Prospective Travel Trends in 2023

(January through December)

JTB Corp.

Domestic travel will recover up to 108.6% year-on-year

International outbound travel and inbound visitors to Japan will increase to 289.7% and 550.6%, respectively, compared to 2022

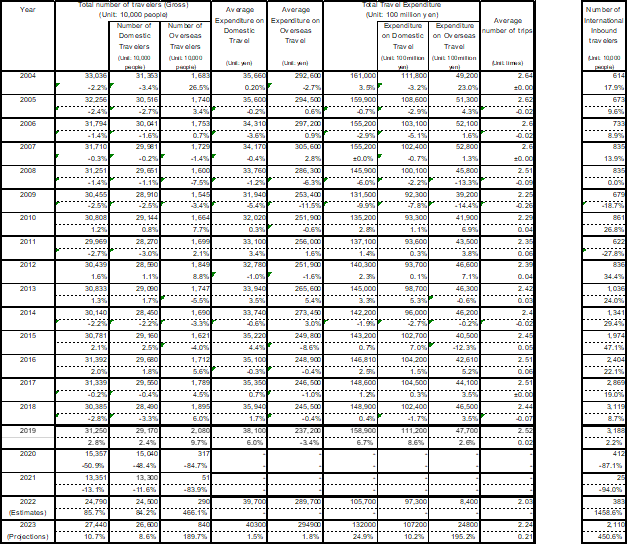

・The number of domestic travelers is estimated to be 266 million (108.6% y-o-y, 91.2% compared to 2019).

・The number of overseas travelers is estimated to be 8.4 million (289.7% y-o-y, 40.4% compared to 2019).

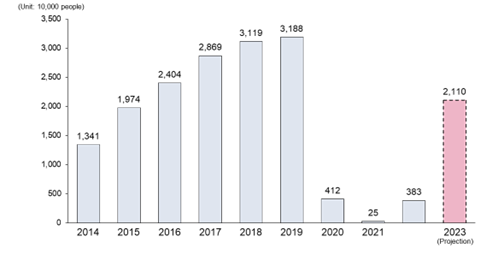

・The number of international inbound visitors to Japan travelers is estimated to be 21.1 million (550.6% y-o-y, 66.2% compared to 2019).

![]()

JTB has published the Prospective Travel Trends in 2023 report. For 2023, the report covers, for the first time in three years, estimates for overseas travel and foreign visitors to Japan in addition to those for domestic travel, in response to the COVID-19 infection status and the government's policy including the relaxation of overseas travel restrictions. In 2021 and 2022, when COVID-19 exerted a serious impact, the report covered domestic travel estimates only.

This survey provides estimates about overnight or multiple night trips (including business travel and family visits) made by Japanese travelers and those made by overseas travelers to Japan, based on various economic trends, consumer behavior surveys, transportation and tourism-related data, and questionnaires conducted by the JTB Group. It has continued since 1981. The projected trends in the travel market in 2023 are shown below.

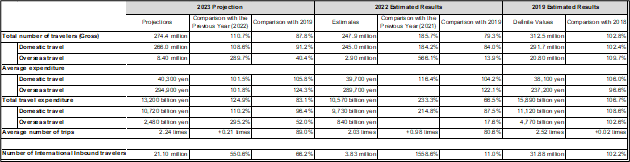

(Fig. 1) 2023 Annual Travel Trend Estimates

* Domestic travel expenditure refers to the total cost of travel from departure to return. It includes expenditures incurred at the destination, such as those for shopping and meals, but excludes those incurred before or after the travel (e.g. cost for the purchase of clothing and other belongings).

* Overseas travel expenditure includes, in addition to the cost of travel (including fuel surcharge), consumption expenditure made at the destination including those for shopping and meals, but excludes those incurred before or after the travel (e.g. cost for the purchase of clothing and other belongings).

* For inbound travel, the report covers only the estimated number of travelers and omits the amount of their expenditure.

* The estimated numbers of overseas travelers were obtained by adjusting the estimates as of the end of the previous year based on the actual numbers of individuals who entered or left Japan as announced by the Ministry of Justice.

* The year-on-year figures were rounded to the first decimal place. The number of domestic travelers is the number of travelers who stayed at least overnight at the destination.

* The numbers of domestic and overseas travelers include those who travel for business or family visit purposes.

<Socioeconomic Trends and Circumstances Surrounding Travel>

- COVID-19 Status and Travel Trends up to the End of 2022

Three years have past since March 2020, when the World Health Organization (WHO) declared the outbreak of COVID-19 to be a pandemic. As of January 8, 2023, more than 650 million people have been infected by the virus and more than 6.5 million deaths from the disease have been reported worldwide (announced by the Quarantine Information Office, Ministry of Health, Labour, and Welfare on January 11, 2023). In the early stages of the outbreak, states of emergency were declared around the world, preventing people from living a normal life and actively engaging in economic activities. Later, in 2022, as vaccination rates rose, a growing number of countries decided to change the direction of policy toward the normalization of socioeconomic activities. Many jurisdictions, those in Europe in particular, began to relax their border control measures (e.g. lifting of entry restrictions and shortening of quarantine period) and international airlines resumed their flights. This move also spread across Asian nations, not only Thailand and Singapore but South Korea, Taiwan, and other countries that were cautious about relaxation. While none of them have declared the end of COVID-19, international travel is gradually returning to the pre-pandemic status.

