Prospective Travel Trends in 2020

JTB Corp.

Tokyo 2020 Olympic and Paralympic Games to be held

No. of overseas visitors to Japan to continue to rise

Market for Japanese travelers to increase for both domestic and overseas travel

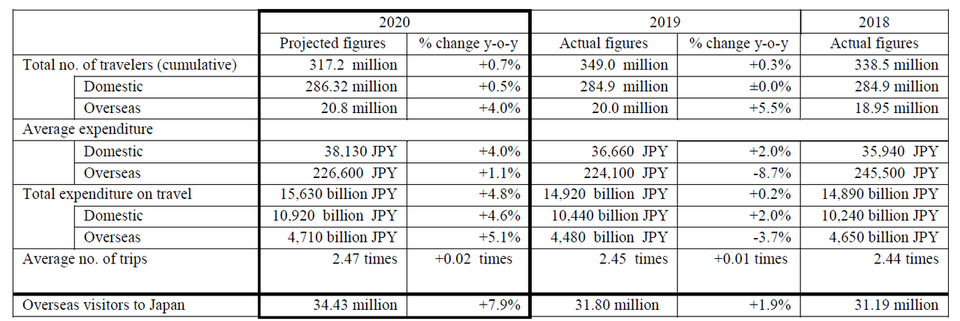

JTB Corp. has published the results of a survey of projected trends in 2020 for travel by Japanese travelers involving at least one overnight stay (including business travel and visits to the family home) and for overseas visitors to Japan. The results are based on predictions of various economic trends, surveys of consumer activity, and transportation and tourism-related data, as well as the results of a questionnaire survey implemented by JTB. This survey is the 41st since the first in 1981. The projected trends in the travel market in 2020 are as follows.

Notes:

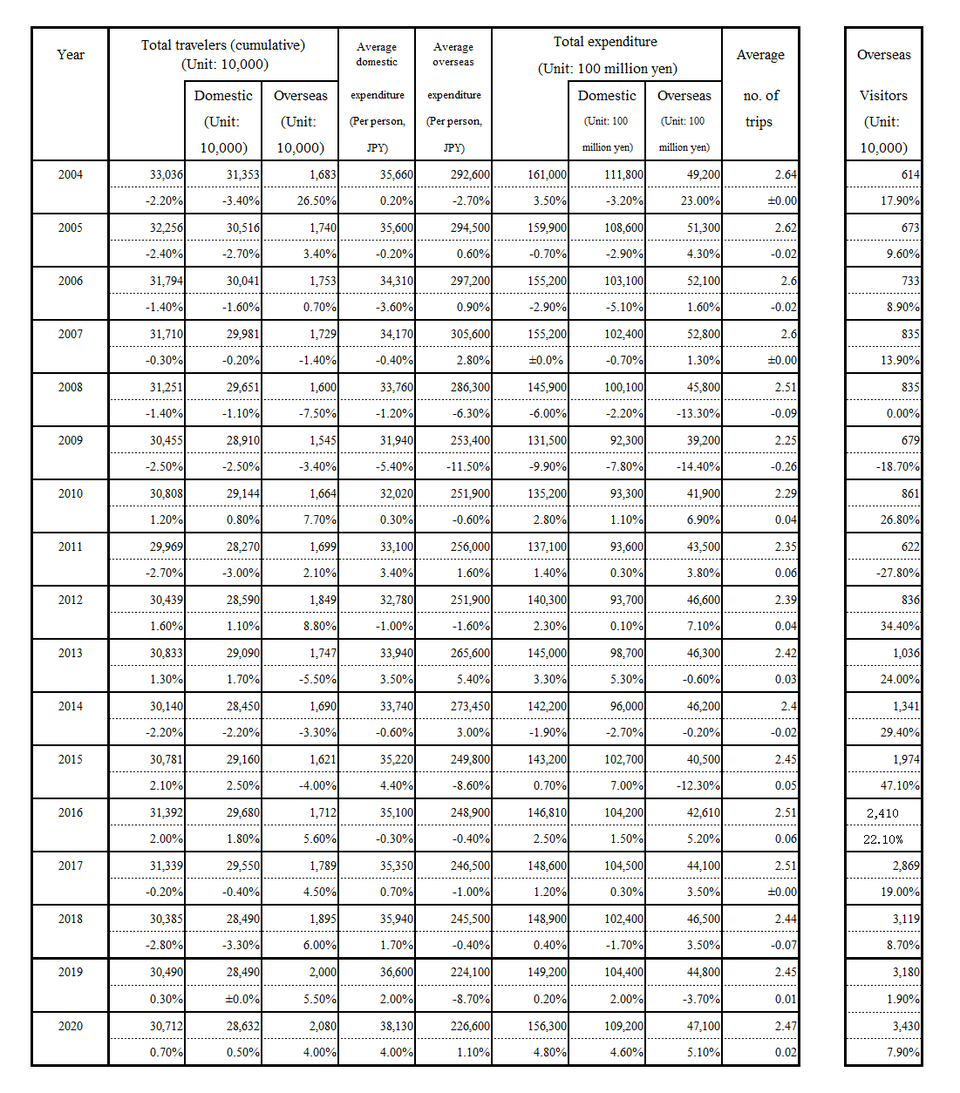

* In the table above, domestic travel expenditure includes all door-to-door travel and accommodation-related costs, and purchases and meals at the destination. Expenditure excludes before-and-after trip expenditure such as for clothing and luggage, etc.

