Travel Trends for Summer 2019 (July 15 - August 31, 2019)

No. of international travelers to reach all-time high

JTB Corp

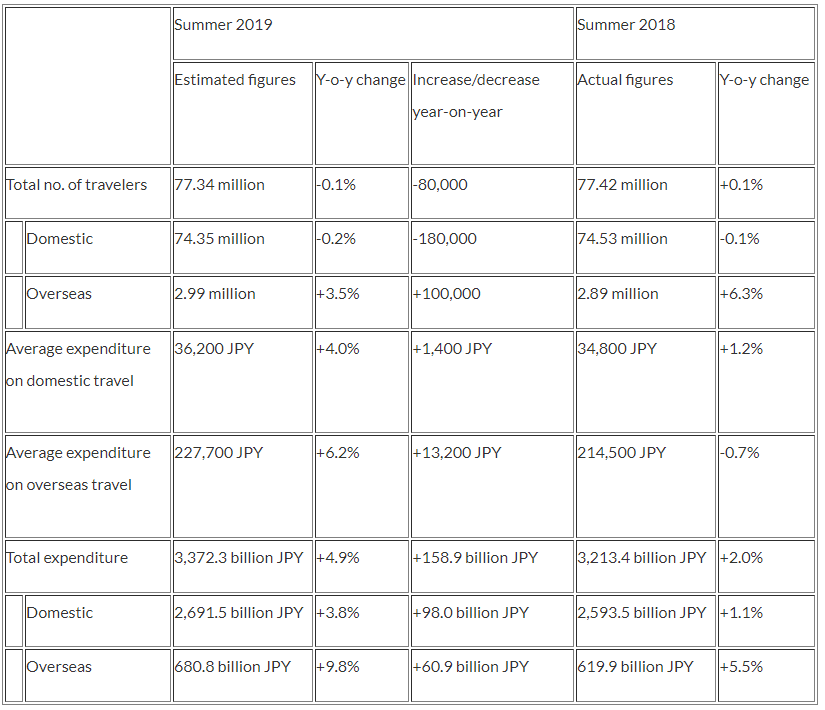

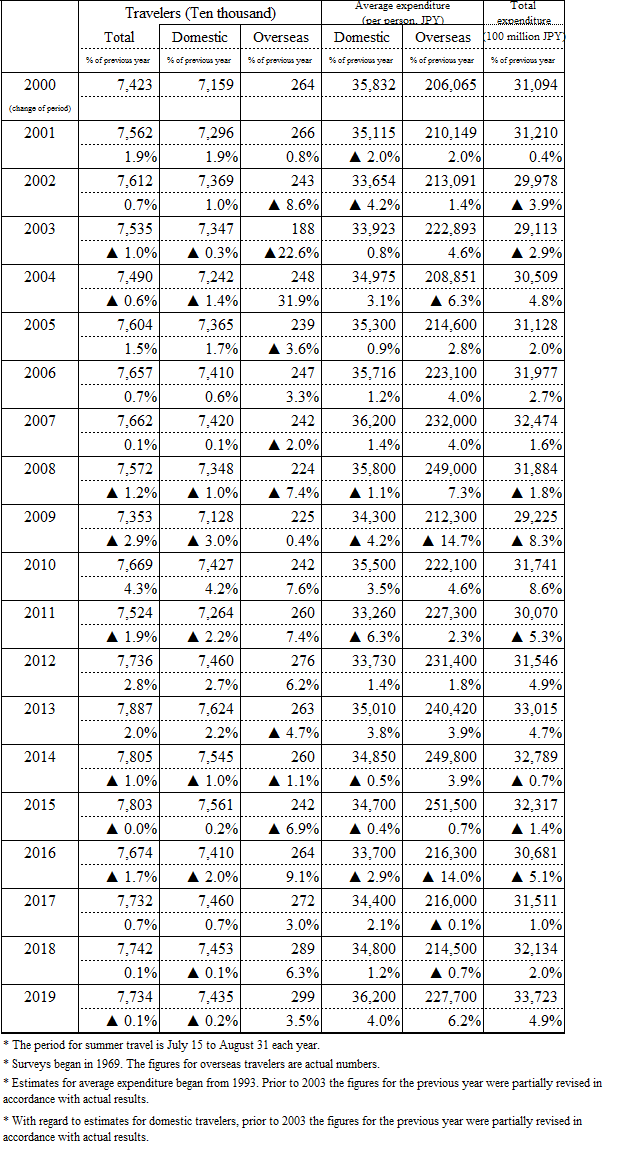

Total no. of travelers slightly down (-0.1%) at 77.34 million

-

No. of domestic travelers 74.35 million (-0.2%)

