JTB reports Consolidated Financial results for the Fiscal Year 2022

JTB Corp.

Tokyo, Japan., May 26, 2023 - JTB today reported the JTB Group's Consolidated Financial Results for the period April 1, 2022, to March 31, 2023.

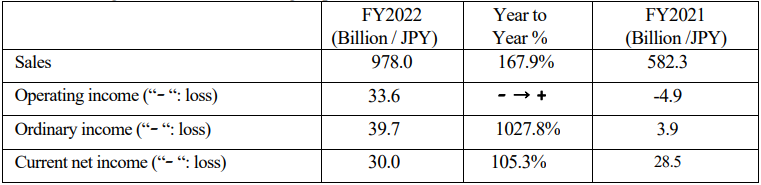

1. Consolidated Financial Results

(1) Overview

In this consolidated fiscal year, the market conditions surrounding us were significantly affected by the seventh wave of COVID-19 in the first half of the year, but in the second half of the year there was a gradual convergence and a significant recovery in domestic human flow. In addition, inbound travel to Japan following the lifting of travel restrictions also showed significant growth, especially in the fourth quarter (January-March 2023). Overseas travel, on the other hand, showed only a moderate recovery due to the weak yen and rising fuel prices.

In our Group, the recovery of domestic travel demand, driven by the Japanese government's "National Travel Support" program launched in October, the rapid recovery of inbound travel to Japan brought by the relaxation of border controls, and the steady recovery of global outbound travel have ensured a significant increase in travel and event handling. We also saw a steady recovery in non-travel related businesses, such as publishing and trading. Moreover, by expanding our products and services to individuals, companies, and communities, which are our core customers, we have strengthened our business for the future, which has contributed to our earnings growth. In addition, as a result of our determined implementation of structural reforms over the past three years, we have significantly improved our corporate strength and financial base.

As a result, consolidated sales totaled JPY 978.0 billion (JPY 395.7 billion increase from the previous period), with an operating income of JPY 33.6 billion (JPY 38.5 billion increased from the previous period), and an ordinary income of JPY 39.7 billion (JPY 35.9 billion increased from the previous period). The current net income stood at JPY 30.0 billion (JPY 1.5 billion increased from the previous period).

The following is an overview of our group.

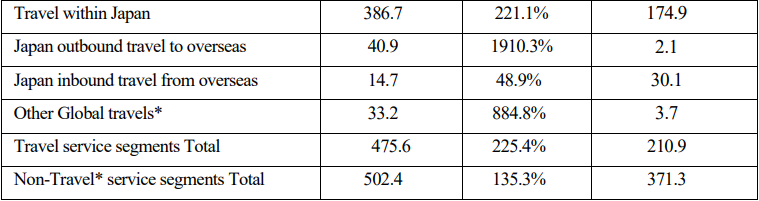

Segment Overview (All amounts are Sales)

*Other Global travels: Travel business between Third Countries (excluding Japan)

* Non-travel: MICE, regional vitalization & BPO, trading, publishing business, etc.

(2) Overview by business segments

Ⅰ. Tourism segment

In the Tourism segment, we reviewed and refined our products, services and delivery processes to create new value and improve productivity.

For individual customers, we promoted OMO*1 and strengthened services to enhance the value of customer experiences with a variety of content, including adventure tourism products and products that promote sustainability such as nature conservation and decarbonization. Furthermore, we contributed to regional revitalization through travel products that leveraged our advanced planning capabilities, such as the "Nihon no Shun*2" campaign covering Shikoku in the first half and Tokyo-Yokohama in the second half, Tokaido Shinkansen charter train packages, and co-creation with theme parks, and these products exceeded our plan. In corporate sales, the handling of educational travel showed a solid recovery, surpassing the level before the COVID-19 pandemic. Taking advantage of the signs of recovery in demand for group tours, we also made efforts to increase the population of non-residents by sponsoring the Honolulu Festival for the first time in four years and sending guests to the "Mori no Nigiwai, Okinawa" event.

Ⅱ. Area Solution segment

In the Area Solution segment, we have divided our business into three categories: "Supporting the Digitalization of Tourism Destinations," "Supporting the Development and Operation of Tourism Destinations," and "Providing Content During Travel," and promoted our businesses for each.

In "Supporting the Digitalization of Tourism Destinations," the ticket distribution platform provided by GoodFellows JTB expanded the gross merchandise value, and the number of companies that have adopted "JTB BÓKUN," which provides centralized management of inventory and reservations for activity products, increased. We also promoted "Kotozna In-room" and "JTB Data Connect HUB" as solutions to improve DX and productivity in accommodation facilities and increased the number of facilities that have adopted them. In the Tourism Platform Gateway (TPG)*3, we worked to promote regional excursions by creating common tickets and promoted the development of multilingual support and other measures in response to the recovery of inbound demand.

In the "Support for the Development and Operation of Tourism Destinations" business, we promoted new sales to municipalities for the individual version of Hometown Tax Donation Program, leading to an increase in contracts. Due to increased recognition of JTB travel vouchers as a return gift, the number of vouchers issued remained at over 150% of the previous year. The trading division of the Group companies responded to industry issues by joining the (General Incorporated Association) Amenity Recycling Association and establishing a program to recycle amenity goods at lodging facilities into sustainable materials.

In "Providing Content During Travel," we invested in and participated in Regional Revitalization Solution Fund, which operates the "ALL-JAPAN Tourism Nation Fund," as a foothold for accelerating the development of regional co-creation.

III. Business Solution segment

In the Business Solutions segment, efforts to use digital solutions to solve market issues in the M&E area and to develop human resources were successful, resulting in significantly higher performance than in the previous fiscal year despite the challenging market environment. Specifically, we promoted DX for event management using Cvent*4, conducted market research and external seminars, and strengthened M&E digital human resources in both sales and operations.

