JTB reports Consolidated Financial results for the First Half Year 2022

JTB Corp.

Tokyo, Japan., November 18, 2022 --JTB today reported the JTB Group's Consolidated Financial Results for the period April 1, 2022, to September 30, 2022.

For the full year of FY2022, it is expected to achieve the initial plan of 6.3 billion yen in operating income announced in May, as well as to achieve a positive final profit.

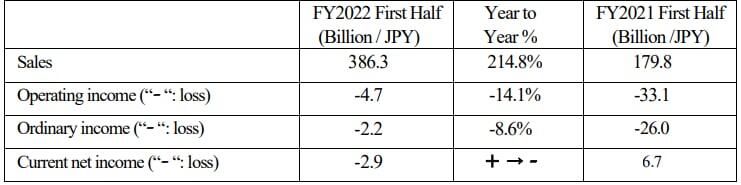

1. Consolidated Financial Results

(1) Overview

Market conditions surrounding the tourism industry in the second quarter (interim period) continued to be significantly affected by the COVID-19 pandemic, as in the previous period. While the human flow overseas continued to recover, travel demand in Japan remained stagnant due to the impact of the seventh wave of infection spread that began in late June.

Underthe circumstance, " Travel" and "MICE," the Group's core businesses, are showing signs of a certain degree of recovery, although demand has not yet recovered to the level of pre-pandemic levels. Meanwhile, our BPO operations for corporations and municipalities in Japan contributed to earnings growth by leveraging our accumulated operational know-how and sales contacts. For mid- to long-term growth, we pushed forward with the growth strategies set forth in our medium-term management plan. Specifically, the amount of gross merchandise value and the number of contracted businesses expanded in the area of " Digitalization of tourism destinations," which is a key pillar of the Area Solutions business.

As a result, consolidated sales totaled JPY 386.3 billion (JPY 206.4 billion increase from the previous period), with an operating loss of JPY 4.7 billion (JPY 28.4 billion reduced from the previous period), and an ordinary loss of JPY 2.2 billion (JPY 23.8 billion reduced from the previous period).The current net loss stood at JPY 2.8 billion.

The following is an overview of our group.

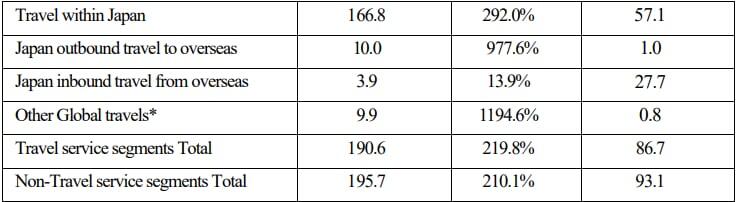

Segment Overview (All amounts are Sales)

*Other Global travels: Travel business between Third Countries (excluding Japan)

* Non-travel: MICE/BPO, trading, publishing business, etc.

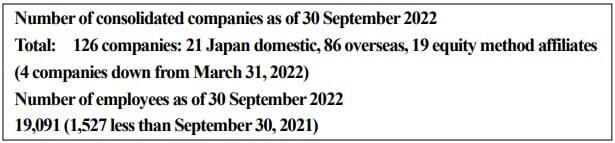

On the human resources front, we have resumed recruiting new graduates for the first time in two years, and plan to hire 300 new graduates for the entire group in FY2023. At the same time, we established a new digital career track and promoted career recruitment centered on DX, laying the groundwork for human resources for re-growth.

In addition, we established the "JTB Corporate Governance Basic Policy" to continuously strengthen corporate governance, and also set the Sustainability Policy and JTB's decarbonization target to accelerate our efforts to "Decarbonization of human interaction".

(2) Overview per main business segment

I. Tourism segment

In our Tourism segment, we have deepened our relationships with customers by improving the delivery speed and quality of our products, services, and solutions in order to enhance the real value experience of our customers. We increased our number of offices with integrated "corporate x individual x purchasing" functions from 8 to 32 prefectures, which we have been promoting since the beginning of the fiscal year, and accelerated the development of destination-based content, and promoted community-based sales and promotions to attract customers to the regions. In particular, the destination campaign running across the entire JTB called "Nihon no Shun, Shikoku" contributed to regional revitalization through "JTB's sales and customer creation capabilities" and outperformed the plan.

For individual customers, we strived to enhance the real value experiences by providing information and content unique to the region, covering sales channels such as the website, retail stores, and online consultation. In addition, flexible utilization of human resources and multitasking in business operations have become widespread at our sales offices nationwide, and we are making progress in optimizing our store network and effectively utilizing our human resources. In the corporate sector, the education business returned to its pre-pandemic handling level and remained strong, and we accelerated our efforts in MICE and public-academic collaboration on SDGs-themed projects with a high social contribution potential. In the sports business domain, we won an exclusive contract in Japan for the official hospitality program for the upcoming Rugby World Cup 2023 in France.

II. Area Solution segment

In the Area Solution segment, we have defined our business segments into three categories: "Support for the digitalization of tourism destinations," "Support for the development and operation of tourism destinations," and "Provision of content during travel," that are promoted with a focus on both achieving results from a short-term perspective and achieving growth from a medium- to long-term perspective.