-

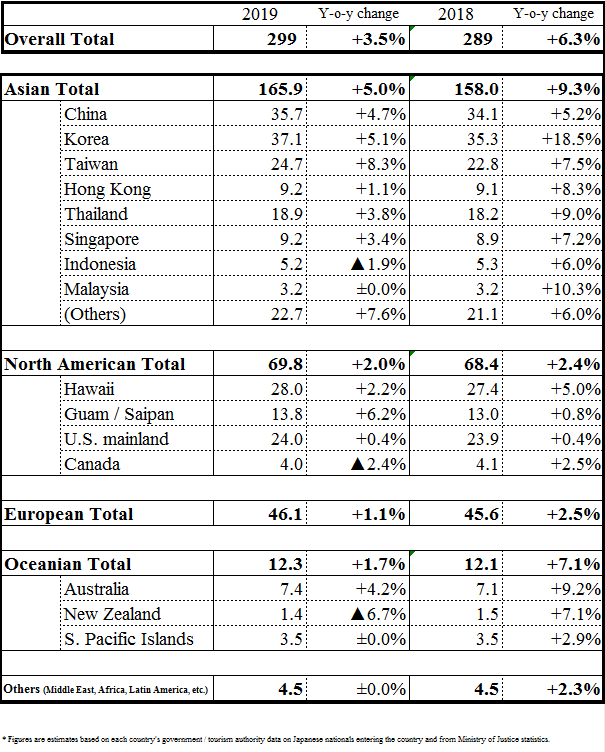

No. of overseas travelers 2.99 million (+3.5%)

*Since comparable surveys started in 2000

JTB Corp. has just published a survey of forecast travel trends involving at least one overnight stay for summer holiday travel (from July 15 to August 31, 2019).

The survey was based on a questionnaire survey of 1,030 respondents, economic indices, industry and economic trends, the status of airline reservations, and the status of bookings at JTB Group companies, from which estimates have been compiled. The results of this, the 51st such survey since the first in 1969, are as follows.

Table 1: Estimates for Summer Travel 2019 (no. of travelers, average expenditure, total expenditure)

Notes on the table:

- Numbers of travelers are cumulative totals; average expenditures are per person.

- Numbers of domestic travelers are those making overnight stays (only for tourism and trips to the family home). Numbers of overseas travelers are for all those departing Japan (including business travel).

- Domestic travel average expenditures comprise all costs incurred during travel, including transport, accommodation, meals and souvenirs.

- Overseas travel average expenditures include fuel surcharges. Locally paid expenses at the destination, including for souvenirs, etc., are excluded.

- Year-on-year changes are rounded to the nearest first decimal point.

Socioeconomic Environment and Consumer Trends

- Socioeconomic environment surrounding travel and leisure consumption

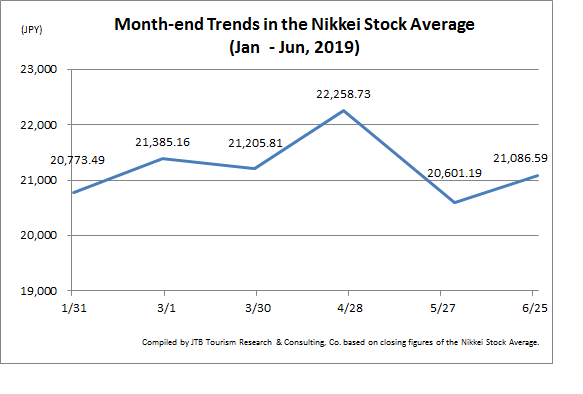

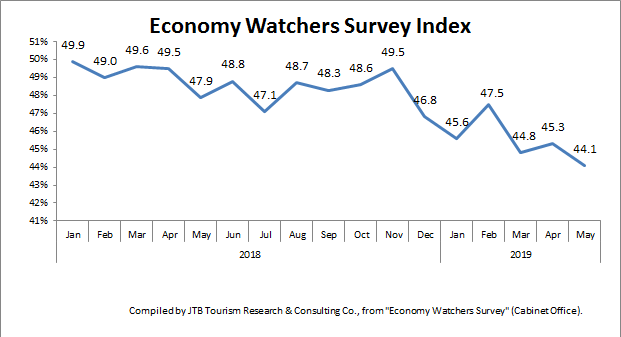

In terms of the economic fundamentals that have an impact on summer season travel, the average summer bonus payout offered by large companies is projected to be down 2.52% year-on-year at JPY971,777, which is the first decrease for two years (figure announced by Keidanren (Japan Business Federation), June 11). In the Economy Watchers Survey (*1) issued by the Cabinet Office in May 2019 the diffusion index (DI) for current conditions was down 1.2 points on the previous month and the DI for future economic conditions was down month-on-month by 2.8 points. However, the ratio of job openings to job applicants remained at a high level of 1.63 (seasonally adjusted value), which was almost the same as the previous month. On the currency markets the outlook is for yen appreciation risk to continue, with concerns about the potential impact on the economy (Fig. 1, Fig. 2).