* Overseas travel expenditure includes all travel and accommodation-related costs (including fuel surcharges), plus the costs of purchases and meals at the destination. Expenditure excludes but excludes before-and-after trip expenditure such as for clothing and luggage, etc.

* Estimates of overseas visitors to Japan are for their numbers only and do not cover expenditure.

* Actual figures for overseas visits by Japanese travelers in 2014 are the revised estimated figures from last year for total departures and arrivals issued by the Ministry of Justice.

* Year-on-year comparisons are rounded down to the nearest decimal.

* No. of domestic travelers is limited to those whose travel entails an overnight stay (for the purpose of tourism or returning home)

The Market Environment in 2020

- A year in which the eyes of the world will be on Japan during the Tokyo 2020 Olympic and Paralympic Games

2020 is the long-awaited year in which the Tokyo 2020 Olympic and Paralympic Games (hereinafter Tokyo 2020 Games) will take place. The new National Stadium has already been completed and momentum continues to heighten towards the opening of the Games. On March 26 the Olympic Torch Relay will start in Fukushima Prefecture and over the course of four months the Olympic Flame will visit every region of Japan, where it will be carried using methods that highlight the history and cultures of each region. 2020 will therefore be an ideal year in which to rediscover the attractions of Japan, including at the regional level, and it is anticipated that this will boost exchange and interaction.

2019 marked the dawning of a new era for Japan with accession of the Emperor and the changing of the Imperial era name. The ceremony of enthronement held on Tuesday, October 22 was attended by heads of state, members of royal families and politicians and was watched around the world. The Rugby World Cup 2019 Japan (RWC2019), the first rugby world cup to be held in Asia, took place from September 20 to November 2. Its great success provided an opportunity for all regions of Japan to extend hospitality to rugby fans from around the world. At the same time, the consumption tax hike that was implemented from October 1 brought with it significant changes in the way people go about their daily lives, including the point rebate system that was launched to offset the consumption tax increase and which has greatly increased use of cashless settlement methods in society. There were also various unforeseen natural disasters, including Typhoon Hagibis (Typhoon No. 19), which inflicted damage across wide swathes of Japan, and the regions affected still need considerable time to recover.

