2024年(1月~12月)の旅行動向見通し

株式会社JTB

訪日外国人数は過去最高の3,310万人の見通し

●国内旅行者数は2億7,300万人(対前年97.2%、対2019年93.6%)と推計

●海外旅行者数は1,450万人(対前年152.6%、対2019年72.2%)と推計

●訪日外国人旅行者数は3,310万人(対前年131.3%、対2019年103.8%)と推計

JTBは、2024年の旅行動向見通しをまとめました。本見通しは、新型コロナウイルス感染症(COVID-19/以下新型コロナ)の影響が大きかった2021年、2022年については国内旅行のみ推計内容を公表しましたが、2023年より海外旅行、訪日外国人旅行についても発表を再開しました。

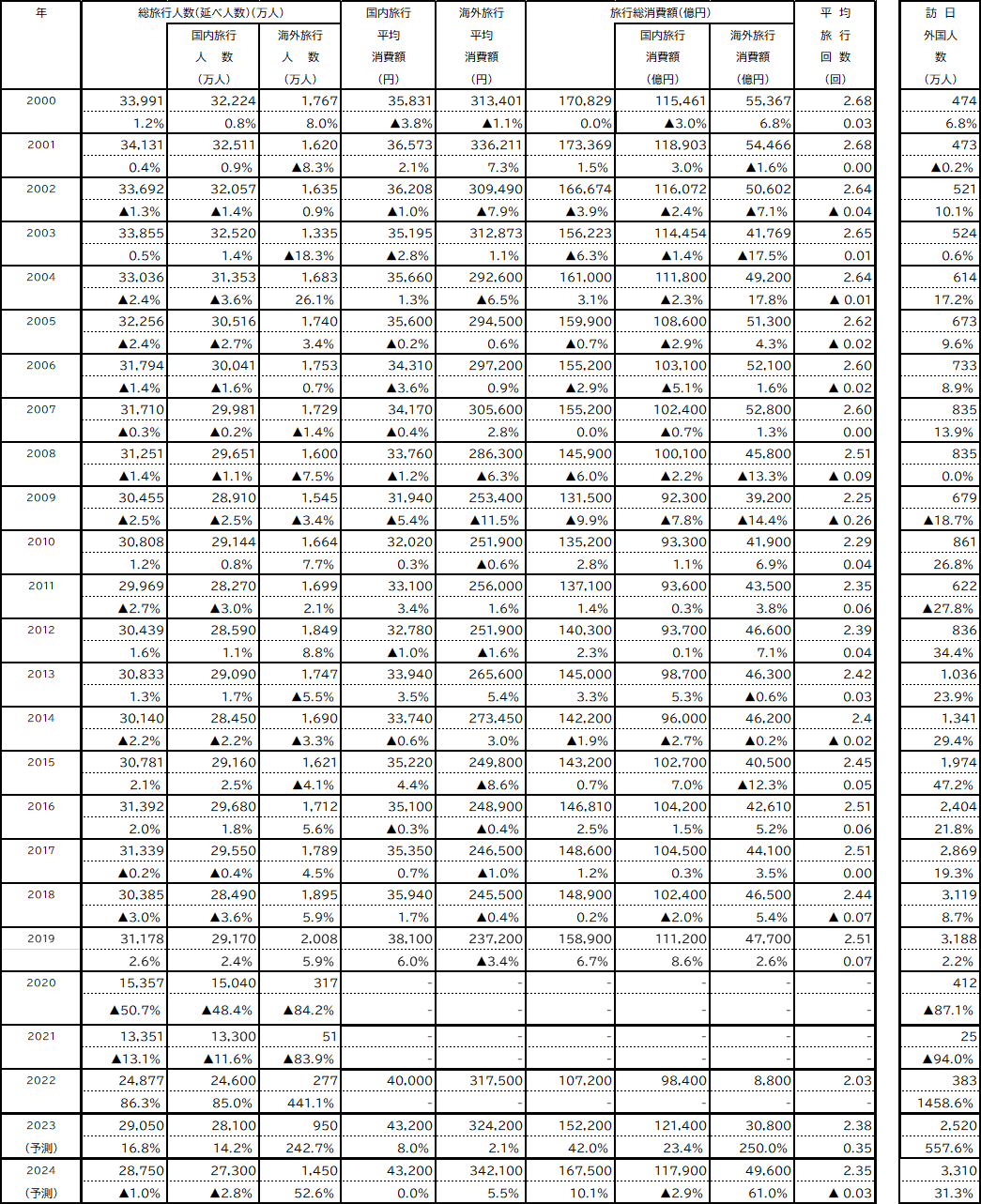

当調査は、1泊以上の日本人の旅行(ビジネス・帰省を含む)と訪日外国人旅行について、各種経済指標や消費者行動調査、運輸・観光関連データ、JTBグループが実施したアンケート調査などから推計したもので、1981年より継続的に調査を実施しています。推計した2024年の旅行市場規模は次のとおりです。

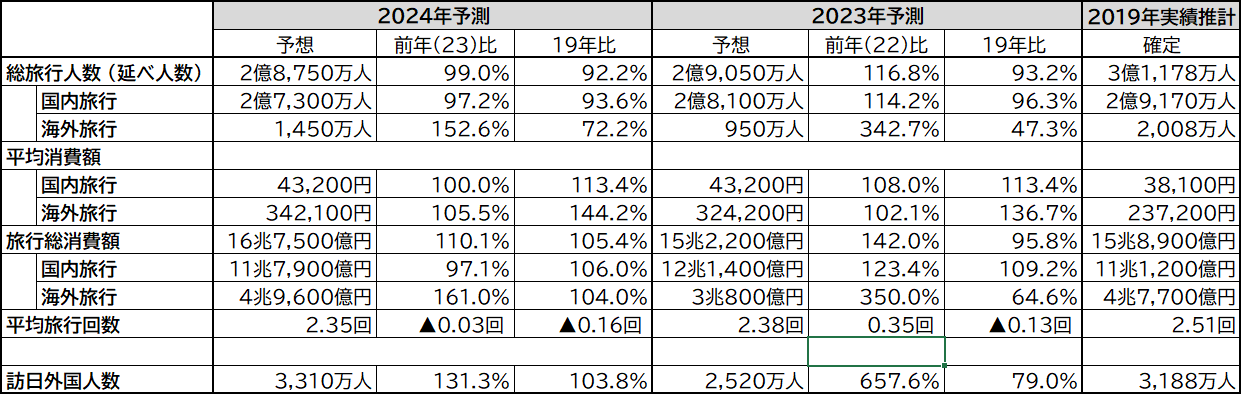

(図表1)2024年 年間旅行動向推計数値

*国内旅行消費額は、自宅を出発してから帰宅するまでの総費用。現地での買物代、食事代など現地消費分を含む。旅行前後の消費(衣類など携行品の購入費用など)は含まない。