Looking to the situation within Japan, since the pandemic explosion in March 2020, the government repeatedly declared a state of emergency and released the pre-emergency measures and requested people to restrict their activities. After that, with infection prevention actions being successfully undertaken and vaccination programs becoming more prevalent, the frequency of these declarations and releases reduced in stages. In the summer of 2022, the spread of the Omicron variant caused the seventh and eighth waves of infection and the number of new patients drastically increased. However, no requests for voluntary restraints on various activities, including traveling, were issued by the government on either occasion, having made it normal for people to enjoy travel while taking anti-infection measures.

On October 11, 2022, the Japanese government eased border control measures imposed on those who enter into the country, including the lifting of upper limit on the number of new visitors per day, relaxation of entry requirements such as negative COVID-19 report and mandatory quarantine period, and the removal of ban on independent tour by foreign visitors to Japan. These moves made it easier for Japanese travelers to travel abroad and foreigners to visit and travel Japan. In October, the government launched the "Domestic Travel Subsidy Program" as a measure to stimulate nationwide tourism demand. As a result, increase of tourists were seen in various places across the country.

- Economic Environment Surrounding Travel and Household Circumstances

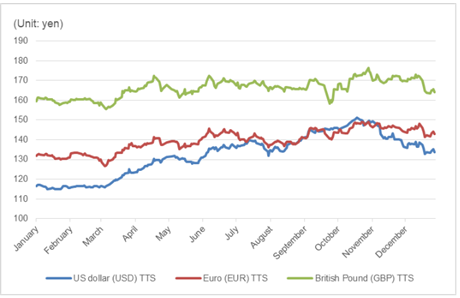

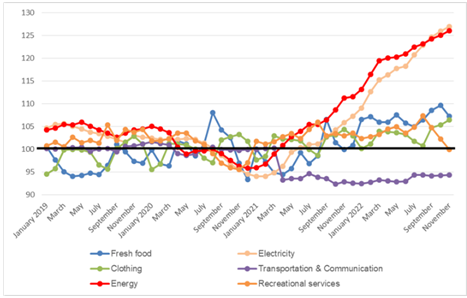

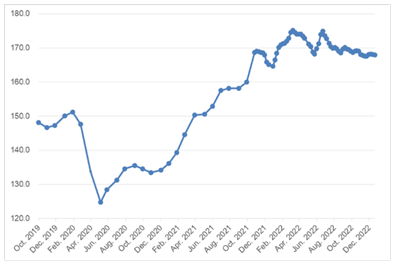

Looking at the recent economic situation, the yen has rapidly depreciated against the US dollar since 2022, and hit a 32-year low in the foreign exchange market on October 22, 2022, temporarily falling to around 150 yen to the dollar. The currency is still hovering around 130 yen--a depreciation of approximately 20 yen against the dollar compared to the pre-COVID-19 level. This has led to the hikes in prices of energy and imported goods, for example, and such price increases are affecting household budgets. In major items of the consumer price index, an increase is seen in all items other than transportation and communications. In particular, a sharp rise is observed in gasoline and other energy-related prices, as well as in electricity fees (see Figs. 2, 3, and 4).

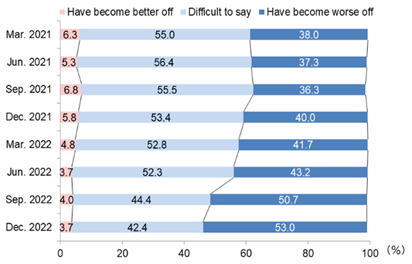

As for consumer awareness, consumption related to going out and eating/drinking decreased for some time after the worldwide outbreak of COVID-19, affected by the request for self-restraint of activities. As a result, there were growing expectations for revenge consumption. However, as the economic environment changes, the yen is increasingly depreciating and people's living conditions are worsening. According to the "Household Circumstances" section of the Bank of Japan's "Opinion Survey on the General Public's Views and Behavior," the proportion of respondents who answered that they "have become worse off" had been stable up to September 2021. However, since then, the proportion has been on an increasing trend, and, in December 2022, it increased to 53.0%, up 13.0 points from the same month of the previous year. This is the highest percentage since the initial outbreak of COVID-19 (see Fig. 5).

On the other hand, according to the short-term economic forecast by the Japan Center for Economic Research (JCER), Japan's real GDP growth rate forecast for 2023 was improved to 0.8% in December 2022 from 0.1% in March 2022. JCER commented that the spread of Omicron shares delayed the recovery expected in 2022 and added it to the growth rate of 2023.

(Fig. 2) Key Foreign Exchange Rates against Yen in 2022

Source: Tokyo Foreign Exchange Market/T.T. Selling

(Obtained from "Foreign Exchange Market Information" offered by Mitsubishi Tokyo Research & Consulting Co., Ltd.)