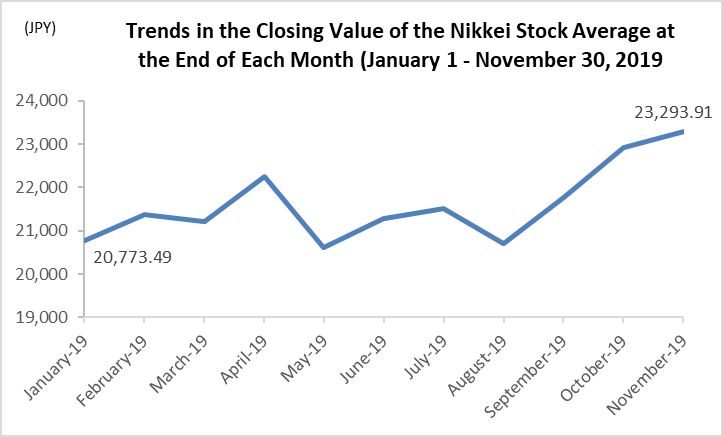

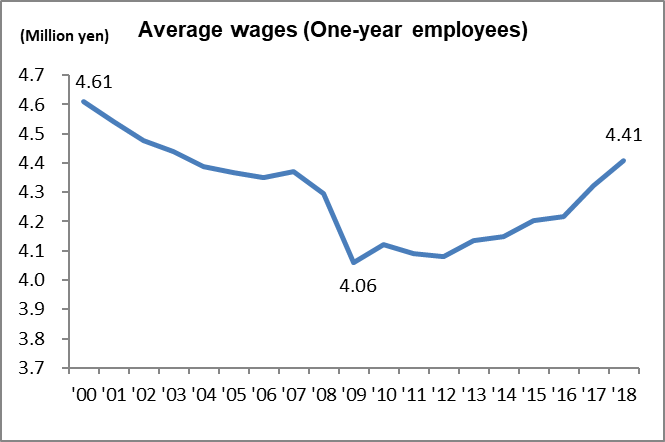

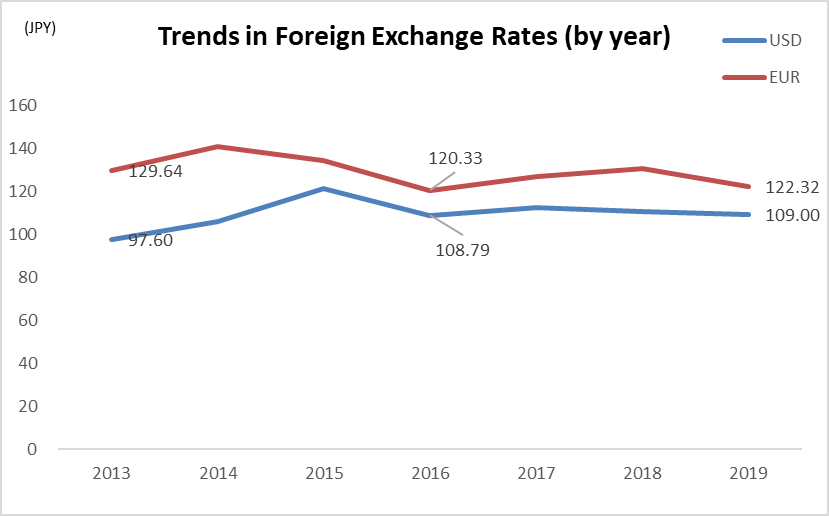

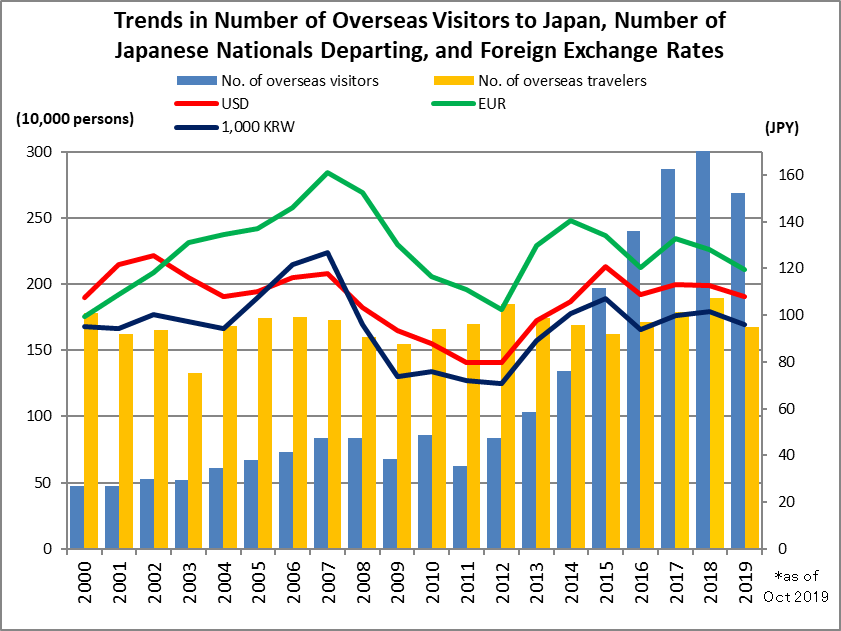

Looking at the fundamentals of the Japanese economy, according to the composite index (CI, 2015 = 100) of business conditions released by the Cabinet Office in October, the economy was judged to be "deteriorating," with the coincident indicator that shows the current status of the economy down 5.6 points on the previous month. In the Bank of Japan's Tankan (Short-term Economic Survey of Enterprises in Japan) for December, the diffusion index (DI), which expresses corporate business sentiment, had deteriorated among large manufacturing companies and non-manufacturing companies, and in terms of the outlook for the next three months the DI remained steady at large manufacturing companies and had further deteriorated among non-manufacturing companies, which indicates the continuing sense of uncertainty about the corporate business outlook. In terms of positive signs in the economy, share prices reached their highest levels for approximately 20 years, in addition to which wage income is on an upward trajectory and the employment situation remains robust. In terms of foreign currency exchange rates, the yen remains stronger than it was in 2014 and 2015, and somewhat stronger than last year, which is thought to be a positive factor for overseas travel (Figs. 1-3).

In 2019 various laws relating to work-style reform entered into force and all companies are now obliged by law to ensure that employees use at least five days of paid leave. Following the enactment of this legislation, many companies have also introduced systems to encourage employees to take five or more days of consecutive paid leave. It is expected that correcting long working hours and promoting flexible working styles will make it easier for people to take paid leave and also boost people's leisure time.

