Travel Trends in Golden Week 2023 (April 25 to May 5)

JTB Corp.

●The number of domestic travelers is expected to be 24.5 million (153.1% year-on-year).

●The number of overseas travelers is expected to be 200,000 (400.0% year-on-year).

* The figure was calculated for the first time in three years.

●Domestic travelers prefer short- to medium-distance travel, and Hawaii and South Korea are popular overseas destinations.

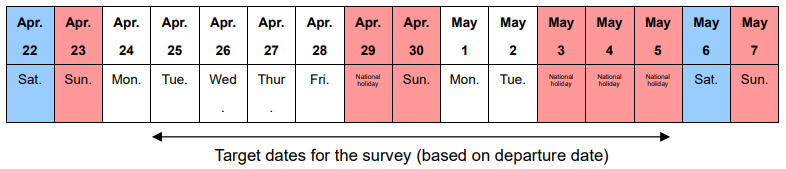

JTB has summarized the outlook for travel trends among people planning overnight or multiple-night travel during the Golden Week (hereafter referred to as "GW") between April 25 and May 5, 2023. Until last year, we published market estimates only for the number of domestic travelers due to the impact of COVID-19. However, since the infection is not currently as prevalent as before and the Japanese government has been easing restrictions on overseas travel, we calculated market estimates for overseas travel for the first time in three years.

This report is a compilation of data about overnight or multiple-night travel made by Japanese travelers estimated based on various economic trends, consumer behavior surveys, transportation and tourism-related data, and surveys conducted by the JTB Group. The survey has been conducted on an ongoing basis since 1969.

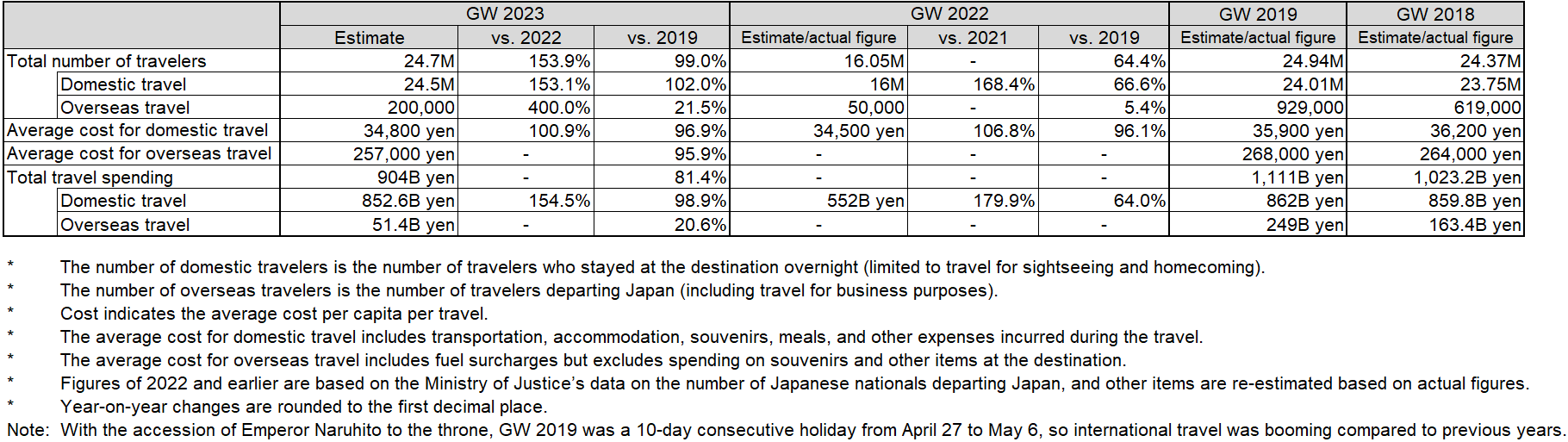

(Figure 1) Estimated figures for travel trend in GW 2023

[Travel trend survey: survey methodology]

Survey dates: March 13 to March 20, 2023

Respondents: Men and women aged 15 to 79 nationwide

Sample size: 20,000 for the preliminary survey and 2,060 for the main survey

(The main survey was conducted only with those who responded in the preliminary survey that they will or probably will travel during GW.)

Survey focus: Overnight or multiple-night travel planned for April 25 to May 5, 2023

(Domestic travel is limited to sightseeing and homecoming trips. Overseas travel includes business trips.)

Survey methodology: Online survey

<Socioeconomic Environment and Trends among Sei-katsu-sha>

- COVID-19 and Trends in Travel and Tourism

Although the World Health Organization (WHO) has not yet declared an end to COVID-19, its impact is diminishing throughout the world. Countries and regions are heading toward normalizing socioeconomic activities, with the relaxation of entry-exit border control and the widespread resumption of international flights and cruise ship operations. According to the United Nations World Tourism Organization (UNWTO), the number of international tourist arrivals in 2022 was about 60% of pre-pandemic levels but may recover to 80 to 95% in 2023 on the assumption of steady growth1.

*1 Source: UNWTO, "World Tourism Barometer January 2023."

Looking at the situation surrounding domestic travel, the government launched a nationwide travel subsidy program in October 2022 to stimulate nationwide tourism demand, as individuals have resumed travel while taking infection prevention measures. From March 13, 2023, individuals can decide whether or not to wear a face mask. On May 8, COVID-19 will be downgraded to Class 5, which is equivalent to seasonal influenza, under the Infectious Diseases Control Law. Many domestic travelers are now seen in various locations. In December 2022, when the discount rate for the nationwide travel subsidy program was high, the total number of Japanese overnight travelers was 40.92 million, an increase of 7.8 points compared to December 2019 (37.95 million)2. The nationwide travel subsidy program will continue after April 2023 (except for April 29 to May 7).

*2 Source: Japan Tourism Agency, "Overnight Travel Statistics Survey ." The figure for December 2022 is the preliminary figure from the second preliminary report, and the figure for December 2019 is the fixed value.

The relaxation of border control measures, effective from October 11, 2022, eliminated the daily cap on the number of new arrivals, relaxed entry requirements for proof of negative PCR test and quarantine periods, and lifted the ban on individual travel by foreign visitors to Japan, making it easier for Japanese people to travel abroad and for foreigner travelers to visit Japan. The number of foreign visitors to Japan in February 2023 (estimate) was 1,475,300, rebounding to 57% of the level seen in February 20193. On the other hand, the number of Japanese people departing Japan in February 2023 (estimate) was 537,700, remaining at 35% of the figure in February 20193.

*3 Source: Japan National Tourism Organization (JNTO), "Visitor Arrivals to Japan and Japanese Overseas Travelers."

