JTB reports Consolidated Financial results for the Fiscal Year 2021

JTB Corp.

Tokyo, Japan., May 27, 2022 _- JTB today reported the JTB Group's Consolidated Financial Results for the period April 1, 2021, to March 31, 2022.

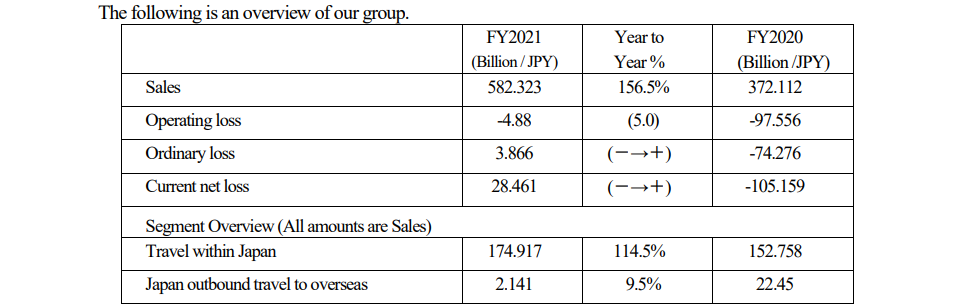

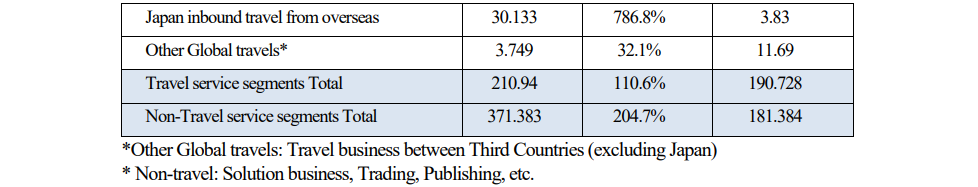

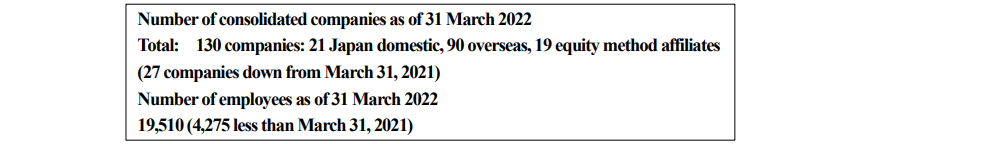

1.Consolidated Financial Results

(1) Overview

Market conditions surrounding the tourism industry in this consolidated fiscal year continued to be significantly affected by the COVID-19 expansion, as in the previous year. In September, the state of emergency was fully lifted, and travel demand showed a temporary recovery trend. However, due to the re-spread of infection caused by the Omicron variant that broke out in January 2022, strict measures to prevent the spread of the virus were applied in many municipalities until mid-March, and travel demand fell again. In addition, demand for overseas and inbound travel almost disappeared over two consecutive years as a result of continued measures restricting entry and travel in many countries.

In the Group, too, demand for travel, the core of our business, remained stagnant, but we accelerated the development of new services leveraging internet, such as online customer service and hybrid MICE, as well as the development of solutions to capture new demand. In particular, the BPO service initiatives of enterprises and public administrations have progressed very well and contributed to the growth of revenues. Under the medium-term management plan, which has been in progress since FY2020, we have steadily executed the subjects set out until FY2021: ''urgent reduction of costs'', ''implementation of structural reforms'' and building a foundation for recovery and growth, which resulted in a significant improvement in operating losses. In addition, the financial base was strengthened through the sale of owned real estates and recapitalization.

As a result, sales for the consolidated fiscal year reached JPY 582,323 million (156.5% of the previous year's level), with an operating loss of JPY 4,880 million and ordinary income of JPY 3,866 million. The current net profit stood at 28,461 million yen from extraordinary gains from the sale of owned real estates and the sale of shares in subsidiaries and associated companies.

(2) Overview per main business segment

Ⅰ. Tourism segment

In our Tourism segment, we started reforming our business model through collaboration between "corporates and individuals" and "departures and destinations", with the aim of both increasing the value of customer experience and productivity.