Figure 1: Annual Trends in 2019 in the Nikkei Stock Average (values at the end of each month)

Figure 2: Trends in Average Wages (2000-2018)

Figure 3: Trends in Exchange Rates (rates at the end of November from 2013 to 2019)

- Although the impact of the hike in consumption tax is likely to linger, household circumstances are expected to recover from the latter half of the year

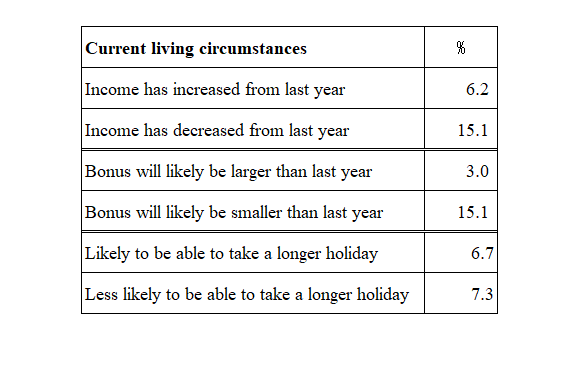

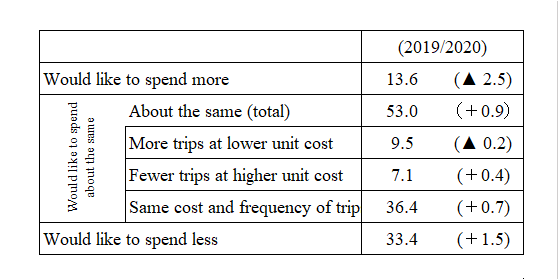

In response to the questionnaire implemented by JTB in November, when asked about current living circumstances, more people responded that "income has decreased from last year" or "bonus is likely to decrease compared to last year" than those who responded that "income has increased" or "bonus is likely to increase." In addition, when asked about their views on overall expenditure on travel in the coming year, there was a 1.5 point increase in people indicating that they "would like to spend less" (33.4%) and a 0.9 point increase in those indicating that they "would like to spend the same," compared to a 2.5 point decrease in respondents indicating that they "would like to spend more" (13.6%). This would suggest that people are not necessarily optimistic about current household circumstances and the outlook for the future (Tables 1 & 2). However, looking back at the previous consumption tax increase in April 2014, although consumption stagnated during the latter half of 2014, by the beginning of 2015 it was on a gentle recovery track. Based on the same consumer psychology and similar economic conditions it is likely that 2020 will also see a recovery in the latter half of the year, with consumption being further aided by the economic effect of overseas visitors to Japan and the psychological boost provided by the Tokyo 2020 Games.

Table 1 Currently living circumstances (Unit: %)

Table 2: Views on Overall Expenditure on Travel in the Coming Year

Single responses / Change over previous year indicated in parentheses / Unit: %

Topics in 2020

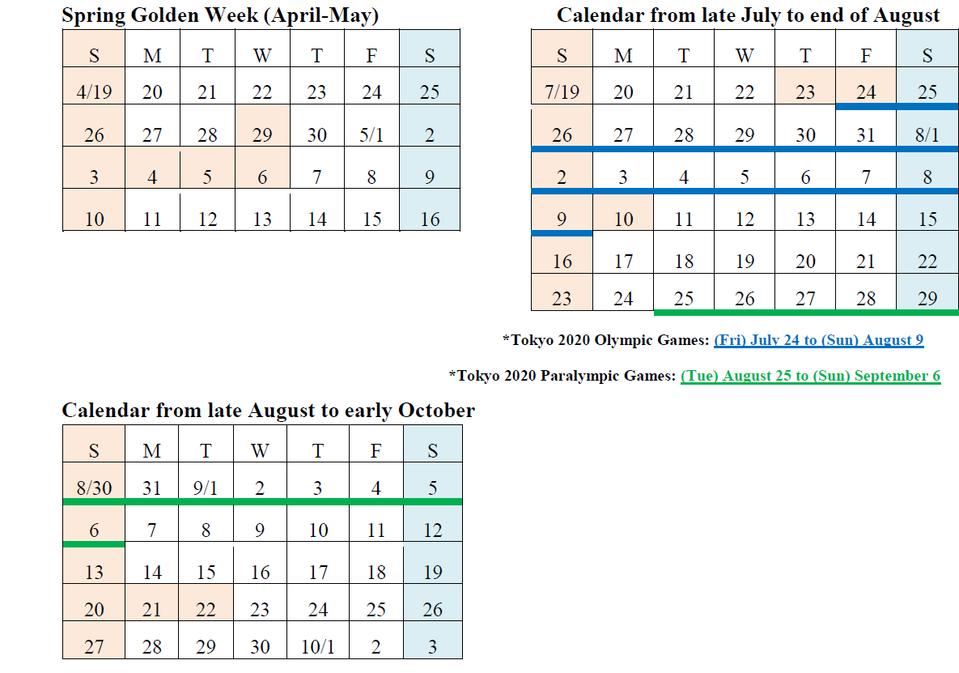

1. Two four-day holidays before and after Tokyo 2020

In terms of key features of the calendar for 2020, the schedules for the Tokyo 2020 Games have been incorporated into the summer holiday period, in addition to which there are two four-day weekends on either side of the Games. The first four-day weekend runs from July 23 (national holiday) to July 26 (Sun), coinciding with the opening ceremony of the Olympic Games, and the second one runs from September 19 (Sat) to 22 (Tue), including Respect for the Aged Day and Autumnal Equinox Day.