- Economic Environment Surrounding Travel and Leisure Consumption and Sei-katsu-sha Mindset

Despite efforts to recover from the economic stagnation caused by COVID-19, it is still difficult to envisage the outlook of the Japanese economy due to the unstable international context and the price hikes resulting from it, as well as emerging concerns such as the collapse of US banks and layoffs at global IT companies. The assessment of the current state of the Japanese economy in the March 2023 Monthly Economic Report indicates risks and precautions such as a downturn in overseas economies, price hikes, supply constraints, and fluctuations in financial and capital markets, despite anticipation of a pickup in the economy. However, personal consumption has been "picking up moderately" since July 2022.

In the current economic context, due to a rapid yen depreciation against the dollar since 2022, the current exchange rate is still hovering around 130 yen to the dollar. This has caused rising prices of imported goods, energy, and other commodities since the second half of 2022, with price hikes affecting household budgets.

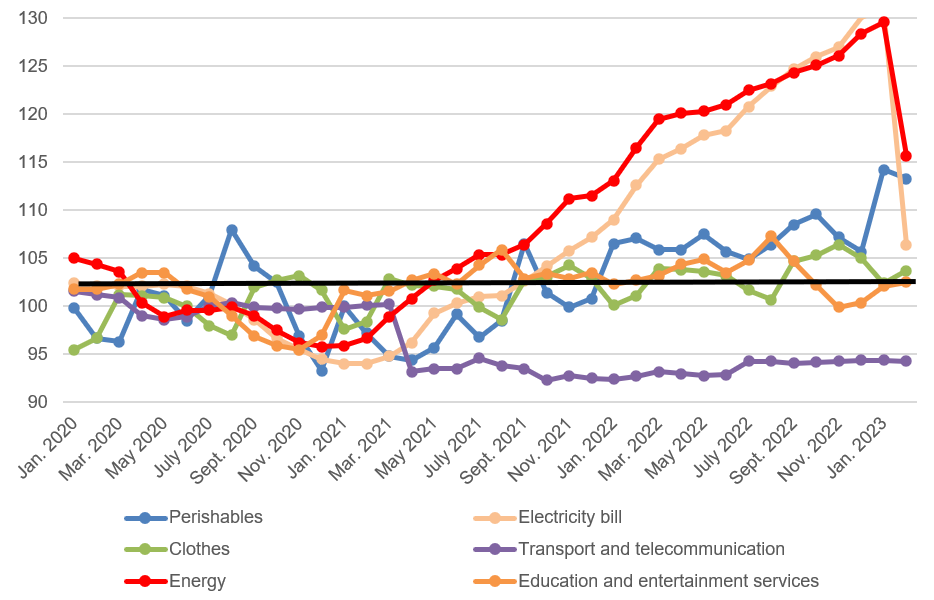

For over a year, consumer price indexes for primary items have been rising or unchanged except for transportation and telecommunications. Energy and electricity bills are still high, despite curbed hikes in February 2023 (Figure 2).

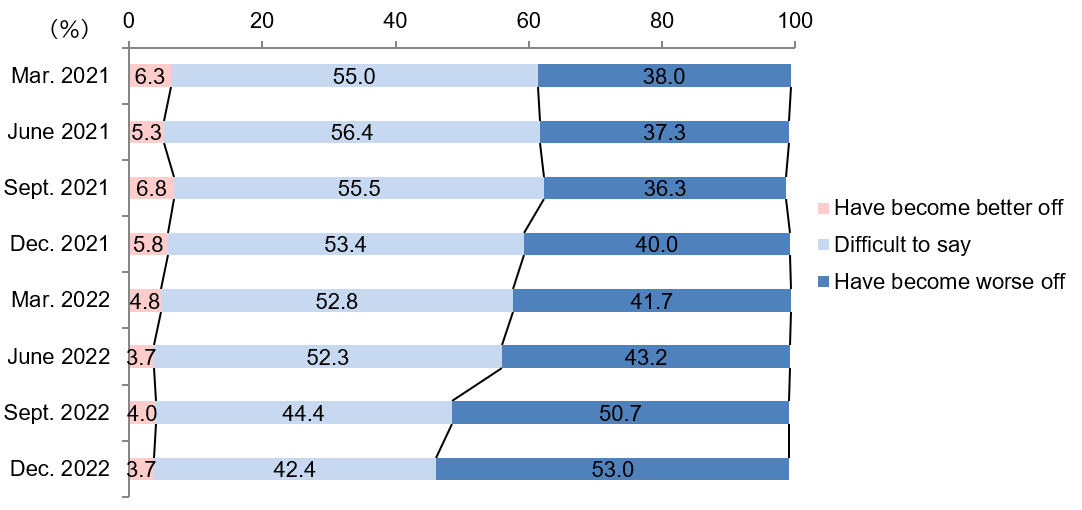

Under these circumstances, the current situation of living conditions can be considered challenging. Regarding the Impression of Household Circumstances in the Opinion Survey on the General Public's Views and Behavior by the Bank of Japan, the percentage of respondents who said their household circumstances "have become worse off" has increased since September 2021, up from the flat level in the previous years to 53.0% in December 2022, showing a 13.0-point increase compared to the same month in the previous year. This is the highest score since the beginning of COVID-19 (Figure 3).