As a new initiative, we launched sales activities by regional sales branches to develop accommodation and destination content to strengthen community-based sales and attraction of visitors. It started in eight prefectures ahead of the nationwide roll-out. We then strengthen our 'arrival/departure linkages', which means that we do not just send customers to the destination, but also work together with regional administrations and tourism providers to create unique products together to enhance the area as a destination and offer them to the market. In local exchanges, we have accelerated our efforts in projects that have been highlighted as social issues, such as collaboration with local administrations to manage tourist destinations and community development, consultations for educational curriculums, development of adventure tourism experience programs and building environments to accept workcations.

In the area of individual travel, in order to enhance the value of the customer's everyday experience (CX), we further promoted our service reforms by staying close to individual customers to meet their expectations through various customer contact points, such as the JTB website, shops and online consultations. Our network of retail shops has clearly defined their roles and optimized their operations.

Ⅱ. Area Solution segment

In the Area Solution segment, we have defined our business segments into three categories: support for the digitalization of tourism destinations, support for the development and operation of tourism destinations, and provision of contents during travel, and worked on each of these priority measures.

In the digitalization support, we focused on expanding sales of ticket contents on the ticket platform (*1) provided by Goodfellows JTB and activity contents on JTB B_KUN (*2). In the support for development and operation of tourism destinations, we expanded the number of municipalities contracted for the individual version of the hometown tax, and also worked to build a sales system to increase the amount of tax, and as part of these efforts we set up satellite offices in Osaki Town, Kagoshima Prefecture, and in Minami-Uonuma City, Niigata Prefecture. "Furusato Connect", a portal site for corporate versions of the hometown tax system, saw a significant increase in donations over the previous year through web-based sales promotion and a new function that allows companies to make online business proposals to local authorities. In the business of providing contents during travel, we participated in a joint venture to provide services for the admission ticket sales system, which will be the starting point for the project, for the Osaka/Kansai Expo. Alongside contributing to the success of the Expo, we strive to establish a framework that encourages tourists to travel around the region and to realize local tourism and economic development.

Ⅲ. Business Solution segment

In the Business Solution segment, we are deepening our relationships with corporate clients based on our ABM (Account Based Marketing) strategy (*3) and have expanded our solutions in the communications area, leading to new business growth in areas such as human resources, administration-related areas and product promotions. During the year under review, we were also able to expand our contacts with ABM customers in connection with the Tokyo 2020 Olympic and Paralympic Games and through BPO services commissioned by companies.

In the business travel area, both domestic and international business trips were handled in a limited way. On the other hand, the relaxation of requirements under the revised law led to progress in new contracts for expense settlement systems, J'sNAVI NEO/Jr (*4), that are compliant with the Electronic Book-keeping Law. In addition, comprehensive contracts with companies expanded due to the withdrawal of in-house agencies (*5).

With regard to the Tokyo 2020 Olympic and Paralympic Games, the decision to hold the Games without spectators (only some local venues had spectators) in principle just before the Games had a significant impact on our business, as official spectator tours were cancelled. However, we were able to work on the management of the Games with COVID-19 measures, and the number of commissioned projects, such as accepting pre-Games training camps, have increased.

Ⅳ.Global Business

In the global DMC sector, the market recovery is coming into view, particularly in Hawaii, and MC&A, Inc, which promotes M&E (*6) business in North America and Hawaii, has won a number of events. In the in-house sector, in preparation for the recovery of international travel, we have developed a video distribution platform for online contents, mainly for corporate clients, to provide new value and expand communication contacts. In the global MICE sector, the service level of 'online M&E' has been improved and established as a new business model without flow of people and in the second half of the year, in particular, we strengthened our efforts to drive forward with the growing need for 'overseas promotions' from Japanese companies and government-related organizations. In the business travel sector, we introduced a range of technologies designed to improve convenience in business travel management, which has become even more complex in the impact of COVID-19. We also conducted webinar promotions and became the first global TMC (*7) to win a global comprehensive contract.

*1 A digital platform that enables the distribution of admission facilities through various sales channels such as the official websites of operators, OTAs and DMO websites.

*2 A digital platform for the global market that enables the creation of diverse distribution opportunities through easy "reservation, sales, settlement and inventory management" of products.