Golden Week (GW) in 2019 was a 10-day holiday, but as GW this year is only a five-day consecutive holiday, it is likely to be quieter than 2019. On the other hand, the government continues to promote various initiatives relating to work-life balance, including the new target of "using 70% of paid leave in 2020," in addition to the legal requirement that employees use at least five days of annual paid leave. It is thought likely that such initiatives to use paid leave, coupled with measures by manufacturers and other companies to establish an extended consecutive holiday period for employees around GW, will encourage people to bring forward holiday plans to GW to avoid accommodation price surges in and around Tokyo during summer holiday season, when rooms will be more difficult to book.

Although there is one fewer long weekend of three days or more in 2020 than in 2019 (seven vs. eight in 2019), given that two of these are going to be four-day weekends it is thought likely that this will create an environment that is conducive to travel.

2. Environment surrounding travel during the Tokyo 2020 Games

For the duration of the Games it is anticipated that many athletes, officials and spectators will be moving around the Tokyo area. The overall impact on travel is anticipated to be as follows. Firstly, in terms of the peak period for airfares, which in a normal year is usually around the traditional O-bon holiday period in mid-August, it is anticipated that prices will be high from the end of July until the conclusion of the O-bon period. This is likely to impact overseas visitors to Japan and also the summer overseas travel plans of Japanese people. In addition, given that accommodation rates in the Tokyo metropolitan region are expected to surge during the Games period and traffic congestion is anticipated, it is thought that with the exception of people coming to Tokyo for the purpose of watching Games-related events, many Japanese domestic travelers and overseas visitors will avoid travel at this time.

Looking at the past cases of the London and Rio de Janeiro Games, for the duration of the Games in those cities there was suppressed demand for overnight travel, particularly in the host city regions. However, the rapid advancement of technology and development of work-style reforms have helped to create new flexible ways of working that combine holidays with working, such as "workations" and "bleisure." If such concepts continue to spread, this could lead to demand for travel.

3. Impact on society and significance of Tokyo 2020 Games

The Olympics also act as a showcase for the latest cutting-edge technologies of each era. At the 1964 Tokyo Olympics color images were broadcast for the first time in Olympic history, which boosted sales of color television sets. It is similarly expected that the Tokyo 2020 Games will lead to the spread of services and devices that use the latest digital technologies such as AI and 5G. The results of a survey implemented by JTB Tourism Research & Consulting, Co., in November showed that approximately 40% of respondents are interested in purchasing 5G smartphones and there is a possibility that 5G usage will make a leap forward after the Games are over. In terms of leisure and travel, the possibility of watching events in ultra-high quality video or from multiple and switchable angles, as well as new ways to enjoy events through augmented reality (AR) or virtual reality (VR), could encourage people to embark on travel.

Furthermore, looking at the example of the United Kingdom, the Olympic Games provided the inspiration for a nationwide program known as the Cultural Olympiad, which generated opportunities to share UK culture with the world. After the Olympics the number of overseas visitors to the UK increased, and the nation brand ranking also improved. In terms of tourism, the UK's "natural beauty" ranking was also positively impacted (Anholt GfK Nation Brands Survey). It is therefore anticipated that the Tokyo 2020 Games will provide opportunities in Japan to convey the appeal of Japanese culture and the attractions of Tokyo and other regions.

Prospects for 2020

- Overseas Visitors to Japan

Although some deceleration is anticipated during the Tokyo 2020 Games, the number of overseas visitors is projected to increase 7.9% year-on-year to reach 34.3 million

The number of overseas visitors to Japan in 2019 exceeded the previous year in every month up to July, but from August the number of visitors started to decrease, due to the impact of tensions in international relations between Japan and Korea. Although the holding of the RWC2019 from September helped to boost numbers overall, since October the number of visitors has been falling below the totals recorded the previous year. The cumulative total for overseas visitors to Japan from January to November 2019 stands at 29.36 million (+2.8%) (announcement of the Japan National Tourism Organization (JNTO) on December 18). Looking at country of origin, other than Korea, visitors from Asian countries, such as China and Thailand, continue to account for the majority of visits. Due to increases in the number of repeat visitors and the expanding number of LCC routes from/to regional destinations, visitors to regional destinations are also increasing.

Although the number of overseas visitors to Japan is expected to increase due to the holding of the Tokyo 2020 Games, in contrast to the RWC2019, which was a nationwide event held over an extended period of time, the schedules for the games are 17 days and 13 days respectively, and the majority of events, with the exception of Sapporo, are scheduled to held in or in the vicinity of Tokyo. It is therefore expected that the majority of visitors to Japan during this period will be Games spectators and it is difficult to envisage that there will be sudden and drastic increases in visitor numbers. Looking at the example of the 2012 London Games, which were held in the capital city of a country with a developed economy similar to Tokyo, although visitor numbers to the United Kingdom dropped year-on-year by 4.2% during the Games, for the full year of 2012 visitor numbers increased 0.9% over the previous year (United Kingdom Office for National Statistics).