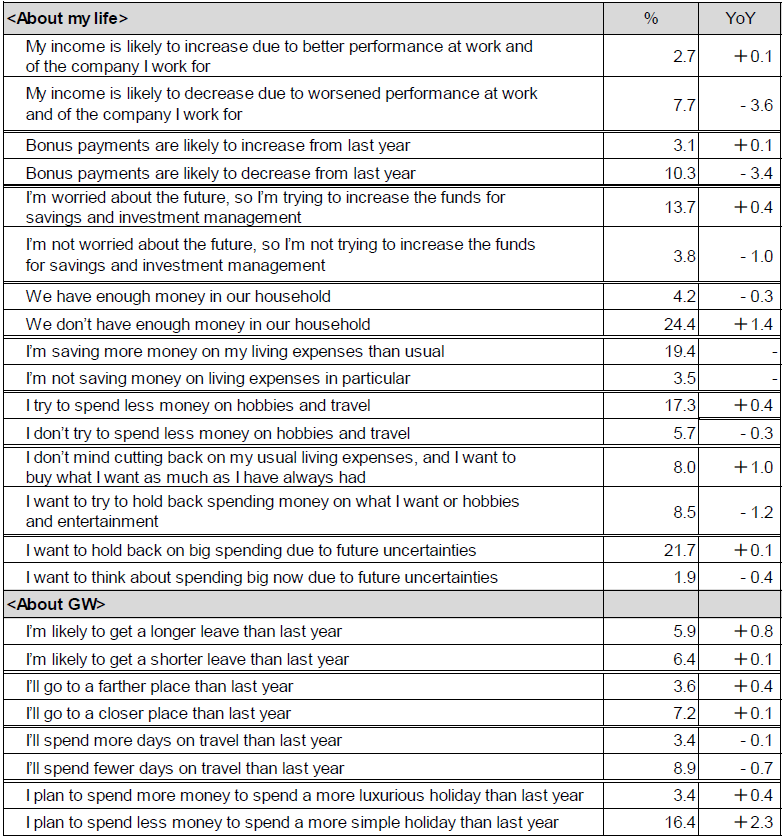

In the question asking to select the statement that best describes their daily lives and GW travel in a survey conducted by JTB, "My income is likely to decrease due to worsened performance at work and of the company I work for" (7.7%) scored higher than "My income is likely to increase due to better performance at work and of the company I work for" (2.7%) but was down 3.6 points from the previous year. However, the score was up by 1.4 points for "We don't have enough money in our household" (24.4%) from the previous year, while that of "We have enough money in our household" (4.2%) was down by 0.3 points. The score of "I'm worried about the future, so I'm trying to increase the funds for savings and investment management" (13.7%) also increased by 0.4 points from the previous year, indicating a continued lack of household funds from last year despite a minor improvement.

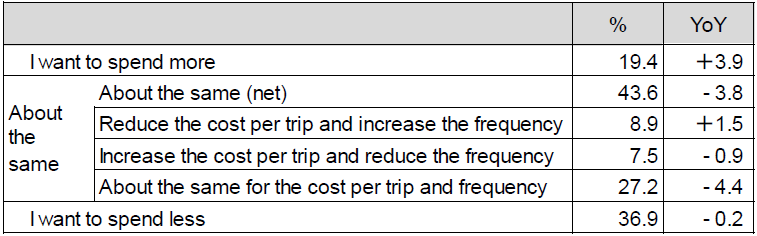

Meanwhile, the respondents are still inclined to long distance than short distance, few days than many days, and budget plan than luxurious plan for travel. However, the gaps in all parameters have narrowed compared to the previous year, suggesting that vigilance toward COVID-19 has eased somewhat (Figure 4). Regarding intentions for travel spending over the next year, "I want to spend less" (36.9%) outscored "I want to spend more" (19.4%). Compared to the 2022 survey, the score of "I want to spend more" increased by 3.9 points, indicating that more people are considering positive spending on travel (Figure 5).

(Figure 2) Transition of consumer price index

Source: Prepared by JTB Tourism Research & Consulting Co. based on the data from Consumer Price Index (2015 base), Ministry of Internal Affairs and Communications

(Figure 3) Impression of household circumstances

Source: Prepared by JTB Tourism Research & Consulting Co. based on the data from an Opinion Survey on the General Public's Views and Behavior, Bank of Japan

(Figure 4) Respondents' current life and GW (multiple answers, N=20,000)

(Figure 5) Spending intention on travel in the next year (single answer, N=20,000)

<Golden Week Domestic Travel Trends>

- Golden Week Calendar and Travel Intentions

This year's calendar makes it easy to take an extended vacation with a possibility of nine consecutive days off by combining a five-day weekend with two additional days off.

26.5% of the respondents indicated travel intention (a combined score of those who will and probably will go somewhere), a recovery to the same level as in 2019.

This year's GW calendar has a five-day weekend from Wednesday (national holiday), May 3, to Sunday, May 7. Taking Monday, May 1, and Tuesday, May 2, off, a total of nine consecutive days off from Saturday, April 29, is possible. The survey mentioned earlier was designed to capture detailed findings on travel intentions, including homecoming trips, for GW 2023 (April 25 to May 5).