For a two-day period from June 28 the G20 Summit on Financial Markets and the World Economy (G20 Osaka Summit) was held in Japan for the first time. Although the Leaders' Declaration noted that the G20 nations "...strive to realize a free, fair, non-discriminatory, transparent, predictable and stable trade and investment environment...", there is still no end in sight to the trade tensions between the United States and China and there is a persistent sense of uncertainty about the future for the global economy.

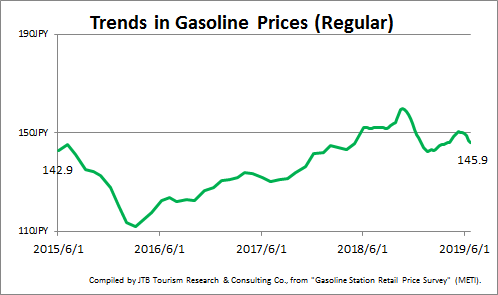

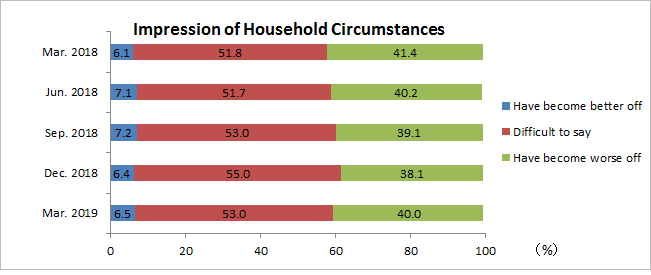

In daily life, although gasoline prices are at almost the same level as last year, according to the Opinion Survey on the General Public's Views and Behavior implemented by the Bank of Japan (announced April 5, 2019), in terms of impressions of household circumstances, the number of people responding that they "have become worse off" decreased for every month from March 2018 until March 2019, when the figure increased (Fig. 3, Fig. 4).

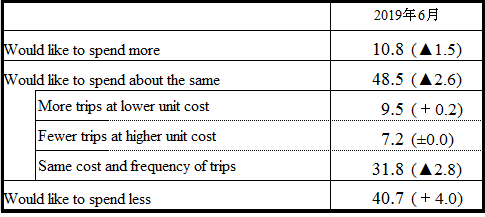

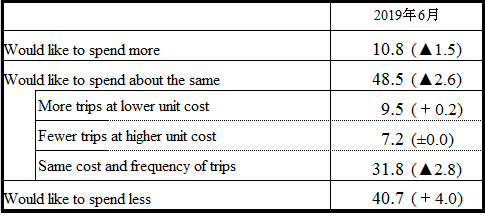

In the travel trends questionnaire implemented by JTB, when asked about their motivation to spend on travel in the future, a total of 10.8% of respondents indicated that they "would like to spend more" (down 1.5 points on the previous year), whereas those indicating that they "would like to spend less" accounted for 40.7%, which represents a 4.0 point increase. Those intending to "spend about the same" accounted for 49.6% of the total, down 2.6 points on the previous year. From these figures it can be appreciated that consumers are cautious about spending on travel (Table 2).

(*1) A diffusion index (DI) that expresses the results of a survey of people who are particularly sensitive to changes in the economy, including taxi drivers and owners of retail outlets.

Figure 1: Trends in the Nikkei Stock Average

Figure 2: Trends in Economy Watchers Survey Index

Figure 3: Trends in Gasoline Prices

Figure 4: Impression of Household Circumstances (March 2018 _ March 2019)

Source: Compiled by JTB Tourism Research & Consulting Co., from extracts of the Bank of Japan's Opinion Survey on the General Public's Views and Behavior (76th)

Table 2: Changes in Motivation to Spend on Travel in the Future (unit: %) n=20,000

(Single responses; figures in parentheses indicate year-on-year % change)

* As some people did not respond, answers do not total 100%.

- First summer holiday period of the Reiwa Era: Environment surrounding the summer holiday period and desire for travel among consumers

This year there are two long weekends during the summer, one from July 13 to 15, including the "Marine Day" national holiday, and one from August 10 to 12, including the "Mountain Day" national holiday. Including the traditional Obon holiday period from August 13 to 16, it is possible that people could take nine consecutive days of holiday this year. There are also two long weekends in September, from September 14 to 16, and 21 to 23. From April this year the Work-Style Reform-related Act entered into force, and it was also made compulsory for all employees to take a minimum of five days of paid leave each year. All of these developments have combined to make it easier for people to take paid leave on consecutive days. In terms of events that are being held from the summer through to the autumn this year, the Setouchi Triennale (summer opening: July 19 to August 25) is an international modern art festival being held in 12 islands and ports in Kagawa and Okayama prefectures, in addition to which sports events are being held as a prelude to 2020, leading up to the Rugby World Cup Japan 2019 that will run from September 20 through to November.