*3 Abbreviation for Account Based Marketing. A BtoB marketing strategy that selects customers of high engagement to the company and takes the most appropriate approach tailored to the issues and needs of customers.

*4 " J'sNAVI NEO/Jr" is a registered trademark of JTB Business Travel Solutions Inc.

*5 A travel agency created by a company or organization within its own organization.

*6 Meeting & Event

*7 Abbreviation for Travel Management Companies. Companies that deliver a satisfying experience for business travelers and steer complex business travel management by leveraging a number of integrated technologies, while eliminating wasteful spending, assisting in cost and risk management, and providing comprehensive support for the entire program.

2.Full year forecast for FY2022

For the full-year forecast for FY2022, we expect to achieve a positive operating profit and a positive final profit for the second consecutive full-year.

The convergence of COVID-19 is still expected to take a certain period of time, and the environment surrounding the tourism industry, including the situation in Russia and Ukraine, remains challenging. On the other hand, with the recovery of flow of people by lifting movement restrictions in Japan and the gradual relaxation of travel and entry restrictions, we expect the travel market recovery to be 90-100% of the FY2019 level in the domestic travel market and 20-30% of the FY2019 level in the international and inbound travel market. We expect our gross profit from travel products and services in FY2022 to be 64.3% of the FY2019 level and 263.0% of the FY2021 level, with a view to steadily capturing domestic travel demand, which is on a recovery trend, and to the future recovery of international flow of people in overseas travel and inbound travel, where recovery has been delayed.

In addition, non-travel products and services are expected to increase to 183.7% of the FY 2019 level and 79.3% of the FY 2021 level by continuing to expand conference and event management and BPO services for corporates and governments, and by striving to strengthen DX support for tourist destinations. As we are entering the next phase of the medium-term management plan, the 'recovery and growth' phase, from this year, we will take initiatives to realize our further growth strategy. The Group as a whole aims to achieve an operating profit of JPY 6.3 billion in FY2022 and a positive final profit, by both capturing travel demand that is expected to recover and accelerating growth in non-travel segments.

3.Towards sustainable creation of opportunities for meaningful human interaction

JTB Group has established a Sustainability Committee tasked with coordinating enterprise-wide sustainability initiatives and monitoring sustainability performance under JTB's Sustainability Strategy and three materiality-guided sustainable priorities. Under the themes of (i) Enriching the Human Experience and (ii) Nurturing our Surroundings, and through (iii) Engaged Partnering with stakeholders, we will further accelerate the positive effects generated by human interaction and take on the challenge of reducing negative impacts such as environmental footprint.

In particular, to realize a decarbonized society, JTB Corp aims to achieve practically zero CO2 emissions (Scope 1 and 2) by FY2030, and to achieve carbon neutrality in its entire supply chain (Scope 3) by FY2050. The JTB Group has launched services that contribute to CO2 reduction in the travel and MICE services provided to customers, as well as paperless services through the digitization of vouchers and contracts. We will continue to increase the number of options related to sustainability in our services and solutions for our customers and provide opportunities for them to deepen their understanding of the sustainability initiatives of the destinations they travel to. Furthermore, we will strengthen our cooperation with business partners who are actively working to reduce their environmental footprint and are committed to addressing sustainable tourism along the entire value chain.

The JTB Group is committed to 'fostering peace and global interconnectedness through the creation of opportunities for meaningful human interaction' and the responsible and sustainable delivery of excitement, wonder, results and real value to its customers around the world in alignment with the Group's mission, vision and values.

The JTB Group is committed to 'fostering peace and global interconnectedness through the creation of opportunities for meaningful human interaction' and the responsible and sustainable delivery of excitement, wonder, results and real value to its customers around the world in alignment with the Group's mission, vision and values.

|

<About JTB> Today's JTB traces its roots back to Japan Tourist Bureau, an agency formed in 1912 for the purpose of servicing the ticketing needs of foreign tourists in Japan. Over a century of history, JTB steadily evolved into a travel and tourism industry leader. Through vision, integrity, innovation, and unsurpassed know-how, the JTB Group consistently creates unparalleled value for its stakeholders. |

*The JTB Logo, and all trademarks and service marks are owned by JTB Corp. unless otherwise noted.

JTB Corp. Public Relations & Communication Team

Phone: +81 3 5796 5833