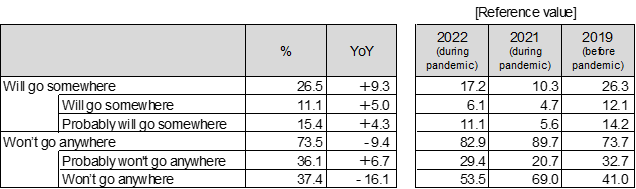

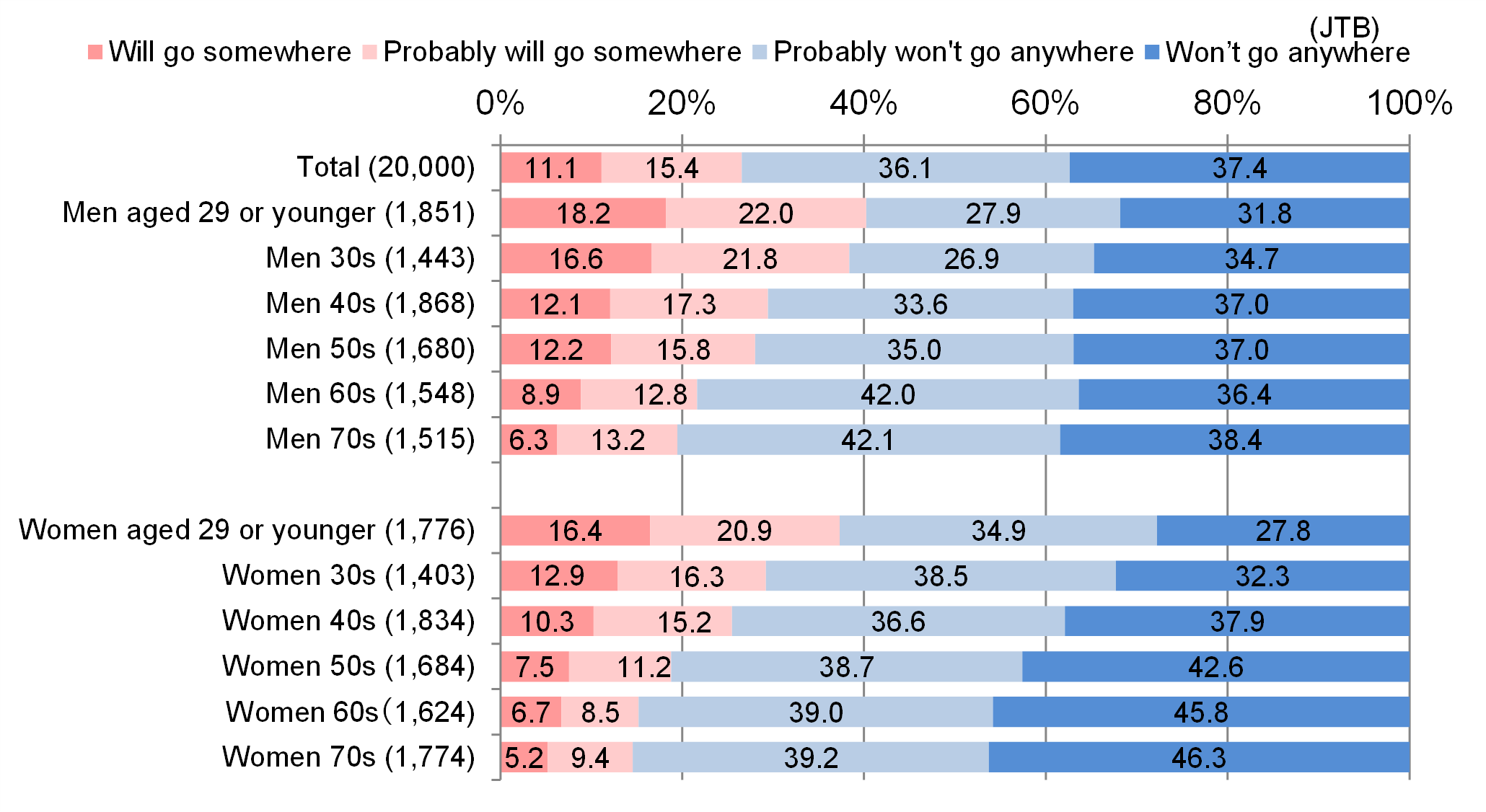

Regarding whether or not people will travel during GW, 26.5% of the respondents said they will (a combined score of those who will and probably will go somewhere), an increase of 9.3 points compared to the previous year. The pre-pandemic score for 2019 was 26.3%, indicating that travel intentions have recovered to the same level as before COVID-19. (Figure 6) By gender and age, the younger the age group, the higher the travel intention is for both men and women. The breakdowns of respondents with travel intentions (a combined score of those who will and probably will go somewhere) were 40.2% of men (29.0% in the previous year) and 37.3% of women (23.7% in the previous year) among those aged 29 and younger, and 19.5% of men (11.0% in the previous year) and 14.6% of women (8.2% in the previous year) among those in their 70s. Please note that the scores improved notably across all age groups. (Figure 7)

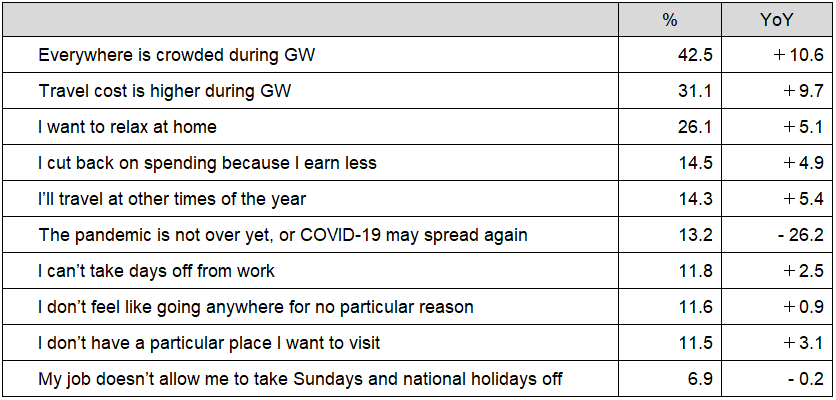

The most common reason for not traveling was "Everywhere is crowded during GW" (42.5%), up 10.6 points from the previous year. Next in line were "Travel cost is higher during GW" (31.1%), up 9.7 points, "I want to relax at home" (26.1%), up 5.1 points, and "I cut back on spending because I earn less" (14.5%), up 4.9 points, with reasons other than infectious diseases ranking high compared to the previous year. "The pandemic is not over yet, or COVID-19 may spread again" (13.2%), the most common response in 2021 and 2022, moved down in the rankings with a sharp 26.2-point decrease from the previous year. (Figure 8)

(Figure 6) Intention of travel during GW (single answer, N=20,000)

* No data is available for 2020 because the results were not announced.

(Figure 7) Intention of travel during GW (by gender and age, single answer, N=20,000)

(Figure 8) Reasons for having no intention to travel during GW this year (multiple answers, N=14,689)

- Golden Week Traveler Estimate for 2023

The number of domestic travelers will likely recover to 24.5 million (153.1% y-o-y, 102.0% compared to 2019).

The number of overseas travelers is estimated to be 200,000, showing a gradual recovery.