(Fig. 3) Changes in Major Consumer Price Index Categories

Source: Created by JTB Tourism Research & Consulting Co. based on the data from the "Consumer Price Index (2020 Base)" released by the Ministry of Internal Affairs and Communications

(Fig. 4) Changes in Unit Prices of Regular Unleaded Gasoline

Source: Created by JTB Tourism Research & Consulting Co. based on the "Petroleum Product Price Survey" published by the Agency for Natural Resources and Energy

(Fig. 5) Changes in Household Circumstances (Level of Being Well-off)

Source: Created by JTB Tourism Research & Consulting Co. based on the "Opinion Survey on the General Public's Views and Behavior" published by the Bank of Japan

- Current State of Travelers

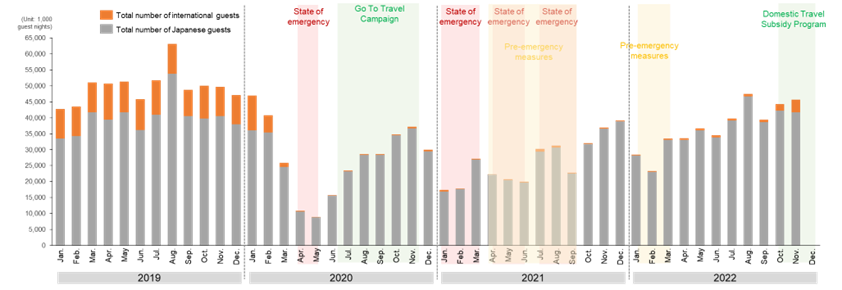

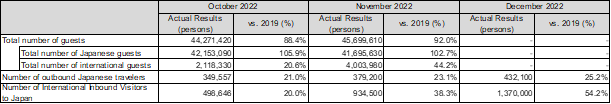

With regard to domestic travels, if we look at the changes in the total number of overnight guests, which was announced by the Japan Tourism Agency in its "Overnight Travel Statistics Survey," most Japanese travelers restrained themselves from going on a trip whenever a state of emergency was declared or the pre-emergency measures were in place, in order to comply with the central/local government's request. In 2022, the total number of overnight guests have turned to recovery since the pre-emergency measures were lifted in March and no declarations or measures were issued thereafter. Furthermore, the measure to stimulate tourism demand named "Domestic Travel Subsidy Program," which was launched on October 11 (October 20 in Tokyo), achieved a success and led to an increase in the total number of Japanese overnight guests to 105.9% in October and 102.7% in November compared to the same months of the previous year (2019). As a result, the total number exceeded the pre-COVID-19 level, indicating that domestic travel is on the pathway towards a full-fledged recovery (see Figs. 6 and 9).

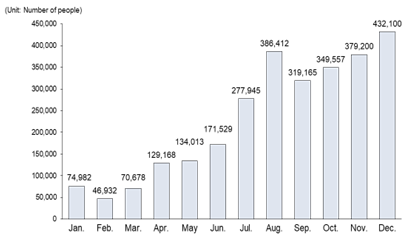

With respect to overseas travel, the number of Japanese outbound travelers showed an increasing trend, as a result that part of border control measures for inbound and outbound travelers have been relaxed since around the long holiday season in the spring of 2022 and travel agents gradually resumed the sale of overseas package tours. The relaxation progressed further in October onwards, creating an environment that encourages people to travel abroad. On the other hand, affected by the yen's depreciation combined with the increasingly rapid price appreciation around the world--as well as by the soaring travel costs resulting from the rise in fuel surcharges on air tickets and the unstable geopolitical situation in Ukraine and other parts of the world--the number of overseas tourists is recovering only slowly. According to the preliminary report of the Japan National Tourism Organization (JNTO), the number of outbound travelers in December 2022 was 432,100, a modest increase of 82,500 from October. If compared to the same month in 2019, the year preceding the COVID-19 crisis, it remains at 25.2% (see Figs. 7 and 9).

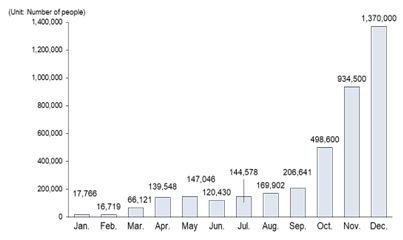

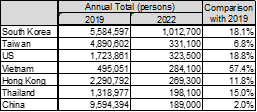

In contrast to overseas travel, inbound travel to Japan is so far on a rapid recovery trajectory against the backdrop of the yen's depreciation. The number of international inbound visitors to Japan in October alone was 498,646, more than double the number from the previous month, surpassing the number of Japanese outbound travelers. According to the preliminary report for December, the number of foreign visitors to Japan was 1,370,000, a recovery of 54.2% compared to the same month in the pre-COVID-19 year of 2019. Looking at 2022, the top countries and regions in terms of the annual number of international inbound visitors to Japan are, in descending order, South Korea (1,012,700 visitors, 18.1% compared to 2019), Taiwan (331,100 visitors, 6.8%), and the United States (323,500 visitors, 18.8%). Incidentally, as a result that the Chinese government continued to apply the Zero-COVID-19 policy up until 2022, the number of Chinese visitors remained at 189,000 (see Figs. 8, 9, and 10).