Although there are concerns that deceleration in the global economy may impact the number of overseas visitors to Japan in 2020, based on the assumption that visitor numbers from Korea, which were severely down in 2019, rebound by approx. 15%, and factoring in the ripple effect of the Tokyo 2020 Games, as well as the relaxation of visa requirements for Chinese and Indian citizens from January 2020, and also the increase in air routes to Japan and projections for visitors from China to continue to grow and for visitors from emerging Asian economies with strong economic growth to also increase, it is estimated, therefore, that visitor numbers to Japan in 2020 will increase 7.9% year-on-year to 34.3 million.

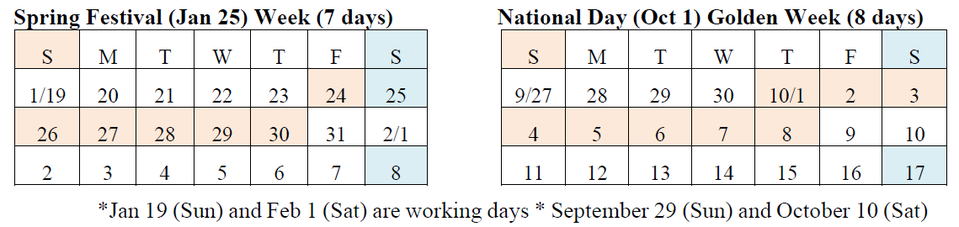

Reference) Calendar for Spring Festival and National Day Golden Week holidays in China in 2020 (Compiled based on announcement by Chinese government authorities)

Diverse range of accommodation facilities, use of private accommodation, and multiple openings of luxury hotels

In response to the increase in overseas visitors, new hotels continue to appear in every region of Japan. At the same time, the number of simple accommodation facilities, such as guest houses, is also significantly growing, which are increasingly being used by overseas visitors. In recent years there has been an increase in accommodations that use old traditional houses or historic buildings, as well as themed accommodations, and the opportunity to experience the lifestyle and culture of a particular region is attracting the attention of overseas visitors. In terms of private accommodations, during the course of the RWC2019 a website that offers private accommodations handled 650,000 users, including Japanese people. It is therefore highly likely that many people will seek to use private accommodations during the Tokyo 2020 Games.

With regard to new hotels for 2020, it has been noted before that Japan lacks sufficient luxury hotels and during this year many luxury hotels will be opening, including The Ritz Carlton Nikko in May and The Kahala Hotel & Resort Yokohama (Minatomirai, Yokohama) in June. Haneda Airport Garden is a commercial facility next to Haneda Airport that is scheduled to open in spring 2020 and it will be home to the Hotel Villa Fontaine Premier Haneda Airport, with direct connectivity to Haneda's international terminal.

Regions are switching to focus on quality over quantity in response to rapid increases in the number of travelers and the growing number of repeat visitors

Initiatives to showcase the natural beauty of Japan, including the Project to Fully Enjoy National Parks

As the number of overseas visitors to Japan increases, in addition to first-time visitors, the proportion of repeat visitors, who have visited Japan on multiple occasions, is continuing to grow. People's needs and requirements for a holiday to Japan are diversifying to include travel for specific purposes, such as watching sporting events, participating in other large-scale events, or enjoying fine cuisine. Furthermore, visitors are not limiting themselves to urban areas and famous tourist sports, but are increasingly seeking to widen their horizons and travel off the beaten path to regions that are not often visited even by Japanese tourists. Many visitors are also seeking to interact with local people or enjoy experiences unique to a specific region or community. There are also increasing numbers of people who want to enjoy local lifestyles, culture and nature, while engaging in activities such as cycling or trekking. However, there are limits to the number of visitors that a specific area or region can accept, particularly when such regions are an integral part of daily life for local people. It is for this reason that recently more regions are shifting their focus from quantity to quality, moving away from efforts that seek to bring in large numbers of visitors to initiatives that provide small groups of visitors with opportunities to understand the real essence and high quality value of a place. One example is moves to promote Japan's natural environment, which stretches through the long Japanese archipelago from north to south. The Ministry of Environment is promoting the Project to Fully Enjoy National Parks, which seeks to develop Japan's national parks as an appealing and globally-oriented tourism resource. It is likely that in the future Japan's rich natural environment and high value-added experiences in nature, including adventure tourism and eco-tourism, will gain further attention.

- Domestic Travel

*Domestic travel by residents of Japan, excluding overseas visitors to Japan.