*海外旅行消費額は、旅行費用(燃油サーチャージ含む)のほか、現地での買物代、食事代など現地消費分を含む。旅行前後の消費(衣類など携行品の購入費用など)は含まない。

*訪日旅行は、人数予測のみで消費額は算出していない。

*前年比および19年比は、小数点第二位以下を四捨五入している。

*国内旅行人数は、宿泊を伴う旅行者の人数。

*国内旅行人数および海外旅行人数は、ビジネス・帰省を含む。

※調査結果の数字は四捨五入のため、小計や前年公表の調査結果との差分が合わない箇所があります。

<社会経済の動きと旅行を取り巻く環境>

1.2023年末までの新型コロナの状況と旅行の動き

2020年3月に世界保健機関(WHO)が新型コロナの流行を「パンデミック(世界的大流行)」と宣言してから3年以上が経過し、WHOは2023年5月に緊急事態宣言の終了を発表しました。経済活動は世界的にほぼ新型コロナ前の状態に戻っていますが、需要の急回復などによる物価高や高金利が継続しており、生活に様々な影響を与えています。旅行に関しては、一部の国・地域を除き出入国制限は概ね撤廃され、海外旅行が新型コロナ前と同様に行えるようになりました。国連世界観光機関(UNWTO)が2023年11月に発表したWorld Tourism Barometerによると、2023年1~9月の世界の海外旅行者数が新型コロナ前の87%の水準まで回復したことを明らかにしました。ただ、不安定な国際情勢およびそれに伴うエネルギーや物価高騰が懸念材料となっています。また、回復には地域差がみられ、欧米などに対して日本を含むアジア太平洋は遅れ気味となっています。

日本においては、2023年4月に水際対策が終了し、5月には新型コロナの感染症法上の位置づけが季節性インフルエンザと同等の「5類」に移行しました。これにより、人々の生活は概ね新型コロナ前の状態となっています。旅行についても制度面の制約はなくなり、また地域によっては「全国旅行支援」や自治体独自の旅行支援策を講じている影響もあり、インバウンドの回復と相まって全国的に賑わいが戻ってきています。その一方で、一部の観光地・観光エリアでは新型コロナによる環境変化に伴い、サービス業従事者の人手不足、宿泊料金高騰、オーバーツーリズムなどの問題が懸念されています。

2.旅行を取り巻く経済環境と暮らし向き

日本経済は、日経平均株価が2023年5月以降3万円を上回る状態が続いており、市況は賑わいをみせています。その一方で、世界情勢や欧米の金融政策などの影響を受けており、景気の先行きが不透明な状態が続いています。IMF(国際通貨基金)が2023年10月に公表した「世界経済見通し」では、2023年の日本の成長率(予測値)は2.0%で、2022年の1.0%(実績値)を上回る予想となっていますが、2024年の成長率(予測値)は1.0%と厳しい予測がなされています。