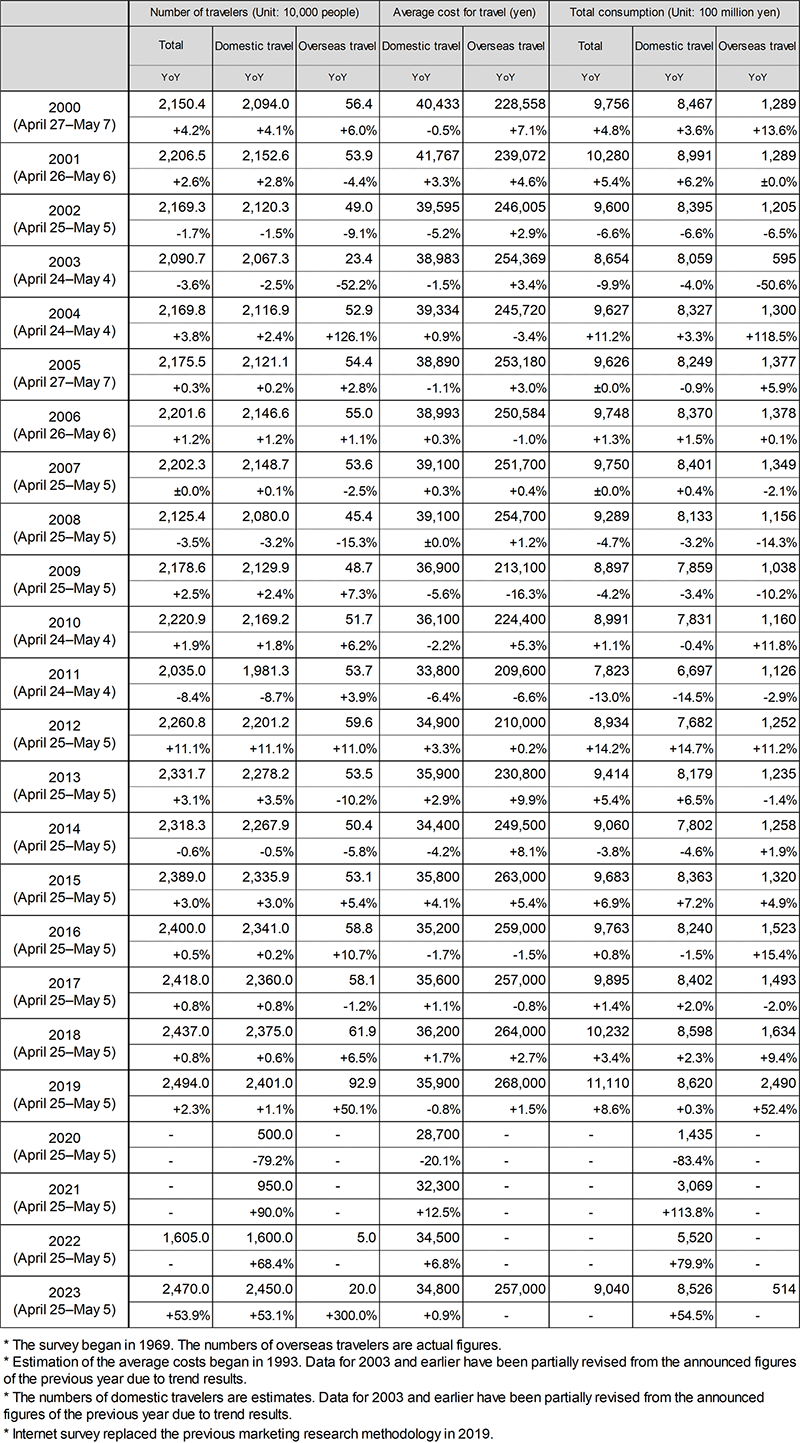

We estimated the total number of travelers at 24.7 million and total travel expense at 904 billion yen regarding GW (April 25 to May 5, 2023) based on data from various economic indicators, transportation companies' actions, accommodation reservations, and various regular fixed-question consciousness surveys.

The number of domestic travelers is estimated at 24.5 million (153.1% vs. 2022 and 102.0% vs. 2019), the average cost for domestic travel at 34,800 yen (100.9% vs. 2022 and 96.9% vs. 2019), and the total domestic travel spending at 852.6 billion yen, back to the same level as pre-COVID-19. Meanwhile, the number of overseas travelers is estimated at 200,000 (400.0% vs. 2022 and 21.5% vs. 2019). With the accession of Emperor Naruhito to the throne, GW 2019 was a 10-day consecutive holiday from April 27 to May 6, so international travel was booming compared to previous years. The number of overseas travelers during GW in the 10 years before COVID-19 was about 500,000 to 600,000, and compared to that average, the figure has recovered to over 30%. The average cost for overseas travel was 257,000 yen (95.9% vs. 2019), and the total overseas travel spending was 51.4 billion yen (20.6% vs. 2019). The recovery of overseas travel is slower than domestic travel due to high prices, yen depreciation, fuel price hikes, and a reduction in the number of international flight seats offered (approx. 60% vs. 2019)4. Specific trends will be described in the following chapters.

*4 Source: Official Airline Guide (OAG), "Capacity Report."

- Travel Trends for GW 2023

Domestic travelers prefer short- to medium-distance travel, and Hawaii and South Korea are the popular overseas destinations.

The 2,060 respondents for the preliminary survey who said they will or probably will go somewhere in GW were asked for details about their trip. The overall trend showed that during the pandemic, many traveled to areas near their residential areas, while strong travel intentions for farther destinations accessible by Shinkansen and airplanes were seen last year as the restrictions on activities were lifted. On the other hand, due to the high cost of living and other factors, this year saw a tendency to travel to relatively close destinations again, mainly to areas near where they live. Specific travel details are as follows.

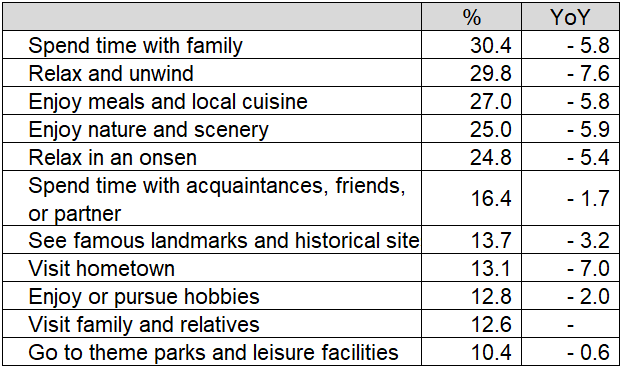

Purpose or motivation for travel (overall): "Spend time with family" (30.4%) was the most popular reason, followed by "Relax and unwind" (29.8%), "Enjoy meals and local cuisine" (27.0%), "Enjoy nature and scenery" (25.0%) and "Relax in an onsen" (24.8%), with the high-ranked attributes remaining unchanged from last year. (Figure 9)