(Fig. 6) Changes in the Total Number of Overnight Guests

Source: Created by JTB Tourism Research & Consulting Co. based on the Japan Tourism Agency's "Statistical Survey on Overnight Travel" (final report for years from 2019 to 2021; second preliminary report for January to October 2022, first preliminary report for November 2022)

Source: Created by JTB Tourism Research & Consulting Co. based on the Japan Tourism Agency's "Statistical Survey on Overnight Travel" (final report for years from 2019 to 2021; second preliminary report for January to October 2022, first preliminary report for November 2022)

(Fig. 7) Number of Outbound Japanese Travelers in 2022

* Provisional figures for January through November, estimated figures for December

(Fig. 8) Number of International Inbound Visitors to Japan in 2022

* Provisional figures for January through October; estimated figures for November and December

Source: Created by JTB Tourism Research & Consulting Co. based on "Number of Inbound and Outbound Travelers" by JNTO

(Fig. 9) Total Number of Overnight Guests, Outbound Japanese Travelers, and International Visitors to Japan from October to December 2022 and Comparisons with 2019

Source: Created by JTB Tourism Research & Consulting Co. based on the Tourism Agency's "Overnight Travel Statistics Survey" (second preliminary report for October; first preliminary report for November) and "Number of Inbound and Outbound Travelers" by JNTO (the numbers of outbound Japanese travelers are provisional figures for October and November and estimated figures for December; the numbers of international inbound visitors to Japan are provisional figures for October and estimated figures for November and December)

(Fig. 10) Number of International Inbound Visitors to Japan in 2022 by Country and Comparison with 2019 (Top 7 Countries)

Source: Created by JTB Tourism Research & Consulting Co. based on "Number of Inbound and Outbound Travelers" by JNTO (definite values for 2019; estimated values for 2022)

<2023 Travel Market>

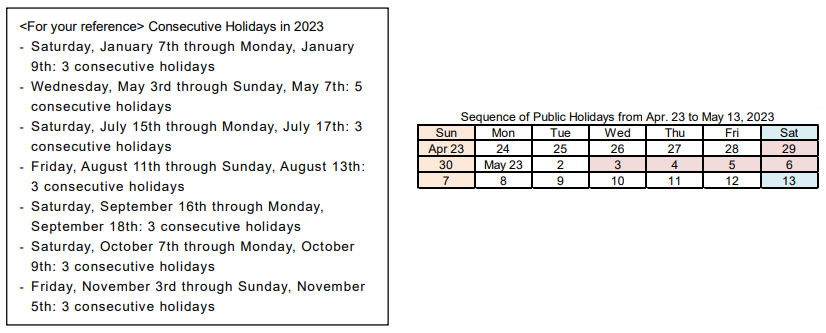

- 2023 Calendar and Major Events

In the 2023 calendar, there are seven times of three or more consecutive holidays. Compared to last year, when there were nine consecutive holidays consisting of three or more days, we have a less number of consecutive holidays this year, as public holidays fall on Saturday for three times. The long vacation season, the so-called "Golden Week," is a 5-day holiday from May 3rd (Wednesday and public holiday) to 7th (Sunday). If one takes a day off on Monday, May 1st and Tuesday, May 2nd, he/she will have nine consecutive holidays from Saturday, April 29 (public holiday) through Sunday, May 7th. In addition to the above, there are three public holidays that will give one four consecutive holidays if he/she takes a day off on Friday, February 24th, Monday, March 20th, and Friday, November 24th, respectively, and has non-working days on Saturday and Sunday. However, the sequence of public holidays is not very encouraging for workers who want to take long holidays in the summer vacation and the year-end/new-year holiday season.

(1) Holding of Long-awaited Large-scale Events

This year, notable sporting events will be held at home and abroad. The 5th World Baseball Classic™ (WBC), which was originally scheduled in 2021 but postponed, will be held from March 8th to 21st in the US, Taiwan, and Japan under the title of "2023 World Baseball Classic™." During the period, four games of the B tournament will be held from March 9th to 13th and the quarterfinals will be played on March 15th and 16th, both at the Tokyo Dome. Furthermore, the 19th FINA World Championships 2022 Fukuoka (World Championships 2022) will also be held from July 14th to 30th after about two years' delay from the original schedule of 2021. As for overseas events, the Rugby World Cup 2023™ will be held in France from September 8th to October 28th.

Another major domestic event is the one that commemorates the 40th anniversary of Tokyo Disney Resort®, scheduled from April 15th, 2023 to March 31st, 2024. In addition, the Jurassic World Exhibition and Tokyo Biennale 2023 are scheduled to be held in Tokyo.