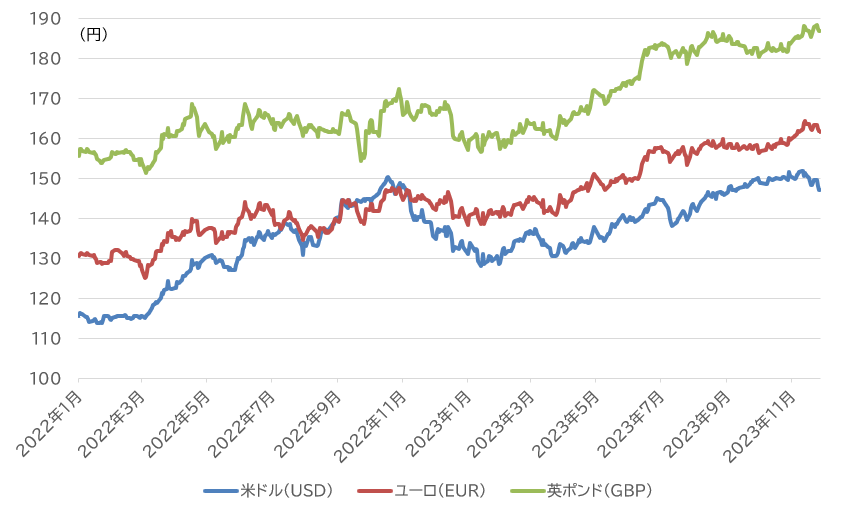

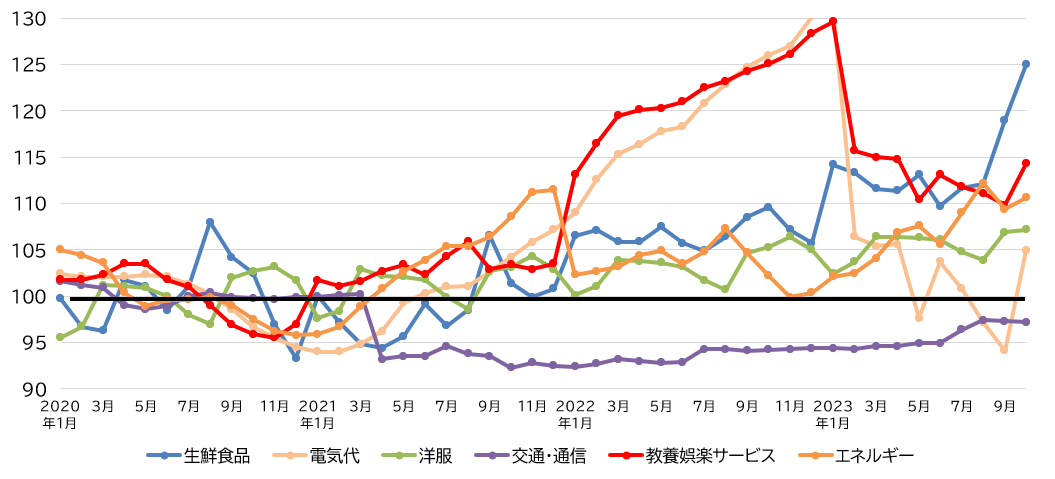

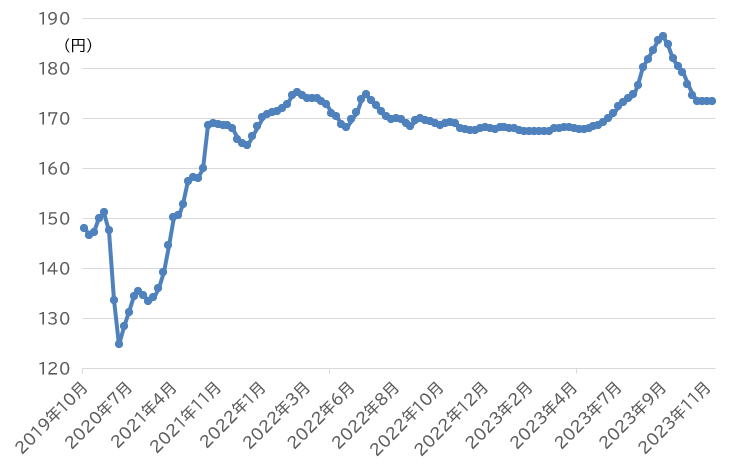

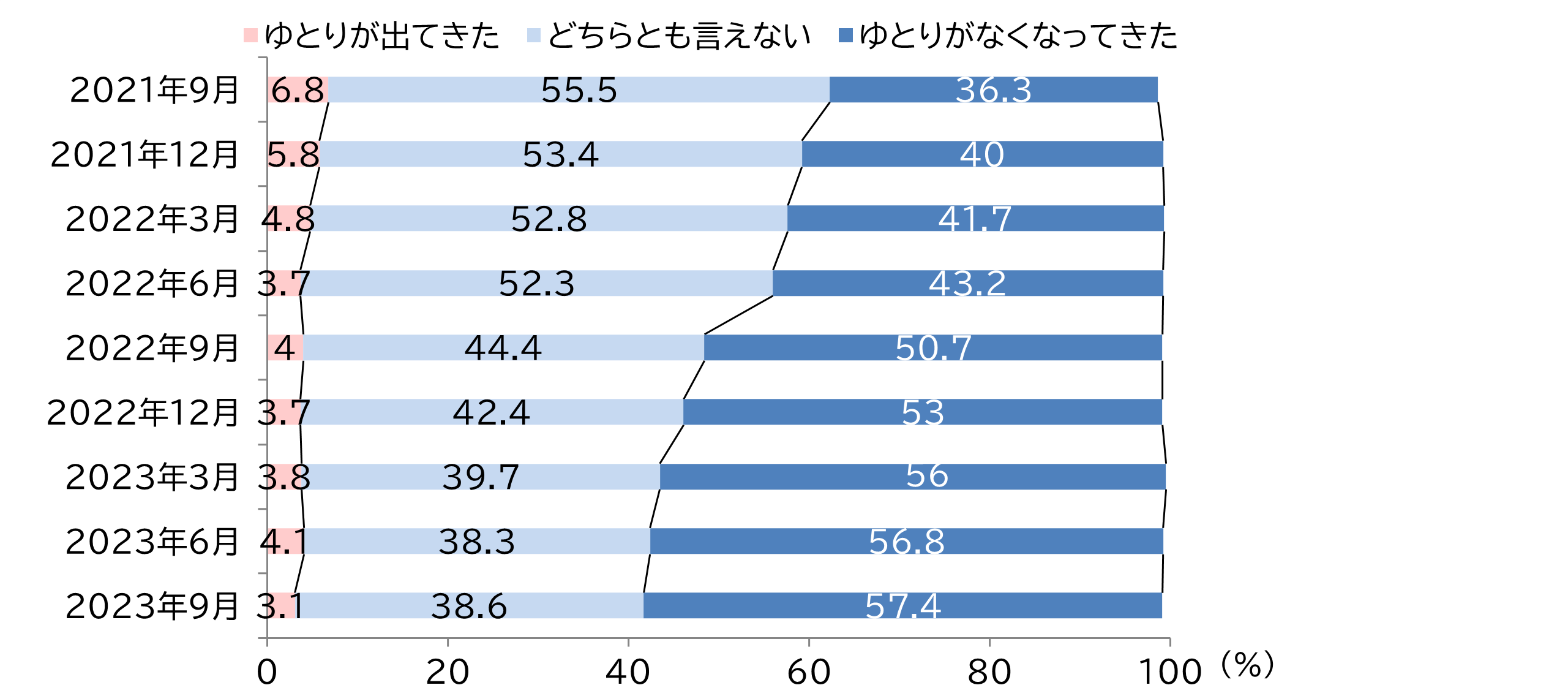

足元の経済状況をみると、円安・ドル高傾向は2023年に一層加速し、11月の外国為替市場では一時1ドル152円台に迫りました。これにより、輸入品価格は高騰が続き、家計に大きな影響を与えています(図表2)。主な項目の消費者物価指数を見ると、補助金が継続投入されている電気代は比較的落ち着いているものの、生鮮食品、洋服などは上昇傾向がみられ、交通・通信も着実に上昇している様子が伺えます(図表3)。ガソリン代についても、補助金の影響で価格は抑えられているものの、170円前後が常態化しています(図表4)。そのようななか、生活者意識に着目すると、日本銀行が実施している「生活意識に関するアンケート調査」の「現在の暮らし向き」は「ゆとりがなくなってきた」の割合が2021年9月以降一貫して増加傾向にあり、2023年9月には57.4%と2021年9月時点から21.1ポイント高くなっています(図表5)。経済状況は、依然として厳しいと捉えられます。

(図表2)2023年の円に対する主な外国為替レート

出所:東京外国為替相場/TTM(Telegraphic Transfer Middle Rate)(三菱UFJリサーチ&コンサルティング「外国為替相場情報」より)

(図表3)主な消費者物価指数の推移

出所:総務省「2020年基準消費者物価指数」データをもとにJTB総合研究所作成

(図表4)ガソリン単価の推移(レギュラー)