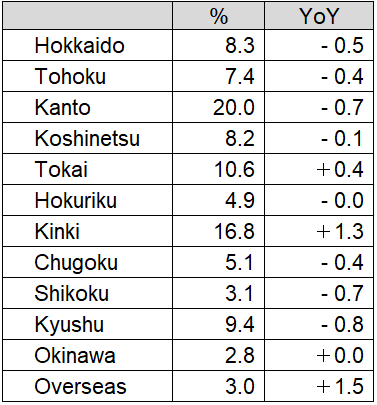

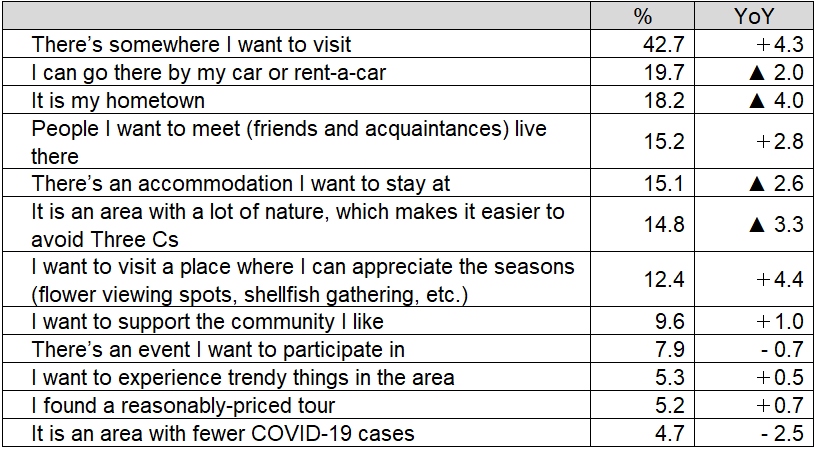

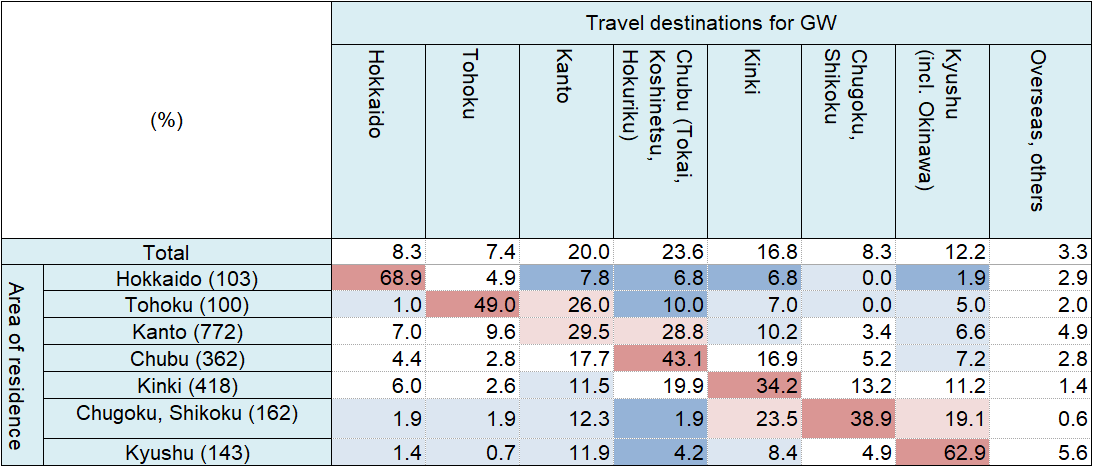

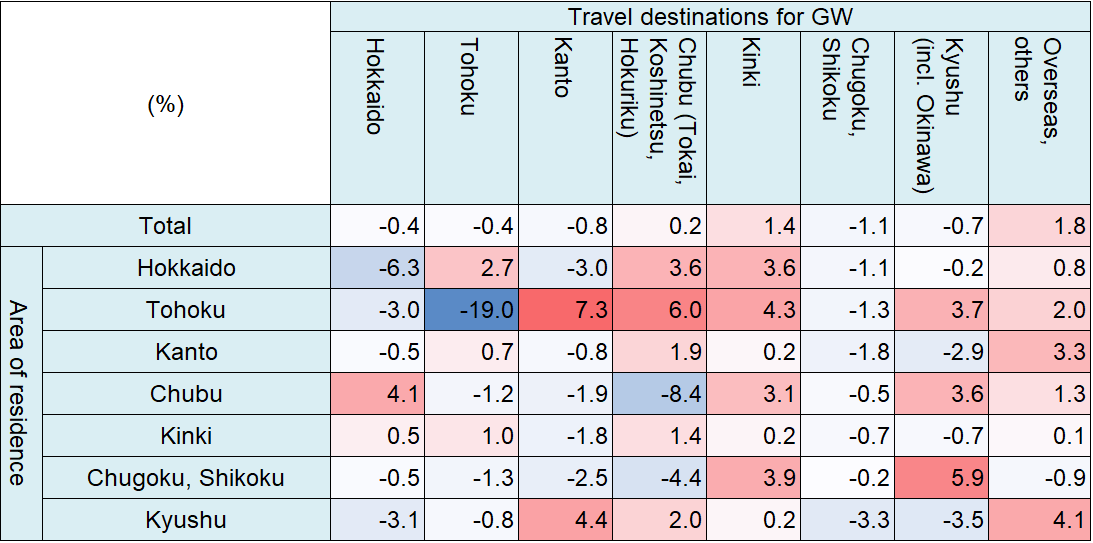

Destinations (domestic): "Kanto" (20.0%) was the most popular destination, followed by "Kinki" (16.8%), "Tokai" (10.6%), and "Kyushu" (9.4%). "Overseas" was cited by 3.0%. (Figure 10) "There's somewhere I want to visit" (42.7%) was the most common reason for selecting the destination, up 4.3 points from the previous year. Meanwhile, a downward trend was seen for "Can go there by my car or rent-a-car" (19.7%, down by 2.0 points), "It is my hometown" (18.2%, down by 4.0 points), and "It is an area with a lot of nature, which makes it easier to avoid Three Cs" (14.8%, down by 3.3 points). The percentage of respondents prioritizing infection control measures went down for the second year in a row. However, a certain number of people still place a high priority on them. (Figure 11) Observing travel destinations by place of residence, the percentages of intra-regional travel, i.e., travel destination and place of residence in the same area, were over 60% in the two areas, "Hokkaido" (68.9%) and "Kyushu" (62.9%), while the percentage was 29.5% in "Kanto." (Figure 12) Compared to the previous year, the percentage of intra-regional travel was down in all areas except Kinki, resulting in increased travel outside the area of residence. (Figure 13) During the pandemic, people selected destinations within their residential areas as means of infection control. However, more people tend to choose destinations outside their area of residence this year.

Destinations (overseas): Looking at the trends, despite the small number of responses, "Hawaii" was the most popular destination, followed by "South Korea."

The data below is based on the responses given by 1,992 respondents who said they will travel to a domestic destination.

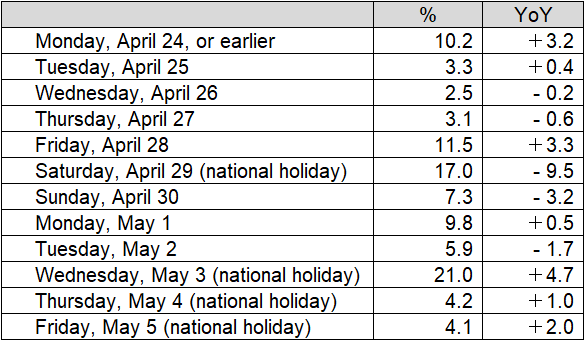

Departure date for travel: "Wednesday (national holiday), May 3" (21.0%), the first day of the five-day weekend, was the most common response, followed by "Saturday (national holiday), April 29" (17.0%) and "Friday, April 28" (11.5%), suggesting that some respondents may take Monday, May 1, and Tuesday, May 2, off for an extended vacation (Figure 14).