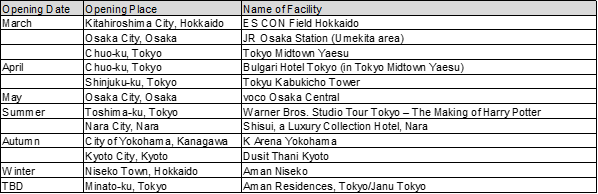

(2) A Series of New Openings of Commercial Facilities and Hotels That Are Hottest Topics among both Domestic and Inbound Tourists

One of the most-talked-about facilities scheduled to open this year in the Kanto area is Tokyo Midtown Yaesu. The commercial complex will start its operation on March 10th, 2023. Following the Bus Terminal Tokyo Yaesu, which opened in advance in September 2022, "Bulgari Hotel Tokyo," the hotel chain's first establishment in Japan, will open in April. Moreover, entertainment facilities including movie and stage theaters, live event halls, and a hotel are scheduled to open in Tokyu Kabukicho Tower in Shinjuku, Tokyo, based on the concept of creation of "the place to master one's 'likes' in the things you enjoy." Likewise, as part of the "Toranomon-Azabudai Urban Redevelopment Project," "Aman Residences, Tokyo" will open in parallel with "Janu Tokyo," a luxury hotel opening for the first time in Japan under the brand name of Janu, a sister brand of Aman. In the summer, "Warner Bros. Studio Tour Tokyo - Making of Harry Potter" will open at the site of former Toshimaen amusement park grounds. Later in the fall, the "K Arena Yokohama," a facility with a capacity of about 20,000 people, will start its operation in the Minatomirai District, Yokohama. Its prospective tenants include the hotel "Hilton Yokohama."

In non-Kanto areas, the Hokkaido Nippon-Ham Fighters, a professional baseball team, will move to its new home "ES CON Field Hokkaido" in Kitahiroshima City, Hokkaido, in March.

In Kansai, a new railway platform will be unveiled on March 18th. Built in the basement of JR Osaka Station (Umekita area), the platform will serve as a stopping point for "Haruka," the limited express bound for Kansai International Airport, as well as "Kuroshio," another limited express bound for Wakayama. On May 30th, "voco Osaka Central" will open for the first time in Japan under the premium hotel brand "voco" offered by IHG Hotels & Resorts. In the summer, the "Shisui Luxury Collection Hotel Nara" will open in Nara City in collaboration with a public-private partnership project aimed at preserving, maintaining, and utilizing areas adjacent to Yoshikien. In the fall, Dusit Thani Kyoto, a member of the Thai luxury hotel brand, is scheduled to open in Kyoto (see Fig. 11).

(Fig. 11) Major Facilities Scheduled to Open in 2023

- Domestic Travel Trends *Domestic travel by Japanese residents, excluding international inbound visitors to Japan

For 2023, the number of domestic travelers is estimated at 266 million (108.6% y-o-y, 91.2% compared to 2019), with the average expenditure of 40,300 yen (101.5% y-o-y, 105.8% compared to 2019), and the total expenditure on domestic travel of 10.72 trillion yen (110.2% y-o-y, 96.4% compared to 2019).

We estimated the number of domestic travelers in 2023 at 266 million (108.6% y-o-y, 91.2% compared to 2019), the average expenditure at 40,300 yen (101.5% y-o-y) taking into consideration the impact of price increases, and the total expenditure on domestic travel at 10.72 trillion yen (110.2% y-o-y). The average expenditure is at its highest since 2000. Considering that the number of infection cases under the eighth COVID wave is still high, the number of travelers will fall below the pre-pandemic level, as a certain number of people will voluntarily refrain from traveling even if they receive no request for movement restrictions. Nevertheless, we project that the average expenditure will exceed the level prior to the outbreak. Partly due to the tourism demand stimulus package "Domestic Travel Subsidy Program," which was launched on January 10, people have a high willingness to travel so far. While there are expectations that the yen's depreciation and the soaring fuel surcharges will lead to a shift in the area of demand from overseas travel to domestic travel, the price hikes will continue to negatively impact the business sentiment.

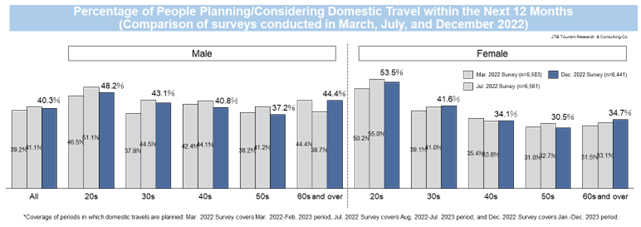

While men and women in their 20s continue to be the most motivated group for domestic travel, seniors are also increasingly travel-conscious. According to the "Survey on Attitude towards Travel and Changes in Lifestyle and Mindset Caused by the Pandemic" published in January 2023 by JTB Tourism Research & Consulting Co., 40.3% of the respondents answered that they were planning or considering to go on a domestic travel in the January to December 2023 period. The most motivated segment was women in their 20s (53.5%), followed by men in their 20s (48.2%), and men over 60 (44.4%). Compared to the previous survey (conducted in July 2022), the percentage of men aged 60 or over increased by 5.7 points to 44.4%, and women aged 60 or over grew by 1.6 points to 34.7%, raising expectations for a recovery in the senior segments (see Fig. 12).

The Survey also suggests a gradually growing impact on travel and the tourism of the changes in lifestyles and values caused by the pandemic, mainly in the flows of domestic travel, in addition to the above-mentioned events and new openings.

The more people work remotely, the more flexible work and stay styles at family visit and travel destinations become popular

During the pandemic, the remote working style was widely adopted as an infection prevention measure so as to allow people to work outside the workplace and avoid traveling and face-to-face meeting. If people can work remotely on weekdays between holidays, they can work at family visit and travel destinations, allowing them to use their time more effectively and enjoy long-term stay and travel. With the emergence of a travel style called "workcation," which combines work and vacation, the boundaries between "living" and "staying" will become increasingly blurred and more people will be connected to local communities in a manner different from the traditional tourism-based relationships.