出所:資源エネルギー庁「石油製品価格調査」よりJTB総合研究所作成

(図表5)現在の暮らし向き

出所:日本銀行「生活意識に関するアンケート調査」データをもとにJTB総合研究所作成

3.旅行者の現状

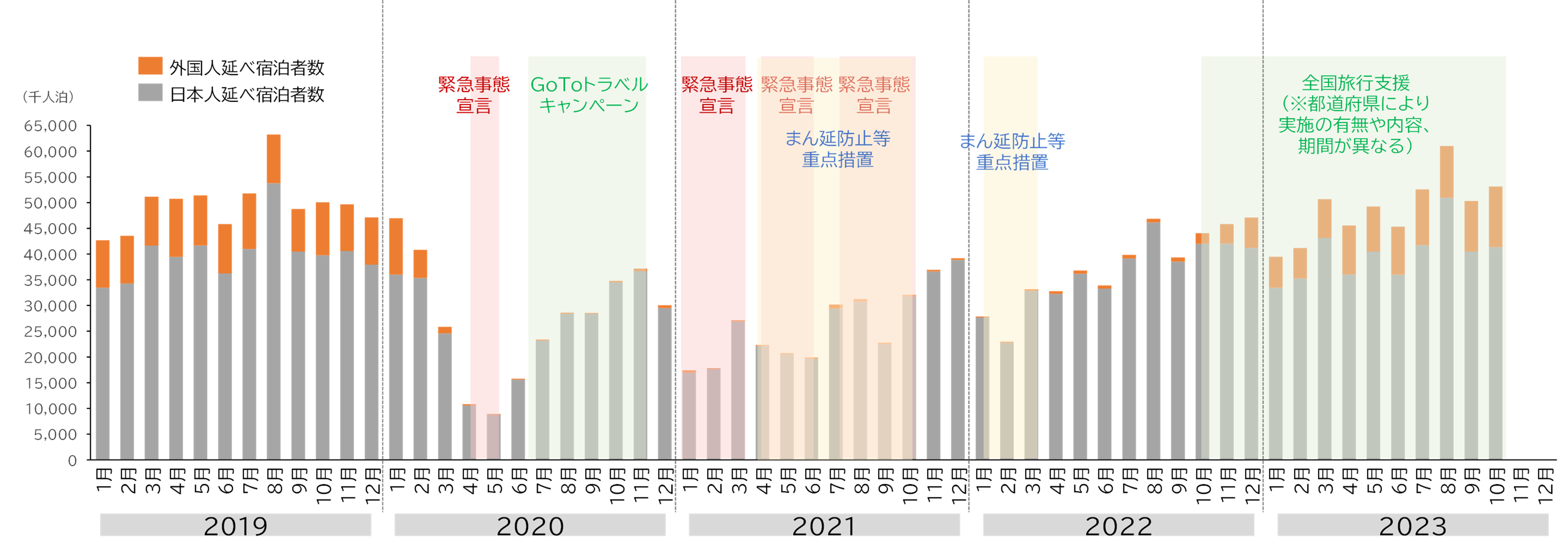

国内旅行について、2023年は新型コロナによる行動制限が発出されなかったことに加え、5月8日の新型コロナの「5類」への移行、「全国旅行支援」の実施などにより、宿泊者数は新型コロナ前と同程度まで回復しています。2023年の延べ宿泊者数をみると、10月は4,133万3千人泊で、2022年同月(4,196万9千人泊)と比べると98.5%、2019年同月(3,979万1千人泊)と比べると103.9%となっています。1~10月の累計は3億9,876万5千人泊で、2022年同期(3億5,073万人泊)と比べると113.7%、2019年同期(4億172万3千人泊)と比べると99.3%となっています*1(図表6)。

*1:観光庁「宿泊旅行統計調査」より、2023年10月の数値は第1次速報値、2023年1~9月の数値は第2速報値、2022年および2019年の数値は確定値

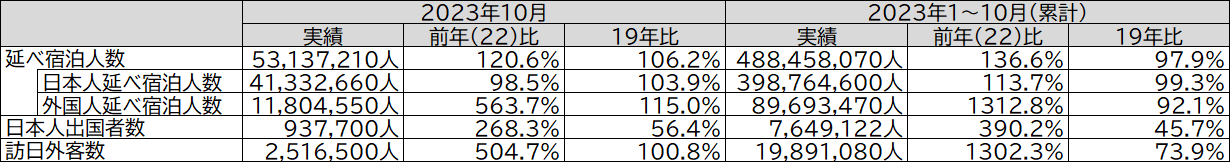

海外旅行について、2023年は4月29日に日本の水際対策が終了したことに伴い、制度上は海外旅行に行きやすくなりました。但し、物価高や円安、一部地域での情勢不安の継続などの要因により、海外旅行者数の回復は遅れています。2023年10月の日本人出国者数は93万8千人で、2022年同月(35万人)と比べると268.3%となっていますが、2019年同月(166万3千人)と比べると56.4%にとどまっています。1~10月の累計は764万9千人で、2022年同期(196万人)と比べると390.2%、2019年同期(1,672万6千人)と比べると45.7%となっています*2(図表7)。

*2:日本政府観光局(JNTO)「訪日外客数・出国日本人数」より2023年10月の数値は推計値、2023年1~9月の数値は暫定値、2022年および2019年の数値は確定値

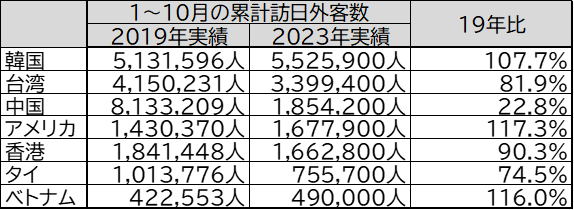

訪日旅行について、2023年は日本の水際対策終了、世界各地での新型コロナ対策の終了や緩和などにより、回復の勢いが増しています。2023年10月の訪日外客数は251万7千人で、2022年同月(49万9千人)と比べると504.7%、2019年同月(249万7千人)と比べても100.8%と単月では新型コロナ前を初めて上回りました。1~10月の累計は1,989万1千人で、2022年同期(152万7千人)と比べると1,302.3%、2019年同期(2,691万4千人)と比べると73.9%となっています*3(図表7)。国・地域別にみると、2023年1~10月の累計は多い順に韓国(552万6千人、対2019年同期107.7%)、台湾(339万9千人、同81.9%)、中国(185万4千人、同22.8%)となっています(図表8)。

*3:日本政府観光局(JNTO)「訪日外客数・出国日本人数」より2023年9月および10月の数値は推計値、2023年1~8月の数値は暫定値、2022年および2019年の数値は確定値

(図表6)延べ宿泊人数の推移

出所:観光庁「宿泊旅行統計調査」(2019年~2022年は年確定値、2023年1~9月は2次速報値、10月は1次速報値)よりJTB総合研究所作成

(図表7)2023年10月単月と1月~10月(累計)の延べ宿泊人数・日本人出国者数・訪日外客数

出所:観光庁「宿泊旅行統計調査」、日本政府観光局(JNTO)「訪日外客数・出国日本人数」よりJTB総合研究所作成

(図表8)国別 2023年訪日外客数と19年比(上位7か国)

出所:日本政府観光局(JNTO)「訪日外客数・出国日本人数」よりJTB総合研究所作成

<2024年の旅行市場>

4.2024年のカレンダーと主なイベント

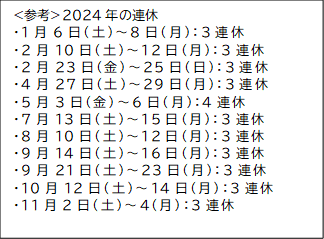

2024年のカレンダーは、3連休以上が11回あります。2023年は7回だったので、大幅な増加となります。GWは前半(4月27日(土)~29日(月))と後半(5月3日(金)~6日(月))に分かれますが、その間の4月30日(火)~5月2日(木)を休めば4月27日(土)~5月6日(月)の10連休になります。夏休みは、お盆期間(8月13日(火)~16日(金))を休むと8月10日(土)~18日(日)の9連休になります。2024年~2025年の年末年始は、12月30日(月)~31日(火)を休めば12月28日(土)~1月5日(日)の9連休になります。

