JTB Reports Consolidated Financial Results for First Half of FY2023

JTB Corp.

Tokyo, Japan., November 17, 2023 - JTB today reported the JTB Group's consolidated financial results for the period April 1 to September 30, 2023.

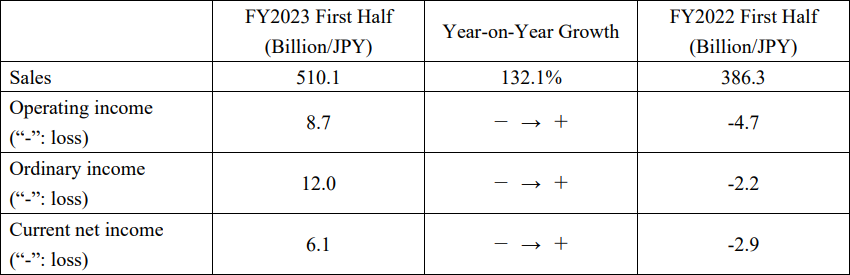

- Consolidated Financial Results

(1) Overview

Market conditions surrounding the tourism industry in the first half of the reported period were characterized by a recovery in domestic tourism and a rebound in international travel, with COVID-19 being redesignated as a Class 5 disease and associated border control measures accordingly being rescinded. Domestic travel was solid on the back of various tourism support measures, while overseas travel has been slow to recover amid the yen's weakness and soaring fuel oil prices. Travel to Japan recovered rapidly, with JNTO data showing September arrivals back at 96% of 2019 levels.

The JTB Group focused its efforts on service improvements designed to enhance customers' real value experience and on digital transformation and business process re-engineering initiatives to improve productivity. In the travel business, domestic travel recovered steadily, with online sales in particular expanding. Overseas travel is also recovering as a result of various external factors, and we have steadily captured demand for inbound travel to Japan. In the non-travel area, we experienced steady growth in the MICE sector, in regional revitalization initiatives, and in business process outsourcing. We also stepped up our business development activities on the back of collaboration with parties both internal and external to the Group, and promoted regional development, helping to create high-value to tourist destinations.

As for the foundations underpinning each of our businesses, we worked on enhancing internal systems and recruiting highly specialized professionals to bolster our workforce, while also taking steps to drive the rebranding that has been underway since April. With the aim of implementing sustainable business management practices,1 we also laid the groundwork for a PDCA cycle geared toward achieving our decarbonization goals.

As a result, consolidated sales totaled JPY 510.1 billion (a JPY 123.8 billion increase from the previous period); the Group booked operating income of JPY 8.7 billion (a JPY 13.4 billion increase), ordinary income of JPY 12.0 billion (a JPY 14.2 billion increase), and net income of JPY 6.1 billion (a JPY 9.0 billion increase).

Group overview

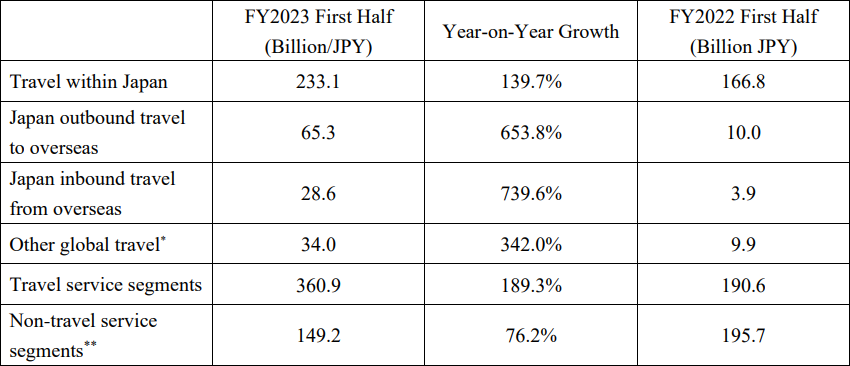

Segment overview (all amounts are sales)

*Other global travel: Travel between countries other than Japan

**Non-travel: MICE, regional vitalization & BPO, trading, publishing, etc.

(2) Overview by business segment

- Tourism

We worked to create new value through co-creation efforts with customers and local communities. In terms of regional exchange efforts, we pushed ahead with our efforts to build a recurring-revenue business model; these resulted in the opening of a tourism facility at Lake Kawaguchi called Tourist Base Kawaguchiko, and being awarded the contract for the Fujiyama Twin Terrace Entrance Facilities development project. In the corporate business area, we had solid outcomes mainly in the MICE segment, including business resulting from the G7 Hiroshima Summit and related ministerial meetings. In the individual leisure traveler segment, demand for outbound overseas travel has yet to fully recover, however domestic travel was solid, with dynamic packaging gaining traction and efforts to grow online sales proving successful. On the inbound front, in conjunction with Trip.com Group we established a joint venture named JTB Inbound Trip, predominantly aimed at capturing Asian demand for travel to Japan. By combining Trip's global sales network and JTB's accommodation purchasing power, we will expand accommodation sales and also support local governments in designing inbound tourism market strategies.