Increase in products and services that contribute to carbon neutrality and SDGs

The travel industry has witnessed the emergence of new products and services that contribute to the carbon neutrality and Sustainable Development Goals (SGDs). In the field of transportation, Japan Airlines started giving passengers the option to opt out of an inflight meal service on all international flights from December 2022, in an effort to reduce food waste caused by last-minute meal cancellations. Oriental Air Bridge came up with an innovative idea and launched a tour in which passengers take a pleasure flight over Fukue Island in Goto Archipelago aboard an airplane that uses bio-jet fuel manufactured and sold by Euglena Co., Ltd.

(Fig. 12) Percentage of People Planning/Considering Domestic Travel within the Next 12 Months (Comparison of surveys conducted in March, July, and December 2022) (Single answer)

Source: JTB Tourism Research & Consulting Co., "Survey on Attitude towards Travel and Changes in Lifestyle and Mindset Caused by the Pandemic" (January 2023)

Source: JTB Tourism Research & Consulting Co., "Survey on Attitude towards Travel and Changes in Lifestyle and Mindset Caused by the Pandemic" (January 2023)

- Overseas Travel Trends

For 2023, the number of overseas travelers is estimated at 8.4 million (289.7% y-o-y, 40.4% compared to 2019), with the average expenditure of 294,900 yen (101.8% y-o-y, 124.3% compared to 2019), and the total expenditure on overseas travel of 2.48 trillion yen (295.2% y-o-y, 52.0% compared to 2019).

For 2023, we estimated the number of overseas travelers at 8.4 million (289.7% y-o-y, 40.4% compared to 2019), the average expenditure at 294,900 yen (101.8% y-o-y) affected by the yen's depreciation and soaring fuel surcharge, and the total expenditure on overseas travel at 2.48 trillion yen (295.2% y-o-y). While the average expenditure per traveler will reach its highest level since 2000, the recovery in overseas travel is expected to grow at a slow pace in contrast to inbound tourism. As a result of the relaxation of border control measures in October, immigration procedures have been simplified, but it is still necessary to submit a vaccination proof and a negative COVID-19 test report. One of the reasons for the slow growth would be the non-fulfillment of certain conditions that had been met in the pre-pandemic era, which results from the fact that there still are several countries and regions that continuously apply counter-infection regulations and rules.

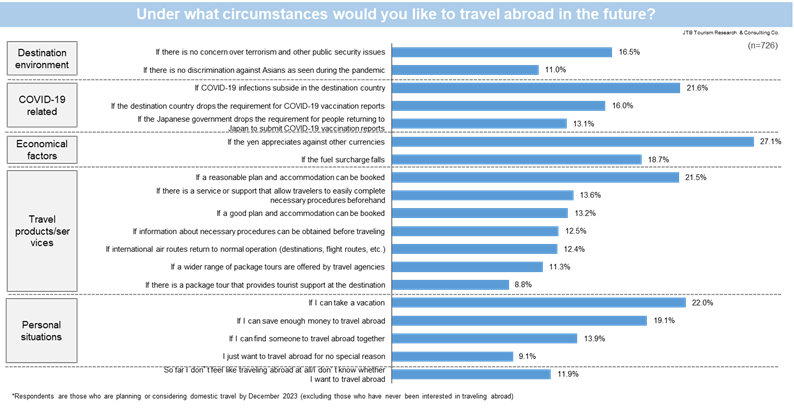

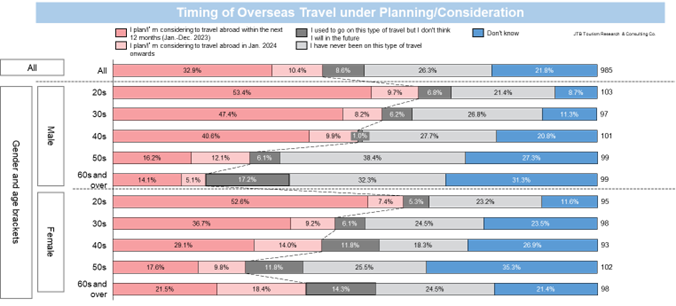

In the aforementioned Survey by JTB Tourism Research & Consulting Co., all respondents--including those who had no plans to travel overseas but excluding those who were not at all inclined to go on an overseas travel--were asked under what circumstances they would like to travel abroad. Top answers to the question were: "If the yen appreciates against other currencies" (27.1%), "If days off can be taken" (22.0%), "If COVID-19 infections subside in the destination country" (21.6%), and "If a reasonable plan and accommodation can be booked" (21.5%). Both men and women in their 20s are the demographic groups that are highly motivated to travel abroad. A large proportion of them showed their willingness to go on an overseas trip during 2023 (see Figs. 13 and 14).