※赤色は国民の祝日

(1)第33回オリンピック競技大会(2024/パリ)・パリ2024パラリンピック競技大会が開催

2024年の注目すべきイベントの一つは、フランスで行われる第33回オリンピック競技大会(2024/パリ)・パリ2024パラリンピック競技大会です。第33回オリンピック競技大会(2024/パリ)は7月26日(金)~8月11日(日)に、パリ2024パラリンピック競技大会は8月28日(水)~9月8日(日)にそれぞれ予定されており、パリを中心とした複数の都市で、またサーフィンに関してはフランス領であるタヒチで開催されます。

(2)国内では北陸新幹線延伸、黒部宇奈月キャニオンルート開通

国内では、北陸新幹線の金沢駅~敦賀駅間が3月16日(土)に開業する予定です。これにより東京駅~福井駅間の所要時間が最短で2時間51分となります。また富山県にある黒部峡谷では、6月30日(日)に黒部ダムと黒部峡谷鉄道欅平駅を結ぶ黒部宇奈月キャニオンルートが一般開放されます。

このほかアートイベントとしては、「第8回横浜トリエンナーレ」(神奈川県横浜市、3月15日(金)~6月9日(日))、「大地の芸術祭 越後妻有アートトリエンナーレ2024」(新潟県十日町市、7月13日(土)~11月10日(日))などが予定されています。

(3)人気テーマパークの新エリア・大型商業施設の開業が各地で相次ぐ

2024年は人気テーマパークの新コンテンツや商業施設の開業も多く予定されています。

ユニバーサル・スタジオ・ジャパンでは春に、現在の「スーパー・ニンテンドー・ワールドTM」のスペースを1.7倍に拡張し、世界的に高い人気を誇る「ドンキーコング」をテーマにしたエリア「ドンキーコング・カントリー」の開業が予定されています。また東京ディズニーリゾート🄬では、6月6日(木)に東京ディズニーシーの8番目となる新テーマポート「ファンタジースプリングス」の開業が予定されています。「アナと雪の女王」「塔の上のラプンツェル」「ピーター・パン」をテーマとする3つのエリアと新たなディズニーホテル「東京ディズニーシー・ファンタジースプリングスホテル」で構成される予定です。

商業施設においては、大阪市(大阪府)の大阪駅周辺で行われている再開発「うめきた2期地区開発事業『グラングリーン大阪』」の一環として、公園、ホテル、商業施設などの一部が9月に先行開業予定です。また名古屋市(愛知県)では、老朽化のため2019年に閉館し再建されていた「中日ビル」が春にグランドオープン予定です。このほか松山市(愛媛県)では、2019年から保存修理のため部分営業を行っていた道後温泉本館が、7月中旬より5年ぶりに全館で営業を再開する予定です(保存修理工事全体の終了は12月)。

(4)宿泊施設も活況、メルキュールホテルの一斉開業をはじめ新規開業施設が続々オープン

宿泊施設も開業が続々と予定されています。大和リゾート株式会社は、既存のダイワロイヤルホテル23軒のうち、12軒を日本初の「グランドメルキュール」ブランド、11軒を「メルキュール」ブランドとしてリブランディングし、4月1日に全国一斉開業します。

このほか関西エリアでは、京都市(京都府)でシンガポールに拠点を持つバンヤンツリーホテル&リゾーツの旗艦ブランド「バンヤンツリー・東山京都」の開業が春に、大阪市(大阪府)では7月開業予定のKITTE大阪内に「大阪ステーションホテル」の開業が予定されています(図表9)。

5.国内旅行の動向 ※訪日外国人旅行者は除く、日本居住者の国内旅行

2024年の国内旅行人数は2億7,300万人(対前年97.2%、対2019年93.6%)

平均消費額は43,200円(対前年100.0%、対2019年113.4%)

国内旅行消費額は11兆7,900億円(対前年97.1%、対2019年106.0%)

2024年の国内旅行者数は2億7,300万人(対前年97.2%、対2019年93.6%)、平均消費額は物価の高値傾向が継続すると予想されるため43,200円(対前年100.0%、対2019年113.4%)、国内旅行消費額は11兆7,900億円(対前年97.1%、対2019年106.0%)と推計します。2023年5月に新型コロナが5類に移行し、新型コロナの影響はほぼ払拭されましたが、家計の厳しさに加え、高止まりする旅行費用や旅行意欲の落ち着き(リベンジ消費の一巡)などが影響し、旅行者数は伸び悩むと考えられます。2024年は国の経済政策に期待がかかるものの、継続する物価高により生活環境は依然として苦しい状態が続くことが想定されます。

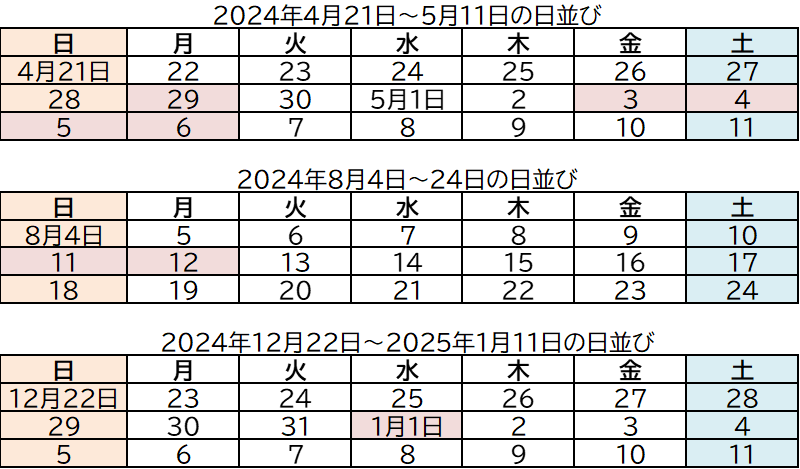

JTBが実施した「年末年始(2023年12月23日~2024年1月3日)の旅行動向」調査のなかで、行先別の今後の国内旅行の実施意向を聞いたところ、「すぐに行きたい」という回答が多いのは「自然が多い場所」が30.2%、「公共交通機関やマイカー、レンタカーなどを利用して行く近隣の都道府県」が29.1%となっており、行先として自然や近場を選ぶ傾向がみられます(図表10)。

新型コロナや気候変動、国際情勢の不安定化などに伴い、ライフスタイルや価値観の変化が世界的に見られ、日本人の国内旅行や国内観光地にもその影響が及んでいます。

SDGs(持続可能な開発目標)を意識した旅行・観光事業者や地域の取り組みの一層の推進

旅行会社では、SDGs(持続可能な開発目標)やサステナビリティへの貢献を目指した各種取り組みを進めています。例えば、CO2の削減を目指したツアーやイベントの実施、地域の伝統文化や伝統芸術の保護・育成・交流、自然資源の観光への利活用などが挙げられます。また航空会社では、SAF(持続可能な航空燃料)の導入などによるCO2の削減に取り組んでいます。