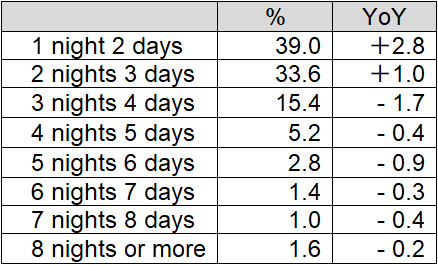

Travel duration (days): "Overnight" was the most common choice at 39.0%, up 2.8 points from the previous year. While the score of "2 nights" (33.6%) increased by 1.0 point, those of "3 nights" (15.4%) and longer all went down, indicating a downward trend in the number of travel duration (days) from the previous year. (Figure 15)

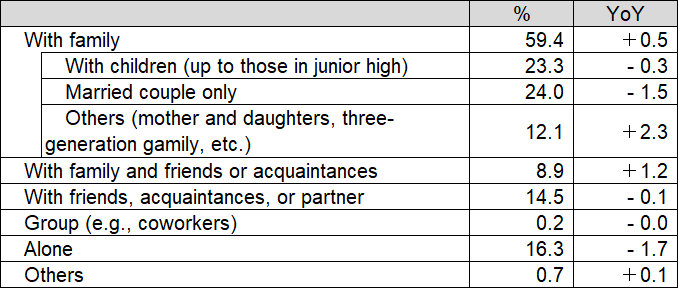

Companions: "Married couple only" (24.0%) scored the highest despite a 1.5-point fall from the previous year, followed by "Family travel with children (up to those in junior high)" (23.3%) with a decline of 0.3 points. On the other hand, the score of "Others (mother and daughters, three-generation family, etc.)" (12.1%) was up 2.3 points, bringing the total for all forms of family travel to 59.4%, up 0.5 points from the previous year. "With family and friends or acquaintances" (8.9%) was also up 1.2 points, while "Alone" (16.3%) saw a 1.7 decline for the second consecutive year despite an upward trend observed during the pandemic. While traveling with a small group of family members or alone had been a mainstay as a measure to prevent infection, the scope of companions is expanding. (Figure 16)

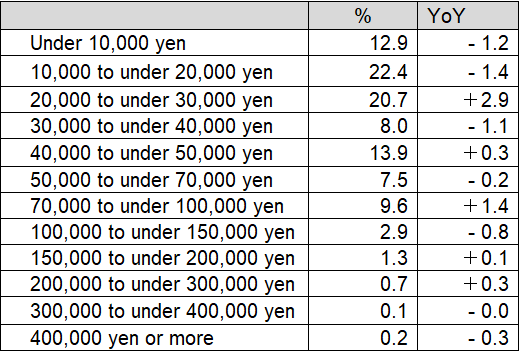

Travel cost per capita: "10,000 to under 20,000 yen" had the highest score at 22.4% but saw a decline of 1.4 points from the previous year. This was followed by "20,000 to under 30,000 yen" (20.7%), up 2.9 points, and "Under 10,000 yen" (12.9%), down 1.2 points compared to the previous year. (Figure 17)

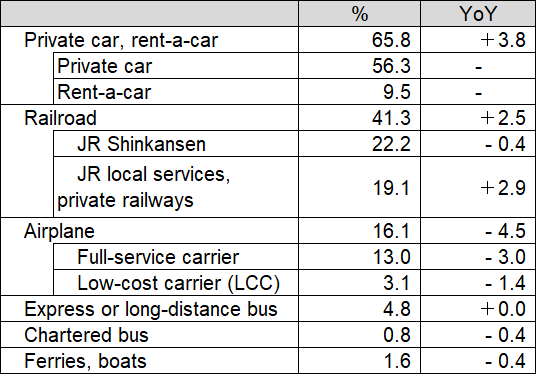

Transportation used: "Private car, rent-a-car" ranked top at 65.8%, up 3.8 points from the previous year. The score of "Railroad" was 41.3%, a 2.5-point increase from the previous year. Looking at the breakdown, "JR Shinkansen" (22.2%) was down 0.4 points from the previous year, while "JR local railways, private railways" (19.1%) was up 2.9 points. The score of "Airplane" was 16.1%, a 4.5-point decline from the previous year. (Figure 18)

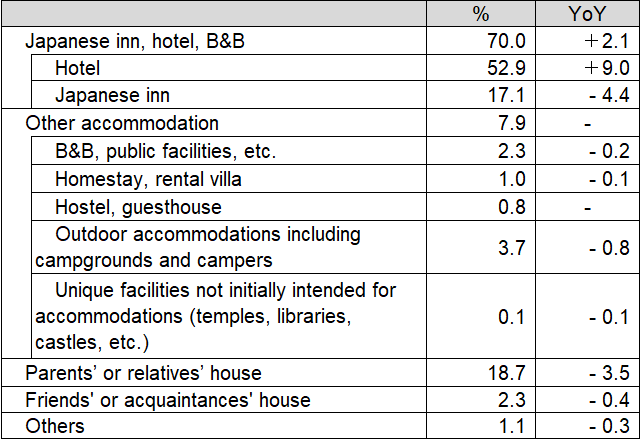

Accommodations used: "Hotel" was the most popular choice at 52.9%, up 9.0 points from the previous year. This was followed by "Parents' or relatives' house" (18.7%) with a 3.5-point decline and "Japanese inn" (17.1%) with a 4.4-point increase. An upward trend was observed for "Outdoor accommodations including campgrounds, glamping, campers, and overnight stay in a car" (3.7%) and "Homestay or rental villa" (1.0%) as infection prevention measures, but scores of these were down this year. (Figure 19)

(Figure 9) Travel purposes and motivations (multiple answers, N=2,060)

(Figure 10) Travel destinations (single answer, N=2,060)

(Figure 11) Reasons for selecting the destination (single answer, N=2,060)

(Figure 12) Travel destinations for GW by area of residence (by area, single answer, N=2,060)

(Figure 13) YoY change in GW destinations by area of residence (by area, single answer)

(Figure 14) Departure date for travel (single answer, N=1,992)

(Figure 15) Travel duration (days) (single answer, N=1,992)

(Figure 16) Travel companions (single answer, N=1,992)

(Figure 17) Per capita travel expenses (single answer, N=1,992)

(Figure 18) Transportation used (multiple answers, N=1,992)

(Figure 19) Accommodations used (single answer, N=1,992)

- COVID-19 measures continue despite diminishing vigilance in preventing infection

Those who plan to travel were asked about their level of vigilance regarding infection prevention, given that individuals can decide whether or not to wear a face mask as of March 13, 2023 and the legal status of COVID-19 is scheduled to be reclassified from Class 2 to Class on May 8.

