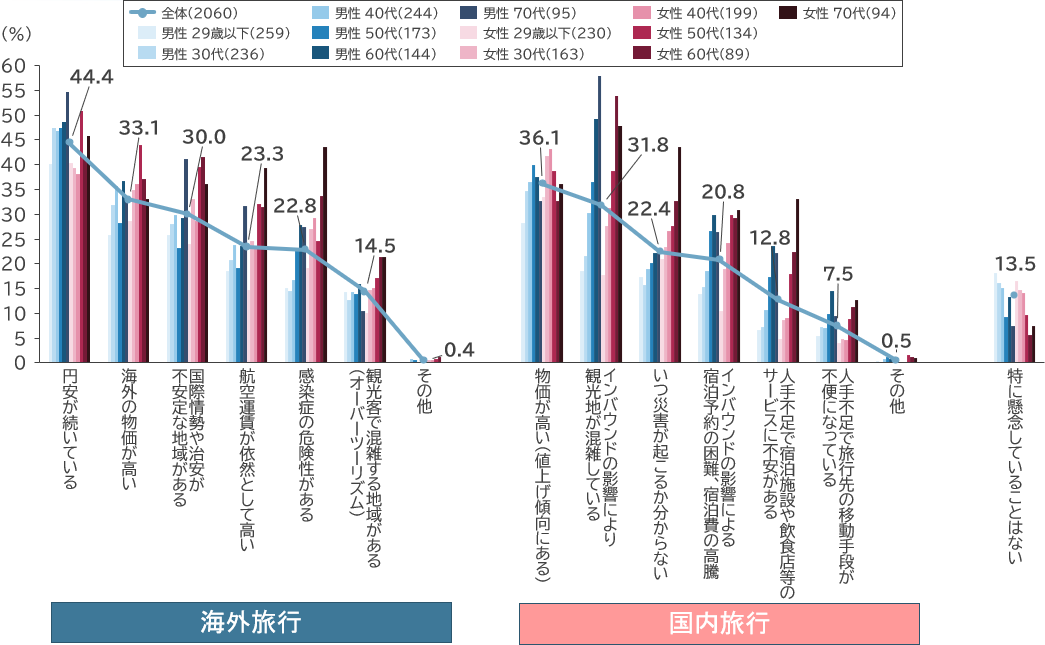

最後に、「今後1年間に旅行する際の懸念事項」を国内旅行、海外旅行それぞれについて聞いたところ、国内旅行では「物価が高い(36.1%)」の懸念がどの性年代でも高い傾向にある一方で、「インバウンドの影響により観光地が混雑している(31.8%)」という懸念は高い年齢層で顕著にみられます。海外旅行については、「円安が続いている(44.4%)」が最も多く、今後の為替相場の行方に注目が集まります(図表27)。

(図表23)消費者物価指数の推移

出典:総務省「消費者物価指数(2020年基準)」データをもとにJTB総合研究所作成

(図表24)現在の暮らし向き

出典:日本銀行「生活意識に関するアンケート調査」データをもとにJTB総合研究所作成

(図表25) 今の自身の生活とGWについて(複数回答、回答者数=10,000)

(図表26)今後1年間の旅行の支出に対する意向(単一回答、回答者数=10,000)

(図表27)今後1年間に旅行する際の懸念事項(複数回答、回答者数=10,000)

【旅行動向アンケート 調査方法】

調査実施期間:2024年3月7日~13日

調査対象: 全国15歳以上79歳までの男女個人

サンプル数: 事前調査10,000名 本調査2,060名

(事前調査で「GWに旅行に行く/たぶん行く」と回答した人を抽出し本調査を実施)

調査内容: 2024年4月25日~5月5日に実施する1泊以上の旅行

(国内旅行は観光および帰省目的の旅行に限る、海外旅行は業務目的の旅行を含む)

調査方法: インターネットアンケート調査

※調査結果の数字は四捨五入のため、小計や前年公表の調査結果との差分が合わない箇所があります。

(図表28)「GW旅行予定人数・費用推計値」の推移

JTB広報室 03-5796-5833(東京) 06-6260-5108(大阪)