- Area Solutions

Working under the key theme of "co-creation and acceleration," we pursued business development fueled by co-creation efforts with parties both internal and external to the Group and extended our efforts to promote the development of regional areas, within the aim of creating high-value tourist attractions. In the area of digital support for tourist attractions, the recovery in the market--including inbound travel--led to record-high sales volume for the admission ticket distribution platform provided by Goodfellows JTB and for JTB BÓKUN, which provides centralized management of inventory and reservations. In the area of support for the development and operation of local tourist attractions, our strengthened consulting services drove a substantial increase in donations under the Hometown Tax Donation Program. In the area of publishing, the Rurubu magazine series, which marked its 50th anniversary, is steadily broadening its readership by expanding its lineup beyond the traditional focus on travel to explore new frontiers that encourage readers to discover wonder everywhere, an initiative that includes collaboration with popular TV shows and anime series. In our trading business, consumable sales were strong amid a recovery in guest room occupancy, as were sales of equipment on the back of projects for newly opening facilities. In the field of Area Development we focused on expanding the number of potential development projects by building on our relationships with the Regional Revitalization Solution Fund, in which we decided to invest and participate at the end of the previous fiscal year, and with a diverse array of partners.

III. Business Solutions

As market conditions recovered, we expanded our handling of events by addressing rising customer needs based on our core ABM strategy.2 In the M&E area, we stepped up efforts to promote the use of event technology (CVENT),3 expanding the scope of services we handle. In the business travel market, new business-- mainly in the domestic market--expanded as the market shifted into recovery mode amid the easing of COVID-related movement restrictions. On the business development front, we continued to pursue the internal "Creating the Future" initiatives we kicked off in FY2021, developing and refining new business solutions, building momentum into the development of new businesses and stepping up our efforts with, for example, the first market rollout of a new project. As for marketing to corporates, we staged the JTB Engagement Camp, a corporate marketing event designed to increase B2B business recognition and brand value, through which we explored untapped needs with respect to customer activities.

- Global business

On the back of a strong global market, sales of our European sightseeing bus tour product Land Cruise4 were solid, and sales at Europamundo Vacaciones expanded. Sales grew markedly in our global inbound business, with sales of Europe-bound trips out of South Korea and Taiwan doing well, and with us also capturing corporate demand. Sales in the M&E business were up substantially year on year, supported by strong demand for travel to Japan. The recovery in corporate demand, which includes strategic meetings management,5 has been striking, particularly in the Indian market. Sales in business travel were well above the previous year's levels as we tapped into the recovery in demand in North America and the Asia-Pacific region. Working with our business partners, we also stepped up our efforts to develop new services to address customers' environmental concerns. We additionally handled an increased volume of inbound travel to Japan, with a number of large-scale events taking place (including the G7 Hiroshima Summit and the swimming World Championships).

- Full-year Forecast for FY2023

In FY2023, the Group expects to achieve its full-year operating income target of JPY 13.4 billion and to book positive net income as forecasted at the beginning of the fiscal year. To realize our vision of "Pioneering ways to bring people, places and possibilities together in a new era", we will accelerate the implementation of growth strategies in each business segment, promote digital transformation and business process re-engineering initiatives to improve productivity, and pursue innovation to achieve sustainable growth.

- JTB Sustainability Report 2023, published October 31 (https://www.jtbcorp.jp/jp/sustainability/pdf/report_2023_en.pdf).

- B2B marketing based on an optimal approach to customer issues and needs.

- An all-in-one event management platform that handles everything from planning through to promotion and execution of meetings and events.

- JTB's seat-in-coach (allows customers to choose any combination of coach seats for their tour) bus tour product.

- An approach to maximizing the effectiveness of business events by creating optimal event management programs tailored to individual customers based on the visualization, collection and analysis of data and processes.

- B2B marketing based on an optimal approach to customer issues and needs.

JTB Corp. Branding & Communication Team (Public Relations)

Phone: +81 (0)3 5796 5833