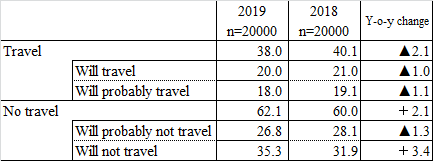

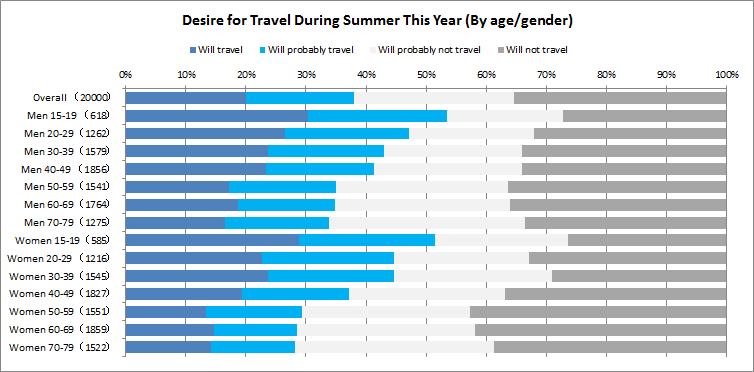

Of the 20,000 people selected to answer a pre-questionnaire about their desire for travel during the summer season, including returning to their family home, a total of 20.0% responded that they "will travel," and 18.0% indicated that they "will probably travel," making a combined total of 38.0%, which was 2.0 points down on the previous year. Those indicating that they "will probably not travel" (26.8%) or "will not travel" (35.3%) make a combined total of 62.1%, which was 2.1 points up on the previous year (Table 3).

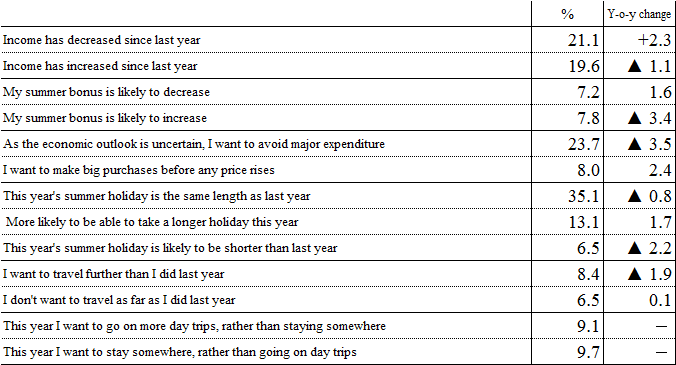

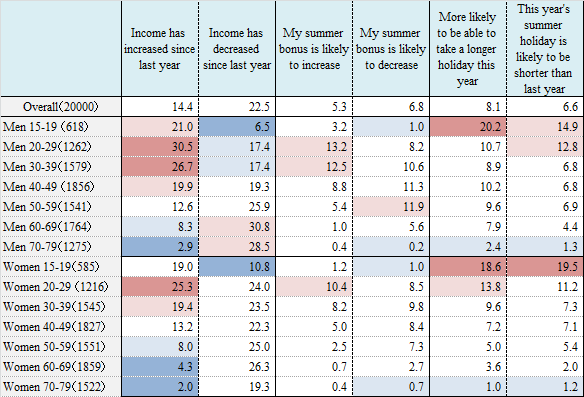

In this year's questionnaire, when asked about "lifestyle and travel during summer 2019," in terms of income, 21.1% of respondents indicated that "income has decreased from last year" (up 2.3 points, year-on-year), and 19.6% responded that "income has increased from last year," representing a decrease from the previous year. With regard to bonuses, 7.2% of respondents indicated that their "bonus is likely to decrease," an increase from the previous year. However, looking on a gender and age-specific basis, the number of men in their 20s and 30s and women in their 20s responding that "income has increased" and "bonus has increased" were in all cases greater than the number reporting a decrease. This suggests that the younger generation is currently enjoying a relatively favorable income situation.

In terms of expenditure, 23.7% of respondents indicated that "as the economic outlook is uncertain, I want to avoid major expenditure," down 3.5 points year-on-year, and 8.0% responded that "I want to make big purchases before any price rises," a 2.4 point increase from the previous year.

In terms of holiday length, 35.1% of respondents indicated that "This year's summer holiday will be the same length as last year's" (down 0.8 points) and 13.1% responded that they are "More likely to be able to take a longer holiday this year" (up 1.7 points year-on-year).