Number of domestic travelers expected to increase 0.5% year-on-year to 286.32 million, with average expenditure increasing 4.0% to 38,130 yen, and total expenditure on domestic travel rising 4.6% to 10,920 billion yen

According to the Statistical Survey of Overnight Travel conducted by the Japan Tourism Agency, thanks to the effect of the 10-day Golden Week holiday period, the cumulative total number of overnight stays by Japanese guests for the January to October period of 2019 increased 0.3% year-on-year. However, due to the impacts of disasters such as typhoons and torrential rains, monthly totals from June onwards have fallen below the levels of the previous year. October also saw the start of the consumption tax increase and people may be starting to feel the pinch financially and economically. Although there are such elements of uncertainty relating to the economic outlook, this has not caused share prices and the employment environment to deteriorate. Although it could be the case that in the first half of 2020 travel may be impacted by the shorter Golden Week holiday period than 2019 and the effects of business and consumer sentiment, and also that the Tokyo 2020 Games may blunt travel to the Tokyo metropolitan area, it is anticipated that in the latter half of the year the adverse effects of the consumption tax increase will have dissipated and accommodation charges will have settled following the conclusion of the Games. Accordingly, it is projected that the number of domestic travelers will increase slightly year-on-year. It is also projected that average expenditure will increase year-on-year, due to the impact of the consumption tax hike and increases in accommodation charges due to the Tokyo 2020 Games.

SNS gives individuals increasing power, which is helping to boost niche markets

Almost everyone has a smartphone these days, and the power of the individual continues to grow as people construct their own SNS-based networks and it has become the norm not only to acquire information, but also send out and share information. This means that individual values and intentions are more strongly reflected, which in turn has given rise to more purpose-driven tourism with specific objectives. Although each individual market is very small, there is great potential in such markets through the impact of SNS linkage. Examples of such markets could be the collection of feudal seals and visiting castles around the country. These experiences offer opportunities for people to get closer to Japanese culture and the appeal of collecting things is also another reason behind their popularity. Trips to castles that have been selected as "Japan's 100 Famous Castles," or "Japan's Next 100 Famous Castles" are also popular. Given that the annual NHK taiga drama for 2020 is "Kirin ga kuru" ("The Coming of the Kirin"), which for the first time in three years is a historic costume drama set in the Sengoku (warring states) period, it is likely that many people will seek to visit locations associated with this drama series.

Diversification of individual preferences and diversification of accommodation facilities due to the market entry of different industries

Due to the diversification of individual preferences people are focusing not just on standard tourist spots, but are seeking out something "extraordinary" in the commonplace surroundings of everyday life, by experiencing life and culture in a local area, for example. This has led to increases in people visiting commonplace areas and is also prompting changes in accommodation facilities. There has also been an increase in "diffused hotels," which are created by refurbishing shopping streets or empty houses and creating contents and spaces across a whole community in order to effect revitalization. In a shopping street in Hyaku-cho, Otsu City in Shiga Prefecture an old townhouse has been transformed into a "shopping street hotel," where visitors can walk around the townscape while remaining in the hotel, getting a feel for local culture and cuisine.

Different industries are also active in entering the travel market and in 2020 the department store Takashimaya is due to open a "Citadines" hotel in Osaka. A new hotel is also scheduled to open in Maebashi City, Gunma Prefecture that will be operated by JINS, a company known for its eyeglasses designed by famous creators from Japan and overseas. The enjoyment of overnight travel will further increase with the diversification of accommodation facilities and it is anticipated that this will boost motivation for domestic travel.

New areas opening in popular theme parks

In April 2020 a new area in Tokyo Disneyland_, "New Fantasyland" is scheduled to open that is themed on the Disney movie "Beauty and the Beast." At Universal Studios Japan the new SUPER NINTENDO WORLD area is scheduled to open prior to the Tokyo 2020 Games. In addition, the indoor miniature theme park SMALL WORLDS TOKYO is due to open in Ariake, Tokyo.

- Overseas Travel

Number of overseas travelers expected to increase 4.0% year-on-year to 20.8 million, with average expenditure increasing 1.1% to 226,600 yen and total expenditure on overseas travel projected to rise 5.1% to 4,710 billion yen

The number of Japanese travelers departing Japan for overseas destinations between January and November 2019 increased 6.0% year-on-year to 18.37 million, and there was a year-on-year increase in almost every month of the abovementioned period. The travel industry is looking closely to see if 2019 will be the year in which the number of Japanese travelers going overseas exceeds 20 million for the first time since the liberalization of overseas travel. Although overseas travel has performed well throughout the year, due to the impact of tensions in Japan-Korea relations there were reduced flight connections and cancellations on Korean routes with the result that the downturn in travelers to Korea has put a dampener on the overall number of overseas travelers. On the other hand there are likely to be a number of positive points for overseas travel in 2020, including the increase in landing and takeoff spots for international flights at Haneda airport, increases in seat availability for Japanese travelers due to the lower growth in overseas visitors to Japan, and the relative strength of the yen. Furthermore, the vibrant employment environment is likely to boost overseas travel, including graduation trips by people in Generation Z (early 20s), who are key drivers for increasing international departure rates.

Although the number of overseas travelers is projected to increase, given that the Golden Week holiday period will be shorter than last year, the increase is estimated to be around 4.0% year-on-year. Average expenditure is projected to increase 1.1%, reflecting an expected upturn in long-haul travel due to the increase in European and North American routes, and increased business demand.