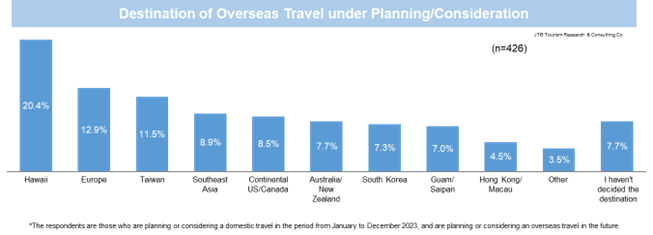

The Survey also asked the respondents who said that they were planning/considering to go on an overseas travel in 2023 or a subsequent year about the intended destination of their next trip. The top three answers to this question were Hawaii (20.4%), Europe (12.9%), and Taiwan (11.5%). This matches the statistics published by the governments' tourism agencies of each of these countries concerning the numbers of Japanese travelers that visited their countries in November 2022. According to these statistics, the numbers of Japanese travelers who visited South Korea, Thai, Hawaii, or Taiwan were 62,422, 46,020, 27,898, and 21,204, respectively. South Korea is likely to grow further as a desirable destination, considering the fact that its fashion and lifestyles are familiar, particularly to young people, and that the country is located close enough to save the cost and time of travel. In the Survey, 7.7% of respondents said they had not decided (their destination) yet, suggesting that there are a fair number of prospective tourists who are willing to devise ways to make their travel plans a reality by selecting a realizable destination (see Fig. 15).

(Fig. 13) Under what circumstances would you like to travel abroad in the future?

(Multiple answers)

Source: JTB Tourism Research & Consulting Co., "Survey on Attitude towards Travel and Changes in Lifestyle and Mindset Caused by the Pandemic" (January 2023)

Source: JTB Tourism Research & Consulting Co., "Survey on Attitude towards Travel and Changes in Lifestyle and Mindset Caused by the Pandemic" (January 2023)

(Fig. 14)Timing of Overseas Travel under Planning/Consideration

(By gender and age) (Single answer)

Source: JTB Tourism Research & Consulting Co., "Survey on Attitude towards Travel and Changes in Lifestyle and Mindset Caused by the Pandemic" (January 2023)

Source: JTB Tourism Research & Consulting Co., "Survey on Attitude towards Travel and Changes in Lifestyle and Mindset Caused by the Pandemic" (January 2023)

(Fig. 15)Destination of Overseas Travel under Planning/Consideration

(Single answer)

Source: JTB Tourism Research & Consulting Co., "Survey on Attitude towards Travel and Changes in Lifestyle and Mindset Caused by the Pandemic" (January 2023)

Source: JTB Tourism Research & Consulting Co., "Survey on Attitude towards Travel and Changes in Lifestyle and Mindset Caused by the Pandemic" (January 2023)

- Number of International Inbound Visitors to Japan

For 2023, the number of international inbound visitors to Japan is estimated at 21.1 million (550.6% y-o-y, 66.2% compared to 2019).

After the relaxation of entry restrictions to Japan in October 2022, a rapid recovery is expected in terms of the number of international inbound visitors to Japan particularly from countries that have already eased their exit regulations ahead of others such as South Korea, Thailand, and Singapore. On the other hand, as of January 2023, a full-fledged recovery is unlikely with regard to China, which accounted for the largest percentage of international inbound visitors to Japan in 2019 before the COVID-19 crisis. This prospect is based on the assumption that inbound demand from China will recover at full scale July 2023 onwards, and that the recovery will rapidly escalate following the same pattern as other inbound markets. However, a significant change may take place depending on future developments (see Fig. 16).

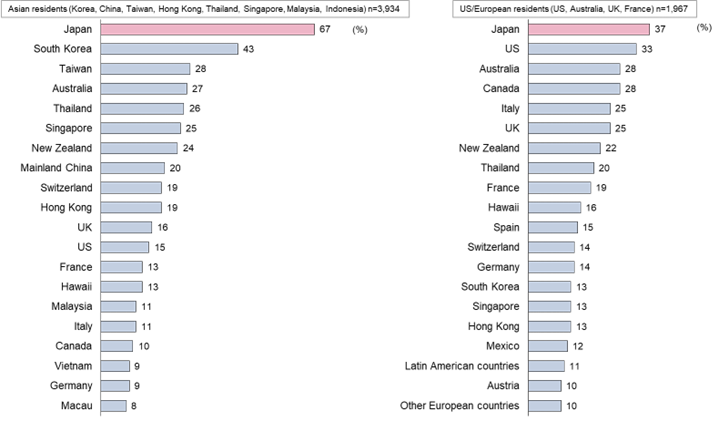

Japan remained as a popular travel destination even during the pandemic. According to a survey released by Development Bank Japan and the Japan Travel Bureau Foundation in February 2022, Japan ranked first by both Asian and Western residents as the country/region where they want to visit as the destination of their next overseas trip. Supporting this trend is the upcoming openings of much-talked-about hotels and commercial facilities, which were referred to in Section 4. Furthermore, there are other locations that are likely to hold new and strong appeal to foreign visitors, including: 1) Shikoku, which was named as the sixth best region in the world to visit by Lonely Planet, the famous travel information magazine, in 2021; 2) "Ghibli Park," which opened in November 2022 in the vacant lot of the 2005 World Expo Aichi Memorial Park in Aichi Prefecture; and 3) Morioka City, Iwate Prefecture, which was listed by the New York Times in January 2023 as one of the "52 Places to Go in 2023" (see Fig. 17).