Table 3: Desire for Travel During Summer This Year

(Reference) Desire for Travel During Summer This Year (By age/gender)

Table 4-1: Lifestyle and Travel During Summer 2019 (multiple responses)

Table 4-2: Lifestyle and Travel During Summer 2019 (by age/gender) (multiple responses) *excerpt

Anticipated Trends in Summer Travel 2019

- Number of overseas travelers set to increase to 2.99 million (+3.5% y-o-y), with average expenditure on overseas travel projected to be JPY227,700 (+6.2% y-o-y). The peak date for departure is expected to be August 10 (Sat).

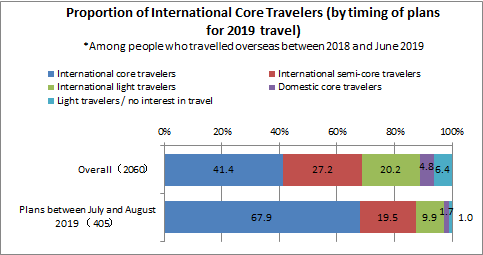

The number of Japanese traveling overseas in 2018 reached 18.95 million, the highest figure ever recorded. In May this year the number of Japanese traveling overseas was up 3.9% on the same month of the previous year at 1,438,000 people (estimated figure), with the cumulative total for the January to May period also up 9.0% over the previous year at 8,021,400 people (figures announced by the Japan National Tourism Organization (JNTO), June 19). Although bookings for travel during summer 2019 have been more subdued than normal, perhaps as this year's summer holiday comes directly after the 10-day Golden Week holiday period, in "The State of Overseas Tourist Travel 2019" survey implemented by JTB Tourism Research & Consulting Co. (targeting people who embarked on overseas tourist travel between January 2018 and June 2019), among the people who responded that they are planning overseas tourist travel in July and August 2019, 67.9% are classed as core overseas travelers (i.e. persons who take at least one overseas holiday each year), which is more than 24 points above the average for the entire period covered by the survey. It appears, therefore, that people traveling during the summer season this year will be people who are extremely proactive in engaging in overseas travel (Fig. 5).

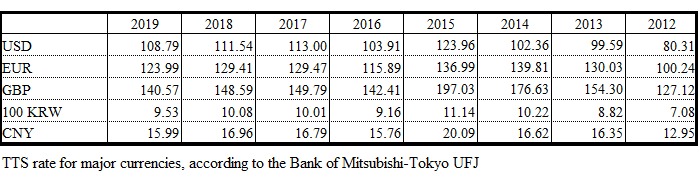

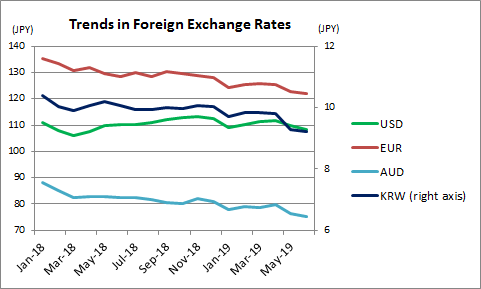

In terms of the exchange rate, since 2018 the yen has been gradually appreciating against various currencies, including the euro, Australian dollar and Korean won (Tables 5-6, Fig. 6). Although fuel surcharges are at a similar level to the previous year, there are plans to increase surcharges for tickets issued after August, meaning that people may choose to depart earlier than usual on overseas travel.

In terms of airline seat supply, seat numbers are increasing to a broad range of destinations, not limited to the Asian region alone, including the following routes: Kansai-Danang (Vietnam Airlines), Narita-Bangkok (Thai Lion Air), Haneda-Vienna (ANA), Kansai-London (British Airways), and Narita-Seattle (JAL).

Although there are concerns about the outlook for the domestic economy, judging from trends seen in previous travel surveys and questionnaires, it can be seen that overseas travel is not as susceptible to economic impact as domestic travel tends to be. For example, in 2009, the year following the international financial crisis, although domestic travel was down 3.0%, overseas travel actually increased 0.4%.

There also appears to be a high desire for travel among the younger generation, whose income and bonuses are increasing, and who are able to take longer holidays (Table 3). Given the above situation, it is anticipated that the number of overseas travelers will increase this year.