In "Support for the digitalization of tourism destinations," we focused on increasing the gross merchandise value of the ticket distribution platform provided by Goodfellows JTB and expanding the number of business partners that have adopted "JTB BÓKUN," which enables centralized management of inventory and reservations for activity products. We also made a push in efforts to promote the creation of attractive tourism areas through DX support. One example is the conclusion of a comprehensive partnership agreement with Salesforce Japan Inc. and the Kyushu Tourism Organization, which will lead to sustainable economic development in Kyushu. In "Support for the development and operation of tourism

destinations," we strengthened our efforts to increase the number of municipalities with which we have contracts for the individual version of hometown tax. In addition, as a result of aggressive efforts to expand recognition of "JTB travel coupons," a return gift that is one of the Company's strengths, sales exceeded 200% of the previous year. In the "Provision of content during travel" area, "Pivot BASE - Travel Café @ Tonbori" opened in September in Dotonbori, Osaka, as a tourism interaction base in preparation for the Osaka-Kansai Expo in 2025 and is promoting new initiatives to enable local residents and travelers to enjoy interaction by providing digital content and a travel concierge.

III. Business Solution segment

In the Business Solution segment, although we were partially affected by the slow recovery of market conditions, we deepened our relationships with client companies based on our ABM strategy (*1) and expanded our handling of events in the communications area. There are signs of market recovery, however, including the first large-scale overseas tour for 500 people since 2019 and the handling of a large-scale domestic awards ceremony for more than 1,000 people. In the M&E area, we improved the level of services provided by event technologies such as CVENT (*2) and were able to exceed the results of the previous fiscal year by undertaking large-scale marketing events. In the area of EVP (*3), we are taking advantage of a major opportunity to respond to the "human capital information disclosure" that will become mandatory from March 2023, mainly for listed companies, and are expanding various EVP contents (training, experiences, and events) to develop professional human resources. In the business collaboration with Benefit One, a strategic partner, we have won more business as a result of increased mutual customer contacts. In the business travel area, there was a recovery trend in demand for business travel, especially to overseas destinations, driven by the lifting of immigration restrictions and the easing of behavioral restrictions.

*1 B2B marketing that selects customers of high value to the company and takes an optimal approach tailored to customer issues and needs.

*2 An event management system with various functions that enables execution and management from planning to promotion and implementation

of meetings and events on the same platform.

*3 Value propositions for work that the company's employees can relate to (keywords for practice emerged from human capital management).

IV. Global Business

In the M&E business, sales more than doubled from the previous year due to strong sales in Europe and the U.S., where human flow is recovering ahead of that in Japan. In particular, demand in the U.S. is recovering and events are performing well, and MC&A's sales have exceeded pre-pandemic levels in some months. The MICE business in Europe is also on a recovery trend. In the DPS business (*1), sales of the "Land Cruise" (*2) bus tour product that loops around Europe resumed, and in North America, demand for tours mainly to national parks is recovering.In the SIC business (*3), travel from Central and South America to Europe is also on a recovery trend, returning to 60-80% of pre-pandemic levels, and travel from the U.S. to Europe also exceeded pre-pandemic levels in some months.In business travel, the market has recovered to 60-70% of its pre-pandemic level, especially in the North American market, which was one of the first markets to return.In the inbound business to Japan, in line with the lifting of restrictions on individual travel, we resumed our SUNRISE TOURS series with new feature of "Rainbow Route that visits Tokyo, Kanazawa, and Kyoto" and the "Fuji Hakone Tour" featuring a carbon offset plan from the perspective of sustainability and the use of EV vehicles to reduce CO2 emissions, which have been in popular demand.

*1 Abbreviation for Destination Products & Services. Also called "destination-based products," travel products made at the traveler's destination.

It is like optional tours to be participated in at the destination.

*2 Sightseeing bus tour products that operate in 12 European countries with accommodation and sightseeing guides. No airfare is included since the tour is arranged to meet and disperse locally.

*3 Abbreviation of "Seat in Coach," bus tours with any combination of courses.

2. Full year forecast for FY2022

The full-year forecast for FY2022 is expected to achieve the initial plan of 6.3 billion yen in operating income announced in May, as well as to achieve a positive final profit.

The JTB Group will push ahead with promotion measures to capture the signs of recovery and revitalization of demand for domestic, overseas, and inbound travel driven by the nationwide travel support launched by the government in October and the relaxation of immigration restrictionsto expand its business.

We will promote flexible reallocation of management resources across organizational boundaries, and in various non-travel solutions, we will strive to solve the respective issues of companies, local governments, and tourism providers, aiming for sustainable development of local communities.

The JTB Group is committed to 'fostering peace and global interconnectedness through the creation of opportunities for meaningful human interaction' and the responsible and sustainable delivery of excitement, wonder, results and real value to its customers around the world in alignment with the Group's mission, vision and values.

<About JTB>

Today's JTB traces its roots back to Japan Tourist Bureau, an agency formed in 1912 for the purpose of servicing the ticketing needs of foreign tourists in Japan. Over a century of history, JTB steadily evolved into a travel and tourism industry leader. Through vision, integrity, innovation,and unsurpassed know-how, the JTB Group consistently creates unparalleled value for its stakeholders.

*The JTB Logo, and all trademarks and service marks such as ""Nihon no Shun, Shikoku", "Land Cruise", "SUNRISE TOURS" are owned by JTB Corp. unless otherwise noted.

JTB Corp. Public Relations & Communication Team

Phone: +81 3 5796 5833