Styles and formats for overseas travel continue to change. Individual travel is increasing thanks to ease of reservation and accessibility of information

According to a survey on overseas travel implemented by JTB Tourism Research & Consulting, Co., the proportion of people making individual travel plans and reserving and purchasing accommodation and flights themselves continues to increase year by year. In the same survey approximately 30% of all respondents had experienced a travel style that did not entail travel with a companion from departure through to arriving home, but rather involved meeting up or going separate ways while still at the destination.

The fact that highly-personalized itineraries are being created and that information is readily accessible via smartphone about all aspects of travel is helping to promote the utilization of local tours. Services like Klook and Veltra are available that allow users to book and pay simply via smartphone, and Airbnb has also introduced "Experiences," where individuals living at the holiday destination can offer experiences to visitors. Destination-based experiences are therefore becoming ever more fulfilling and there is also a possibility that this deepening of exchange will lead to increases in repeat visits.

Increase takeoff and landing slots for international flights at Haneda airport set to boost business-related travel

2020 will see an increase in takeoff and landing slots for international flights at Haneda airport, which will increase to 50 flights a day. Destinations include the U.S., China, Russia, Australia, India, Italy, Turkey, Finland and Scandinavia, and the added convenience of being able to depart from a city center airport is likely to boost not only leisure travel, but also business-related travel. Other than at Haneda, various other new routes are set to be introduced in 2020, including Narita-Vladivostok, Narita-Bengaluru (India), Kansai-Istanbul, and Kansai-Zurich.

In terms of low-cost carrier (LCC) flights, although there was a significant reduction and price crash on routes to Korea caused by bi

lateral tensions between Japan and Korea, in September the second terminal of Chubu Centrair International Airport is scheduled to open, which will be specifically for LCC flights. It looks likely that in 2020 the trend will continue towards route expansion linking Japan with other Asian countries, including China.

(Reference) Trends in Number of Overseas Visitors to Japan, Number of Japanese Nationals Departing, and Foreign Exchange Rates

Provisional Figures for 2019

1. Overseas Visitors to Japan

Number of overseas visitors to Japan projected to increase 1.9% year-on-year to 31.8 million

In terms of overseas visitors to Japan in 2019, since August this year visitors from Korea have decreased due to the impact of tensions in international relations between Japan and Korea. Although visitor numbers were boosted in September thanks to the holding of the Rugby World Cup™ 2019 Japan, visitor numbers in October were down 5.5% year-on-year at 2.5 million and visitor numbers in November were also slightly down (-0.4%) at 2.44 million. The cumulative total for overseas visitors to Japan from January to November 2019 stands at 29.36 million (+2.8%). The number of overseas visitors in 2019 is estimated to rise 1.9% year-on-year to 31.8 million.

2.Domestic Travel

Number of domestic travelers estimated to remain on the same level as the previous year at 284.9 million, with average expenditure projected to have increased 2.0% to 35,880 JPY

At the time of the previous consumption tax increase in April 2014, when consumption tax rose from 5% to 8%, the impact on travel involving stays in overnight accommodation by Japanese people started to become apparent about two months after the tax was raised and until winter of the same year each month underperformed the results of the previous year. According to the Statistical Survey of Overnight Travel conducted by the Japan Tourism Agency, although the cumulative total number of overnight stays by Japanese guests for the January to October period of 2019 increased 0.3% year-on-year, since June the monthly totals have underperformed the previous year's results. Due to such impacts as Typhoon Hagibis (Typhoon No. 19), the provisional figure for October alone is for 37.27 million guest nights, down 2.8% on the previous year. It is estimated that the number of domestic travelers in 2019 will have remained at the same level as the previous year at 284.9 million and that average expenditure will have increased 2.0% year-on-year to 36,660 JPY

3. Overseas Travel

Number of overseas travelers estimated to increase 5.5% year-on-year to 20.0 million, with average expenditure projected to decrease 8.7% to 224,100 JPY

The number of Japanese travelers departing Japan for overseas destinations between January and November 2019 was boosted by increased travel demand during the 10-day Golden Week holiday period, increasing 6.0% year-on-year to 18.37 million. Exchange rates remained largely at the same level as the previous year. Given the increase in the number of people using LCC to predominantly Asian destinations, it is thought that average expenditure is likely to have fallen. Accordingly, it is estimated that the number of overseas travelers will have increased 5.5% year-on-year to 20.0 million, but that average expenditure will have decreased 8.7% to 224,100 JPY.

Figures for 2004 to 2019 and Projections for 2020

------------------------------------------------------------------------------------------------

Survey period: November 5 & 6, 2019

Respondents: Males and females between the ages of 15 and 79

Sample size: Pre-survey 20,000 persons, main survey 1,074 persons

(The main survey was implemented after selecting persons who responded in the pre-survey that they "plan to travel during the year-end/New-year period" and asking them to participate in the main survey)

Content: Travel plans involving at least one night away from home between December 23, 2019 and January 3, 2020 (including overseas travel, but excluding trips for commercial or work purposes)

Method: Internet questionnaire

------------------------------------------------------------------------------------------------