一方、観光地側では、持続可能な観光地を目指した取り組みが始まっています。例えば、世界持続可能観光協議会(GSTC)が開発した「持続可能な観光」の国際指標の認証団体の一つである「グリーン・ディスティネーションズ」の「世界の持続可能な観光地トップ100選2023」には、国内10カ所が選定されました。観光庁では、2020年6月の「日本版持続可能な観光ガイドライン(JSTS-D)」の策定以降、持続可能な観光地マネジメントを促進しています。

国を挙げたオーバーツーリズム対策の推進

新型コロナの収束後、一部の観光地では旅行需要の回復によるオーバーツーリズムが問題となっています。これを受け、政府は「オーバーツーリズム対策パッケージ」を策定するとともに、モデル事業として約20カ所を選定する予定です。支援内容は、観光地の混雑状況の配信による分散化、乗り合いタクシーの導入などを想定しています。

一方、観光地側では、既にオーバーツーリズム対策を取っているところもみられます。例えば、京都では、拝観時間を早朝や夜にまで拡大することで時間の分散化を図っているほか、混雑状況をアプリに表示したり、設置カメラによるリアルタイムでの現場映像を伝えたりすることで混雑の緩和に努めています。

(図表10)旅行先タイプ別、今後の国内旅行の実施意向

出所:「年末年始(2023年12月23日~2024年1月3日)の旅行動向」(JTB)未公開調査データより作成

6.海外旅行の動向

2024年の海外旅行人数は1,450万人(対前年152.6%、対2019年72.2%)

平均消費額は342,100円(対前年105.5%、対2019年144.2%)

海外旅行消費額は4兆9,600億円(対前年161.0%、対2019年104.0%)

2024年の海外旅行者数は1,450万人(対前年152.6%、対2019年72.2%)、平均消費額は引き続き円安や海外物価高などの影響を受け342,100円(対前年105.5%、対2019年144.2%)、海外旅行消費額は4兆9,600億円(対前年161.0%、対2019年104.0%)と推計します。2023年4月の日本の水際対策終了に伴い、制度上は海外旅行に行きやすくなりましたが、経済的要因に加えて不安定な国際情勢などから2024年の海外旅行者数の回復は緩やかであることが想定されます。この影響により、新型コロナ前の人数にまで戻るのは2025年以降と予想されます。また、一人あたりの平均消費額は前年を上回り、2000年以降で最高額となりそうです。