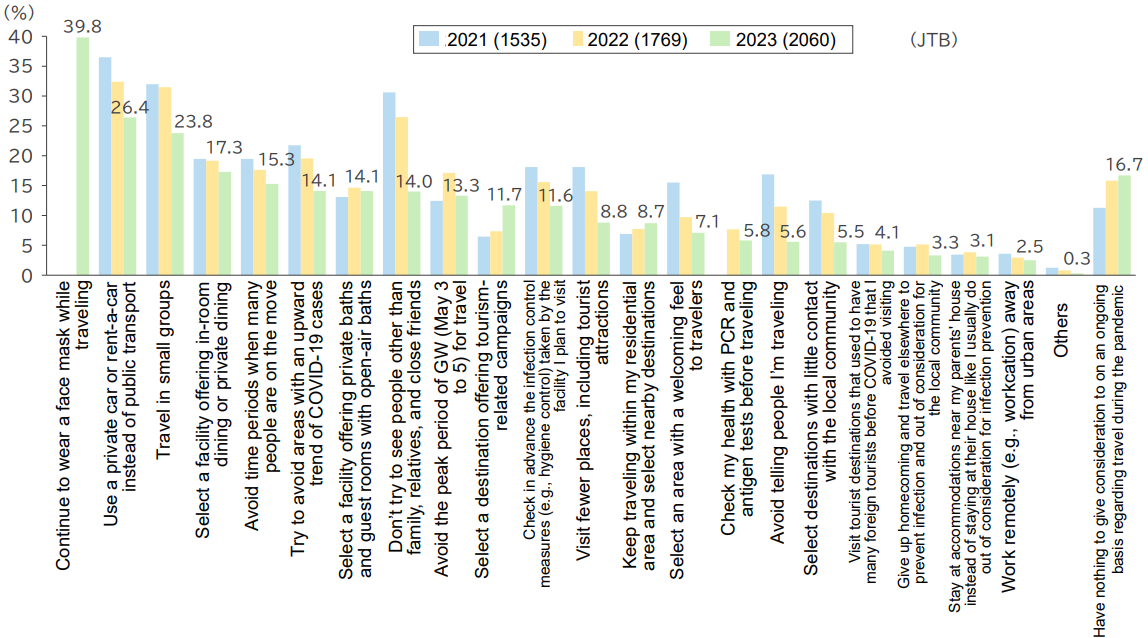

The most commonly cited special consideration was "Continue to wear a mask while traveling" at 39.8%, followed by "Use a private car or rent-a-car instead of public transport" (26.4%), "Travel in small groups" (23.8%), "Select a facility offering in-room dining or private dining" (17.3%), and "Avoid time periods when many people are on the move" (15.3%). While most items had lower scores than the previous year, an increase was observed for "Select a destination offering tourism-related campaigns" (11.7%, 4.4 points) and "Select an area with a welcoming feel to travelers" (8.7%, 1.0 point). Respondents appear to be continuing to take steps to protect themselves against COVID-19, but they also have high expectations for the campaign and other initiatives. (Figure 20)

(Figure 20) Special considerations for GW travel (multiple answers, N=2,060)

- "Places to enjoy nature" and "Food-focused events" were the primary attractions in GW 2023

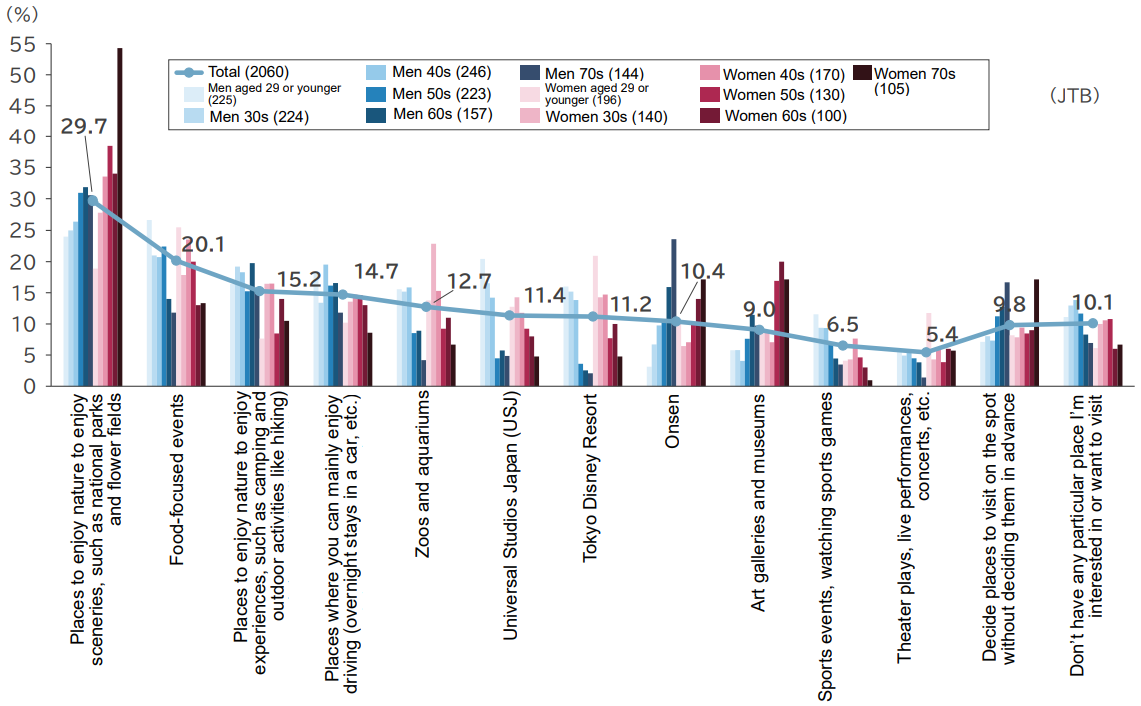

Finally, the respondents were asked to mention interesting places to visit during this GW. As a result, the most popular option was "Places to enjoy nature (to enjoy sceneries, such as national parks and flower fields)" (29.7%), followed by "Food-focused events" (20.1%), "Places to enjoy nature (to enjoy experiences, such as camping and outdoor activities like hiking)" (15.2%). The results indicate anticipation for events that had to be restrained or canceled during the pandemic. Although these figures are for reference only since the given options differ from the previous year, the score of "Don't have any particular place I'm interested in or want to visit" (10.1%) was down by 8.2 points from 18.3% in the previous year's survey, indicating an overall increase in willingness to travel. (Figure 21)

JTB's reservations for accommodation and domestic package products increased substantially in all areas compared to the previous year, and travel to distant destinations using the Shinkansen and airplanes was strong. Among destinations, Kanto (including Tokyo Disney Resort®) and Kansai (including Universal Studios Japan) are performing exceptionally well, with Hokkaido, Okinawa, and other distant destinations gaining popularity. Departure dates in the second half of GW are the most popular, with an exceptionally high share of products departing on May 3, followed by May 4. Including last-minute reservations, growing performance can be expected until right before GW. Hawaii ranks first in the popularity ranking among JTB's overseas package products, followed by Taiwan in second place and South Korea in third. In terms of popularity by departure date, the shares were high for products departing on May 3, followed by those departing on April 29.

(Figure 21) Types of interesting places to visit during this GW (multiple answers, N=2,060)

(Figure 22) Transitions of estimated figures for travel trend in GW

JTB Corp. Branding & Communication Team (Public Relations)

Phone: +81 3 5796 5833