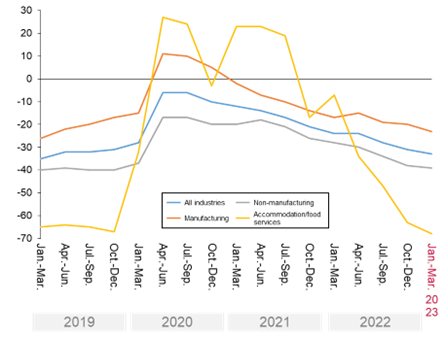

The recovery in the number of travelers has also highlighted some challenges. One of them is the lack of human resources to support the tourism industry. According to the Bank of Japan's Employment Conditions (BOJ Tankan survey, quarterly), the accommodation and food service sector has continued to face a labor shortage since the October-December quarter of 2021. On the other hand, as seen in the changes in the total number of overnight guests shown in Fig. 6, the number of tourists resurged and almost reached the pre-COVID-19 level in the most recent quarter of October and November 2022. The occupancy rates of hotels in Tokyo and Osaka as of November 2022 has recovered to 80% of the 2019 level, suggesting the possibility of further labor shortage when a rapid rebound occurs in the inbound tourism demand. Moreover, Tokyo's average daily rate (ADR) has already reached the level before the pandemic, and further increases in ADR may exert an impact on domestic travel demand (see Fig. 18, figures are omitted for ADR).

*Average daily rate (ADR) refers to the unit sales price per guest room. It is obtained by dividing the revenue from rooms by the number of rooms sold.

(Fig. 16) Number of International Inbound Visitors to Japan

Source: The 2014-2022 data was prepared by JTB Tourism Research & Consulting Co. based on "Number of Foreign Visitors to Japan" by JNTO.

Source: The 2014-2022 data was prepared by JTB Tourism Research & Consulting Co. based on "Number of Foreign Visitors to Japan" by JNTO.

(Fig. 17) Countries/Regions to Visit as Desirable Destination of Next Overseas Travel

(Top 20, by place of residence, Asia or the US and Europe)

Source: Created by JTB Tourism Research & Consulting Co. based on the survey conducted by Development Bank of Japan and Japan Travel Bureau Foundation, titled "DBJ and JTBF: Survey of Tourist Travel to Japan from Asia, Europe, the United States, and Australia (Third Special Survey on the Level of Effects of COVID-19)" (February 2022)(*The survey was conducted in October 2021) *1) Up to 5 countries/regions *2) Answers were received from all respondents except for those who said: a) they had no intention to travel abroad even after the pandemic would end; and b) they did not feel like resuming the planning of overseas travel under the current circumstances, when they were asked about the timing of resuming the planning of overseas travel. *3) Respondents' home countries/regions and neighboring countries/regions were excluded from the options for the question about the country or region to visit as the destination of next sightseeing travel (China-Hong Kong-Macau, Malaysia-Singapore, Thailand-Malaysia, United States-Canada/Mexico/Hawaii/Guam, Australia-New Zealand, UK/France-European countries).

Source: Created by JTB Tourism Research & Consulting Co. based on the survey conducted by Development Bank of Japan and Japan Travel Bureau Foundation, titled "DBJ and JTBF: Survey of Tourist Travel to Japan from Asia, Europe, the United States, and Australia (Third Special Survey on the Level of Effects of COVID-19)" (February 2022)(*The survey was conducted in October 2021) *1) Up to 5 countries/regions *2) Answers were received from all respondents except for those who said: a) they had no intention to travel abroad even after the pandemic would end; and b) they did not feel like resuming the planning of overseas travel under the current circumstances, when they were asked about the timing of resuming the planning of overseas travel. *3) Respondents' home countries/regions and neighboring countries/regions were excluded from the options for the question about the country or region to visit as the destination of next sightseeing travel (China-Hong Kong-Macau, Malaysia-Singapore, Thailand-Malaysia, United States-Canada/Mexico/Hawaii/Guam, Australia-New Zealand, UK/France-European countries).

(Fig. 18) Employment Conditions by Industry

*Figures for Jan.-Mar. 2023 are projections.

Source: Created by JTB Tourism Research & Consulting Co. based on "BOJ Tankan (Employment Conditions) (All Sized)" (December 2022) by the Bank of Japan.

◆Estimates for 2004 to 2022 and Prospect for 2023

* Due to the impact of the COVID-19 pandemic, the details of the actual results and estimates have not been announced for 2020 and 2021.

* Due to the impact of the COVID-19 pandemic, the details of the actual results and estimates have not been announced for 2020 and 2021.

<About JTB>

Today's JTB traces its roots back to Japan Tourist Bureau, an agency formed in 1912 for the purpose of servicing the ticketing needs of foreign tourists in Japan. Over a century of history, JTB steadily evolved into a travel and tourism industry leader. Through vision, integrity, innovation, and unsurpassed know-how, the JTB Group consistently creates unparalleled value for its stakeholders.

*The JTB Logo, and all trademarks and service marks are owned by JTB Corp. unless otherwise noted.

JTB Corp. Branding & Communication Team (Public Relations)

Phone: +81 3 5796 5833