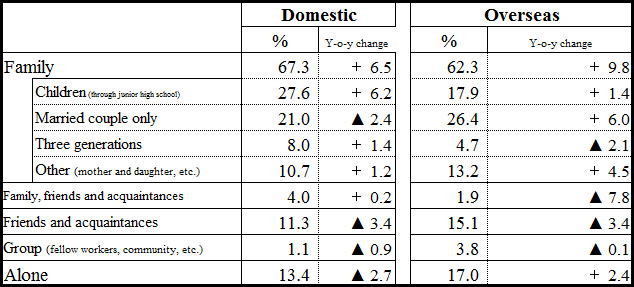

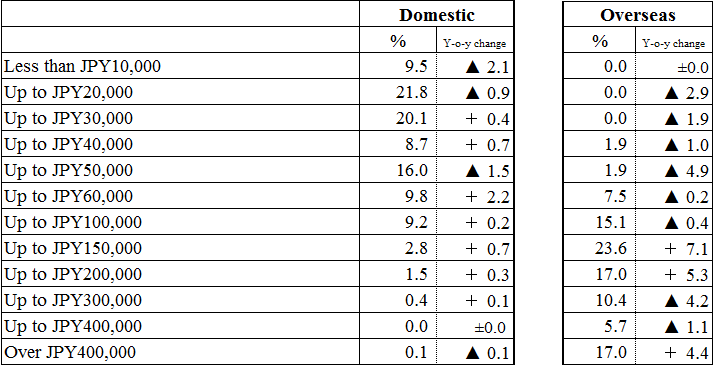

Looking at the responses to the JTB questionnaire, in terms of travel companions, the most common response was to travel as a family (62.3%), within which the number of people traveling as a couple (26.4%) or as mother and daughter, etc. (13.2%) are both up on the previous year (Table 7). In terms of per person expenditure, the most common response was "between JPY100,000 and 150,000" (23.6%), but those people indicating a per person budget of "more than JPY400,000" (17.0%) were up 4.4 points year-on-year (Table 12). In terms of the length of trip, there was a major 14.8 point increase in people responding "eight nights or more." This appears to be due to the fact that the dates fall well this year, which is prompting people to consider long-haul destinations, with the effect that both trip length and expenditure have increased. The average per person expenditure according to the questionnaire is up 10.2% for overseas travel and up 5.4% for domestic travel compared to the previous year.

Looking overall at the status of flight bookings and industry trends, the peak date for departures is anticipated to be Saturday, August 10, around Mountain Day, but there are also significant numbers of bookings for destinations like Hawaii, Guam and Saipan at the end of August, when travel costs decrease.

Looking at the booking status of JTB overseas package tours, the top five destinations are as follows: 1) Hawaii, 2) Guam/Saipan, 3) Korea, 4) Taiwan, 5) Singapore. Looking at the growth rate in reservations, destinations that are performing well are the United Kingdom, which is helped by the addition of a new route linking Kansai Airport with London, and also Hawaii, for which a global destination campaign is being implemented.

Figure 5: Proportion of International Core Travelers Planning to Travel in July-August 2019

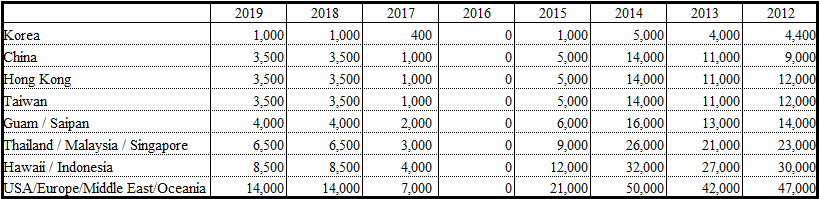

Table 5: Tokyo Foreign Exchange JPY Market/TTS Rate for Major Currencies, according to the Bank of Mitsubishi-Tokyo UFJ as of the End of June Each Year (unit: JPY)

Figure 6: Trends in Foreign Exchange Rates Since January 2018 (unit: JPY)

Table 6: Trends in Fuel Surcharges in August (for JAL, return flights from Japan; unit: JPY)

Source: JAL press release.

- Number of domestic travelers is set to decrease to 74.35 million (-0.2% y-o-y), with average expenditure on domestic travel projected to be JPY36,200 (+4.0% y-o-y).

As for domestic travel, factors such as a lack of certainty about the economic outlook and moves to prepare for the rise in consumption tax later in the year are expected to impact traveler numbers, which are projected to fall slightly to 74.35 million (down 0.2% y-o-y). Overall many domestic travelers will be traveling as families and it is estimated that per person expenditure will be up 4.0% compared to the previous year at JPY36,200.

In this year's questionnaire, with regard to "travel companions" 67.3% of respondents indicated that they would be traveling as a family, a 6.5 point increase from the previous year. Within this figure there was an increase in people indicating that they would be traveling with children (up to junior high school age) (27.6%, up 6.2 points) and also a 1.4 point increase in people planning a three-generation family holiday (Table 7).