In the area of EVP*5, we expanded the content of measures related to human resource enhancement and branding in preparation for the "Disclosure of Human Capital Information" mandated from the fiscal year ending March 31, 2023, while the "WILL CANVAS*6" HR tech for organizations has been introduced by major companies by grasping their issues and needs. In the area of business travel, there has been a certain degree of recovery in the market, especially for overseas travel, along with the easing of restrictions on actions in the COVID-19.

Ⅳ. Global Business

In M&E (Meetings & Events), global MICE demand recovered, driven by real events in the first half of the year and by incentive (reward) and inbound demand in the second half, achieving results well above last year's levels. In DPS*7, sales of "Land Cruise", a bus product touring Europe for the Japanese market, resumed and in SIC*8, Europamundo Vacations increased its business mainly in the Latin American market. In business travel, sales increased significantly, particularly in markets where demand recovered ahead of the market, thanks to the strengthened structure of the Global Operations Center, which operates 24 hours a day.

Regarding inbound travel to Japan, we have been working to capture MICE demand for domestic sports and other events. In the rapidly recovering market for "Sunrise Tour" packages for foreign visitors to Japan, we developed and operated new routes such as the "Setouchi Scenic Route" to strengthen our efforts to eliminate overtourism by avoiding concentration on specific tourist destinations.

(3) Overview of company-wide initiatives

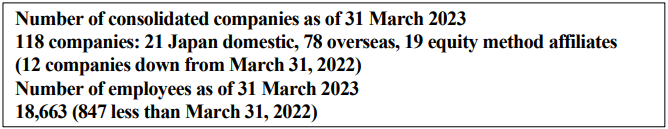

On the human resources front, we resumed the recruitment of new graduates for the first time in two years, expanded the common group human resources exchange system for employee career development, and promoted the recruitment and training of specialized personnel in digital, finance, and other areas to improve the human resources base and enhancing the value of human resources for renewed growth.

In order to realize our Mission and Management Philosophy, we worked on organizing the strategies and systems that form the basis for implementing sustainability in our management and policies and formulated a sustainability policy for our group and set decarbonization targets for our company. Based on the relationship between social issues and our company, we identified priority issues (materiality: enriched lifestyles, environment surrounding people, and partnerships) to be addressed by our Group, and formulated the key themes of "building solutions to create sustainable interactions," "reducing environmental impact," "further improving sustainability infrastructure," and "mutual understanding among stakeholders". In October, we released "JTB Sustainability Report 2022," which summarizes these activities.

To enhance our brand value as ONE JTB, we have begun to develop the foundation for brand management, revised the corporate brand display system for JTB Corp. and the JTB Group for the first time in 35 years, and developed guidelines and tools for rebranding from April 2023.

*1 Abbreviation for Online Merges with Offline; Marketing strategy that merges online (web) and offline (brick-and-mortar stores, call centers, etc.) channels into a complete, integrated system that provides customers with a holistic experience to create purchase intent.

*2A trademarked campaign for the revitalization of domestic tourist destinations conducted by the JTB Group since 1998 under the theme "Rediscovering Japan's Attractiveness". Target destinations are selected every six months.

*3 A software-based service primarily for local governments, DMOs, private urban development companies, and transportation operators that enables centralized search, reservation, payment, and authentication of attractive activities, services, and admissions, general excursion tickets, and special tickets. The data obtained can be used for marketing activities.

*4 An event management system that can perform and manage various functions from planning to promoting and executing meetings and events on the same platform.

*5 Abbreviation for Employee Value Proposition. A value proposition for working for a company that employees can relate to.

*6 A system equipped with a recommendation function and visualization of issues based on the collection and analysis of organizational and employee survey data.

*7 Abbreviation for Destination Products & Services. Also known as Destination Products, these are travel products produced in the region that hosts the traveler. Like optional tours offered at the destination.

*8 Abbreviation for Seat-In-Coach. A bus tour with any combination of courses. "Land Cruise" is the product name of JTB within SIC and is our registered trademark.

2. Full year forecast for FY2023

For the full year of fiscal 2023, we expect both operating income and bottom-line profit to be in the black. Next fiscal year is positioned as an important year for us to steadily implement Phase 2, "Recovery," and establish the fundamentals for Phase 3, "Dynamic Growth and Development," of our medium-term management plan.

In the travel area, we will seize the situation of recovering human flows and capture demand by appropriately investing management resources. Compared with the level in fiscal 2019, we expect the domestic travel market to recover 96%, the overseas travel market to recover 52%, and the inbound travel market to recover 92% in fiscal 2023. Given these market assumptions, we plan to increase sales by steadily capturing domestic travel demand, which is on a recovery trend, and by capturing the recovery in demand for international people flows, such as outbound travel from Japan, inbound travel to Japan, and global travel between third countries. In areas other than travel, we will accelerate the development of products and services that are tailored to corporate, regional, and government needs.

We estimate that in FY2023 we will be able to achieve net sales 113% of FY2022 and gross profit 100% of FY2022, resulting in operating income of ¥13.4 billion in FY2023 and a return to profitability in the bottom line.

<About JTB>

Today's JTB traces its roots back to Japan Tourist Bureau, an agency formed in 1912 for the purpose of servicing the ticketing needs of foreign tourists in Japan. Over a century of history, JTB steadily evolved into a travel and tourism industry leader. Through vision, integrity, innovation, and unsurpassed know-how, the JTB Group consistently creates unparalleled value for its stakeholders.

*The JTB Logo, and all trademarks and service marks are owned by JTB Corp. unless otherwise noted.

JTB Corp. Branding & Communication Team (Public Relations)

Phone: +81 3 5796 5833