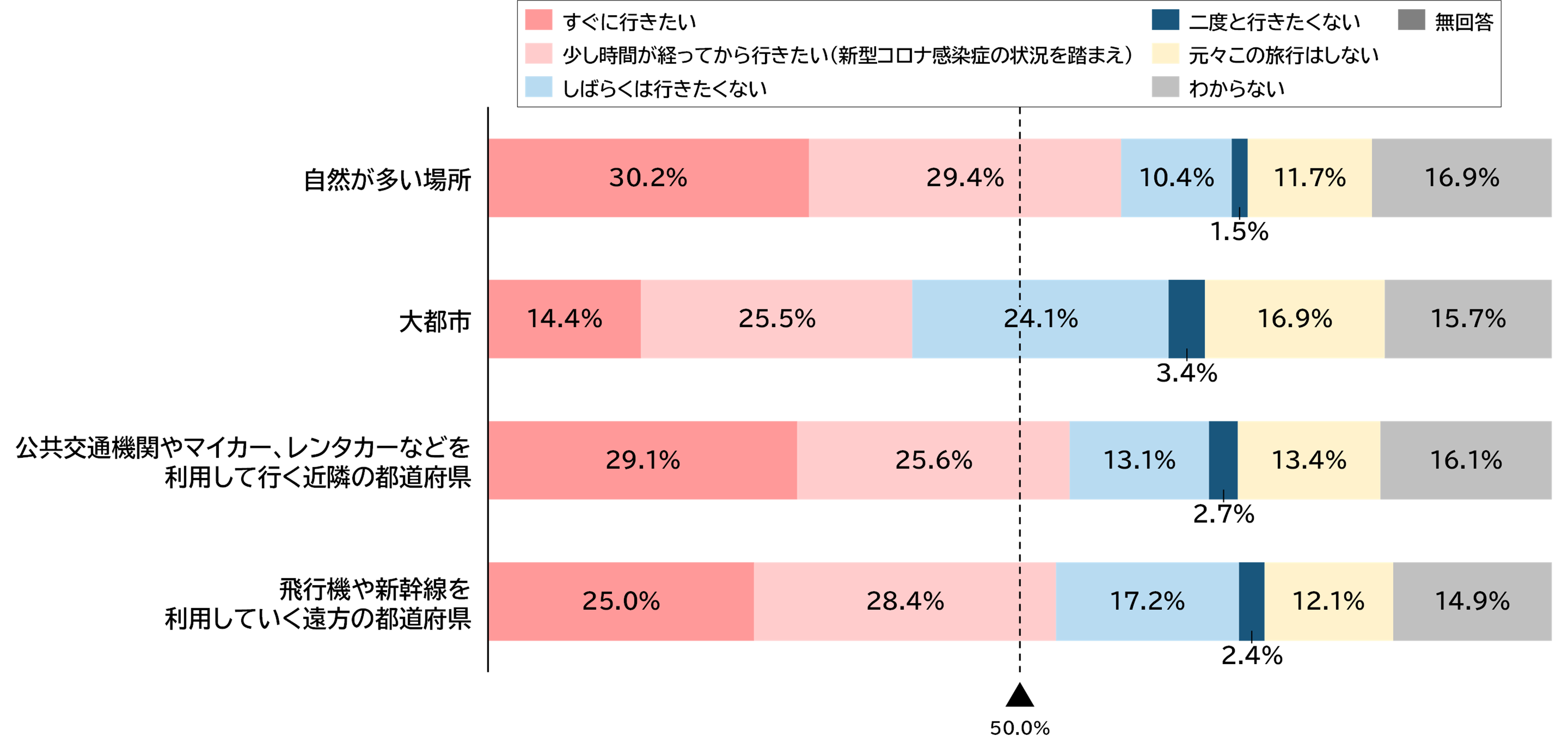

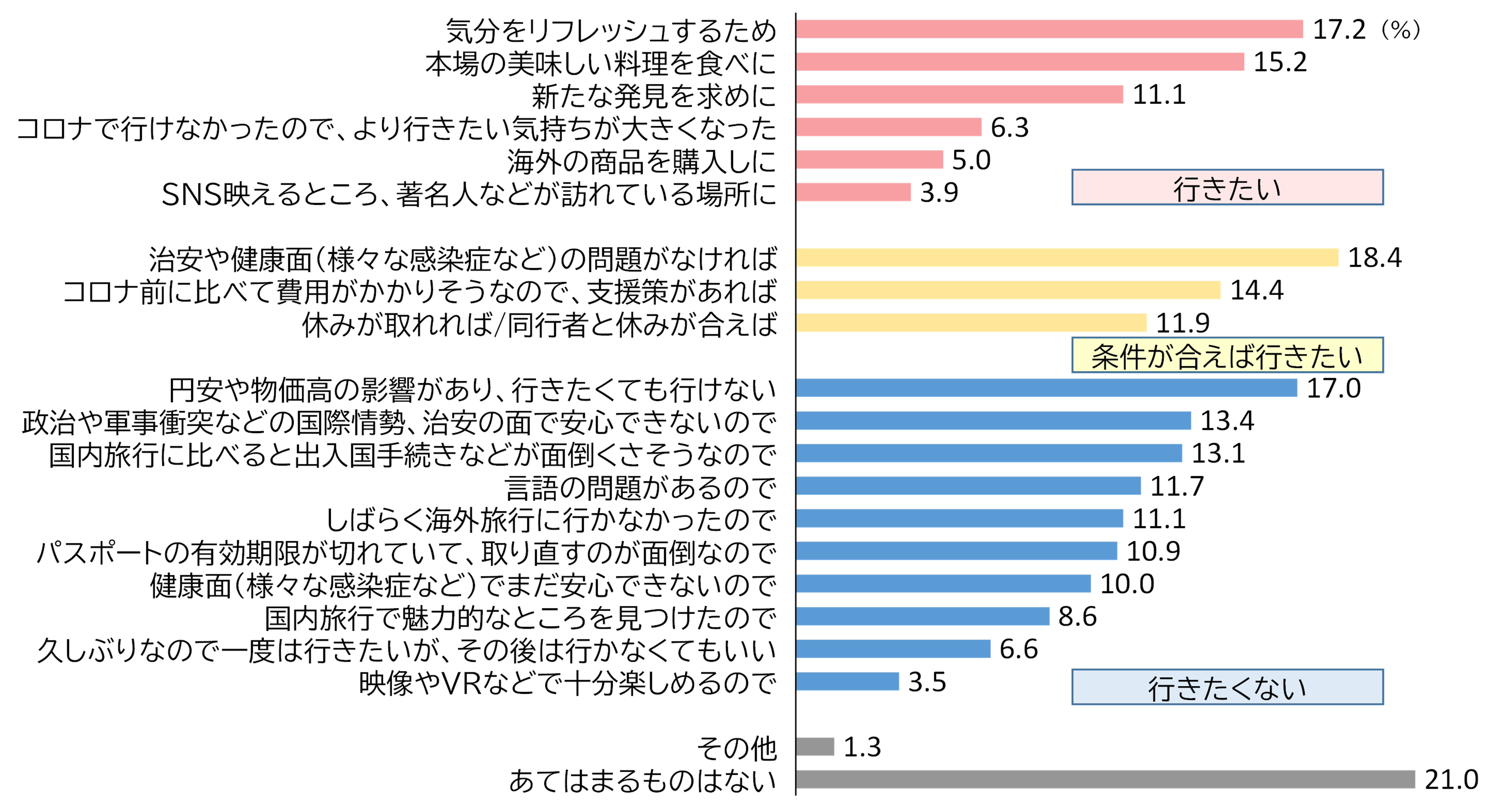

JTBが実施した「年末年始(2023年12月23日~2024年1月3日)の旅行動向」調査のなかで、行先別の今後の海外旅行の実施意向を聞いたところ、「すぐに行きたい」という回答は「ハワイ」が14.3%で最も多く、次いで「ヨーロッパ(12.7%)」「オーストラリア・ニュージーランド(11.8%)」「台湾(10.9%)」「米国本土(10.0%)」「韓国(9.6%)」「グアム・サイパン(9.1%)」となりました。上位は比較的遠距離の地域が多く、次いで比較的近距離の地域となっており、遠方と近隣に分かれる傾向が明確となっています(図表11)。また、現在の海外旅行に対する意向をみると、前向きな反応がみられる一方で、経済的な要因などが妨げとなっている様子もうかがえます(図表12)。

(図表11)行先別、今後の海外旅行の実施意向

出所:「年末年始(2023年12月23日~2024年1月3日)の旅行動向」(JTB)

(図表12)現在の海外旅行に対する意向

出所:「年末年始(2023年12月23日~2024年1月3日)の旅行動向」(JTB)

7.訪日外国人客数

2024年の訪日外国人客数は3,310万人(対前年131.3%、対2019年103.8%)

2024年の訪日外国人客数は3,310万人(対前年131.3%、対2019年103.8%)と推計します。2023年4月の日本の水際対策終了に伴い海外から日本への旅行がしやすくなったことに加え、欧米などと比べて相対的に安い物価と円安というお得感もあり、訪日外国人客数は急速に回復しています。国・地域別にみると、韓国、台湾、アメリカ、香港などは既に新型コロナ前を上回るかそれに近いレベルにあります。2024年も一層の増加が見込まれ、2019年を上回り、過去最高になると予想されます。回復が大幅に遅れている中国については、ゆるやかながら着実に増加しており、2024年は個人旅行を中心に回復が進むものと想定されます。