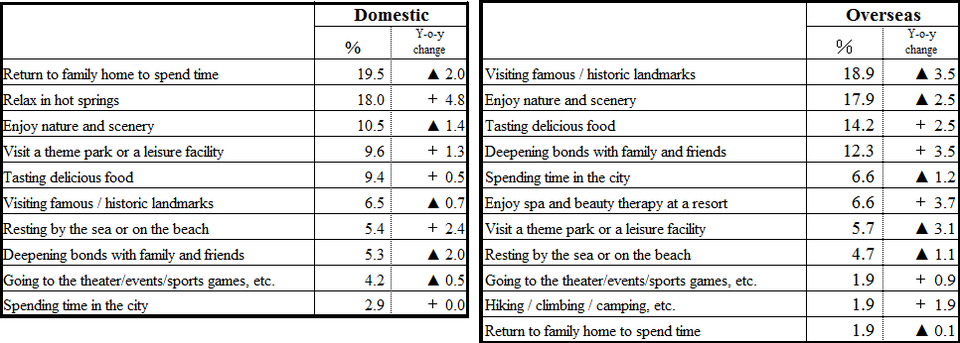

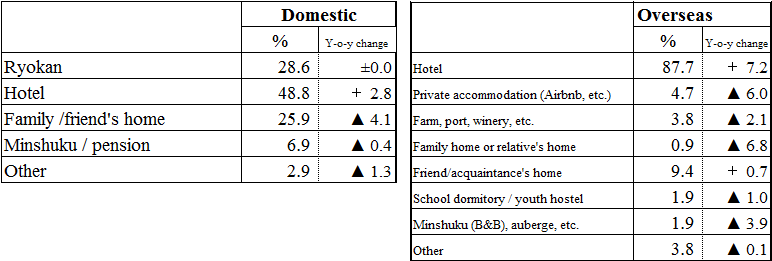

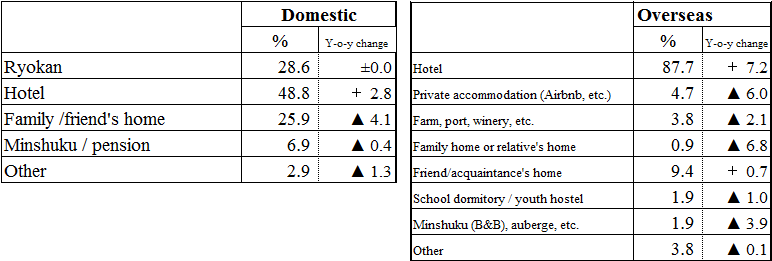

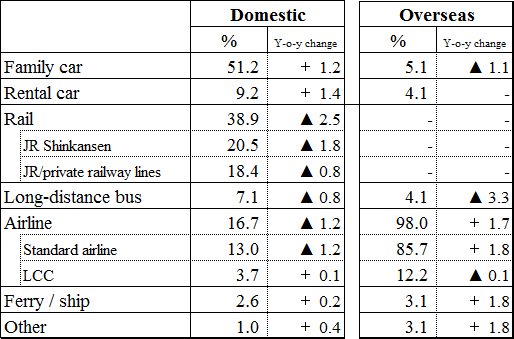

Concerning purpose of travel, the most popular response at 19.5% was "return to family home to spend time," but this percentage was down 2.0 points from the previous year. The number of people planning to "relax in hot springs" was up 4.8 points at 18.0% (Table 8). With regard to means of accommodation, 48.8% of respondents indicated that they would be using a hotel (up 2.8 points) and 28.6% indicated that they would stay in a ryokan. The number of people indicating that they would stay at a "family member or friend's home" was down 4.1 points year-on-year (Table 9). Looking at means of transportation, there was an increase in people indicating that they would use a family car or rental car, and fewer people planning to use trains or airlines (Table 10). This could be due to the growth in people traveling as a family. Although there are projected to be more people traveling as a family, the number of people planning to stay at a "family member or friend's home" has decreased, while hotel reservations are up, which suggests that while people are still keen to economize, they are also inclined to enjoy a summer vacation by spending a little money.

In terms of trip length, there were increases in respondents expressing an intention to stay "1 night, 2 days" (36.6%, up 1.8 points) and "3 nights, 4 days" (16.9%, up 3.9 points), and a decrease in plans for trips of "2 nights, 3 days" (30.8%, down 3.8 points)(Table 11). The most popular responses for average expenditure per person were "10,000 to 20,000 yen" (21.8%) and "20,000 to 30,000 yen" (20.1%)(Table 12).