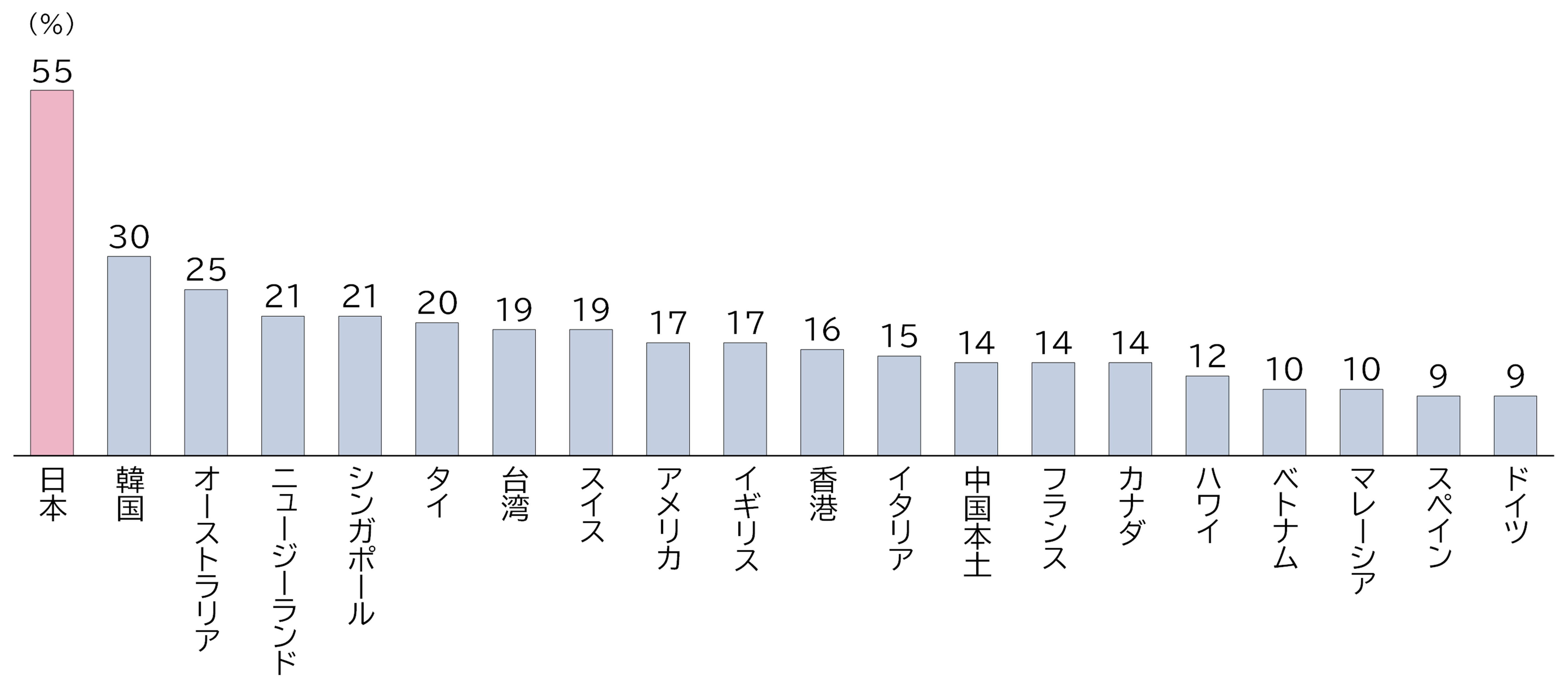

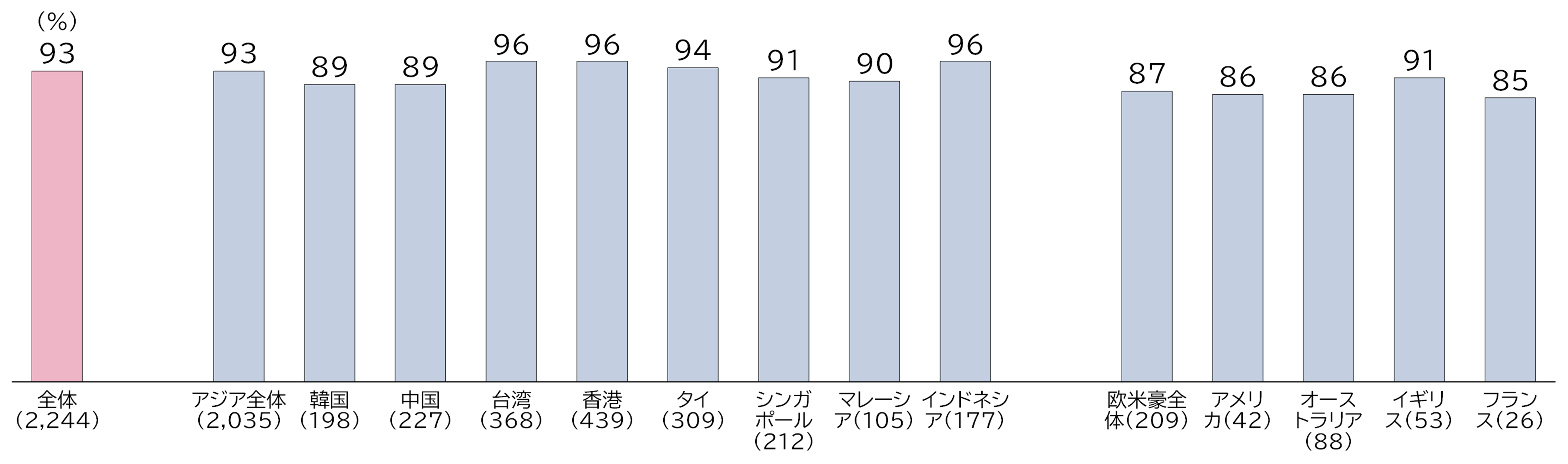

2023年10月に株式会社日本政策投資銀行および公益財団法人日本交通公社が発表した「DBJ・JTBFアジア・欧米豪訪日外国人旅行者の意向調査 2023年度版」*4によると、「次に、あなたが観光旅行したい国・地域」は日本が前年に続いて1位となっており、日本人気の高さがうかがえます(図表13)。また、日本の地方への訪問意向(訪日旅行希望者且つ訪日旅行経験者が対象)は高く、国が進める地方への分散化への期待が高まります」(図表14)。

*4:アジア・欧米豪12ヶ国・地域(韓国、中国、台湾、香港、タイ、シンガポール、マレーシア、インドネシア、アメリカ、オーストラリア、イギリス、フランス)に居住する20歳~79歳の男女かつ海外旅行経験者を対象にした調査

(図表13)次に海外旅行したい国・地域について(n=7,414、最大5つまで、上位20位)

出所:株式会社日本政策投資銀行・公益財団法人日本交通公社「DBJ・JTBF アジア・欧米豪 訪日外国人旅行者の意向調査 2023年度版」 よりJTB総合研究所が作成。

※「次に観光旅行したい国・地域」の選択肢から、回答者の国・地域及び近隣の国・地域(中国-香港-マカオ、マレーシア-シンガポール、タイ-マレーシア、アメリカ-カナダ・メキシコ・ハワイ・グアム、オーストラリア-ニュージーランド、イギリス・フランス-欧州各国)を除いている。割合の算出において、「旅行したい国・地域」と「回答者の国・地域」及び「回答者の近隣国・地域」が同じ場合、当該国・地域の回答者数をサンプル数(分母)から除いている。

(図表14)訪日旅行希望者かつ訪日旅行経験者の地方訪問意向(n=2,244、単一回答)

(「今後もぜひ旅行したい」または「今後も機会があれば旅行したい」と回答した割合)

出所:株式会社日本政策投資銀行・公益財団法人日本交通公社「DBJ・JTBF アジア・欧米豪 訪日外国人旅行者の意向調査 2023年度版」 よりJTB総合研究所が作成。

(図表15)2000年~2022年の推計、2023年~2024年の見通し数値(下段の数値は対前年比)

JTB広報室 03-5796-5833(東京) 06-6260-5108(大阪)