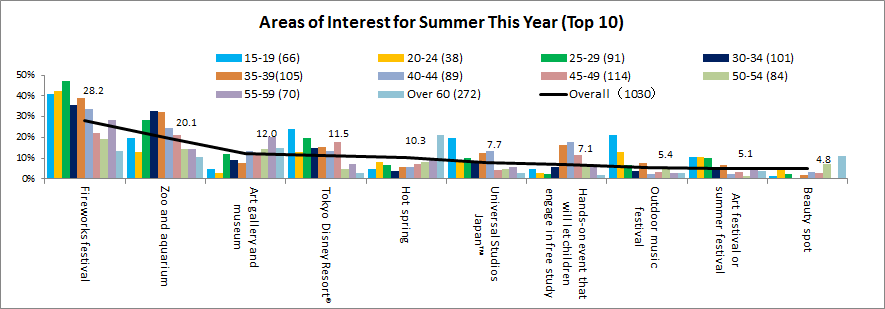

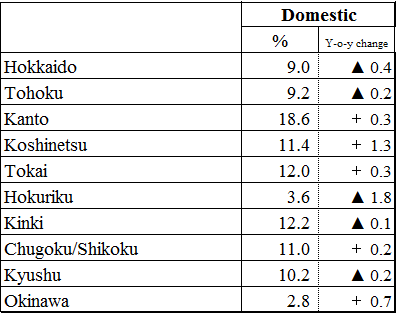

In terms of travel destination, regions that showed an increase over the previous year are Koshinetsu (11.4%) and Okinawa (2.8%)(Table 13). In the same survey, when asked about "areas of interest for summer this year," popular responses were those typically associated with summer holidays, including "fireworks festivals" and "zoos and aquariums," which are easy for the young and those with small children to visit (Fig. 7).

Looking at the booking status of JTB domestic package tours, the peak dates for departure are likely to be Sunday, August 11, and Monday, August 12. In terms of popularity ranking, the top five destinations are: 1) Okinawa, 2) Hokkaido, 3) Kansai (incl. Universal Studios Japan), 4) Tokyo (incl. Tokyo Disney Resort_), and 5) Kyushu. Trips to Ise are also set to be popular, given this destinations close association with the Imperial Family and the fact that the new Reiwa era began earlier this year.

Reference: Internet Survey―Areas of Interest for Summer This Year (Top 10) (multiple answers)

Results of Survey on Travel Trends

Table 7: Travel Companions (single response)

Table 8: Purpose of Travel (single response)

Table 9: Means of Accommodation (multiple responses)

Table 10: Means of Transportation (multiple responses)

Table 11: Length of Trip (single response)

Table 12: Average Per Person Expenditure on Travel

(single response)

Table 13: Domestic Travel Destination (multiple responses)

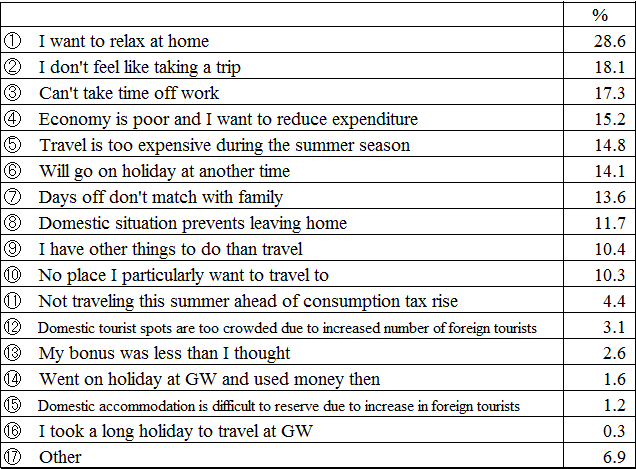

Table 14: Reasons for Not Traveling (including overseas travel) (multiple responses)

Table 15: Changes in Motivation to Spend on Travel in the Future (including overseas travel, responses based on the month of the survey) (same as Table 2 above)

* Tables 9, 10, 13 and 14 may total more than 100% due to responses being multiple responses, and other tables may not total 100% as they are based on single answer questions and some respondents did not provide an answer.

Survey Methodology

Survey period: June 21 to 23, 2019

Respondents: Males and females between the ages of 15 and 79

Sample size: Pre-survey 20,000 persons, actual survey 1,030 persons

Of the 20,000 persons who responded in the pre-survey that they "plan to travel during summer 2019," a total of 1,030 persons were selected to participate in the main survey

Content: Travel plans involving at least one night away from home between July 15 and August 31, 2019

(including overseas travel, but excluding trips for commercial or work purposes)

Method: Internet questionnaire

* From this year the survey method has been changed from the previous method of "individual surveys conducted by survey staff using a questionnaire form on personal visits" to "internet questionnaire." In the summer 2018 market research both types of survey method were implemented in tandem and the year-on-year comparisons this year are based on the responses to the internet questionnaire in 2018.

Table 16: Estimates of Overseas Travelers during the Summer Holiday Period 2019 (July 15 to August 31)

Table 17: Trends in Published Numbers for Summer Holiday Travel (July 15 - August 31)

Tel: 03-5796-5833